Starbucks (SBUX) Valuation Check as Labor Strikes Expand and Investor Sentiment Weakens

Starbucks (SBUX) is back in the spotlight as an expanding wave of U.S. store strikes intersects with fresh legal appeals and new menu launches, a combination that is quietly reshaping investor sentiment.

See our latest analysis for Starbucks.

The widening strike, legal appeals, and fresh store and product launches are all landing at a time when Starbucks’ roughly flat 90 day share price return contrasts with a weaker one year total shareholder return. This suggests momentum is still under pressure rather than turning decisively higher.

If you are weighing Starbucks’ mix of headline risk and long term brand power, it can be helpful to compare it with other consumer names via fast growing stocks with high insider ownership.

With shares down about 12 percent over the past year despite mid single digit revenue growth and a modest discount to analyst targets, is Starbucks now trading below its long term potential, or is the market already pricing in its recovery?

Most Popular Narrative: 10% Undervalued

With Starbucks last closing at $85.12 against a narrative fair value near $94.19, the story hinges on a slow but powerful profit rebuild.

Analysts expect earnings to reach $4.6 billion (and earnings per share of $4.14) by about September 2028, up from $2.6 billion today.

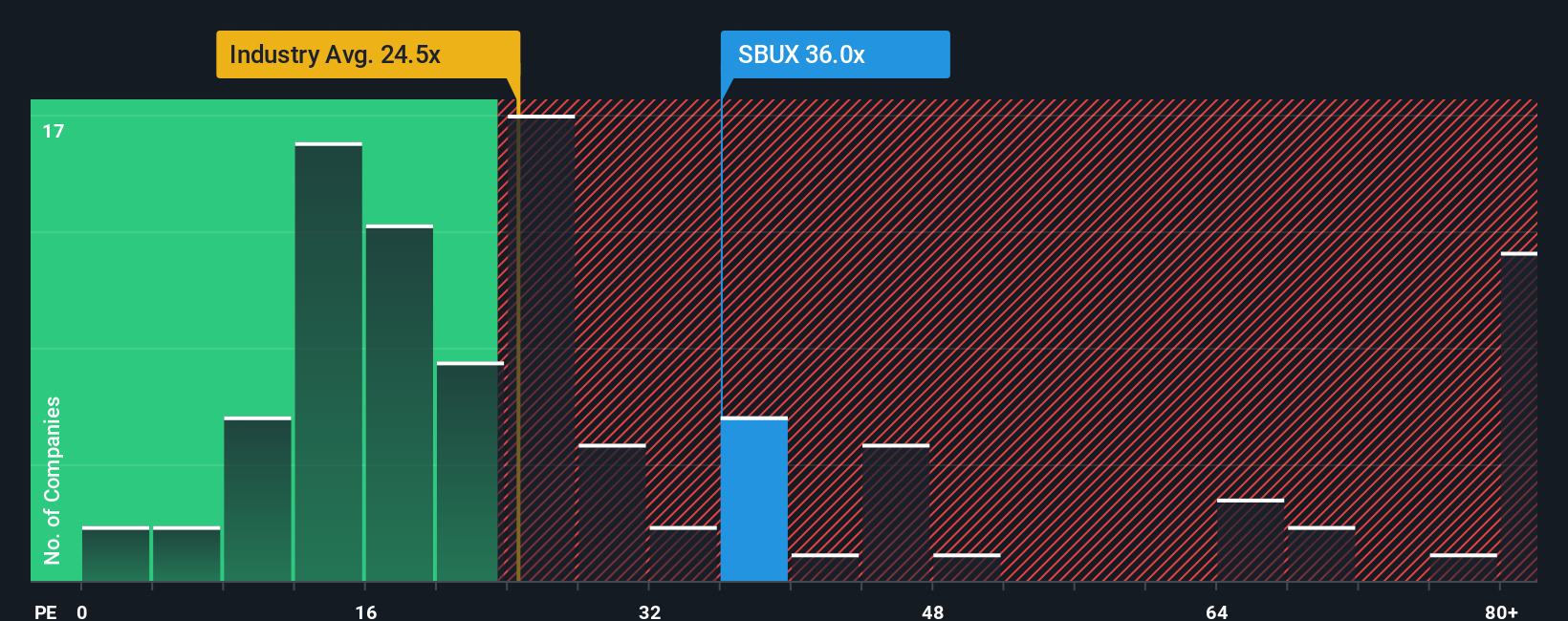

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.3x on those 2028 earnings, down from 36.2x today.

Curious how modest revenue growth, a sharp margin rebuild, and a rich future earnings multiple can still argue for upside? The full narrative spells it out.

Result: Fair Value of $94.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower comparable sales and ongoing margin pressure from labor investments could delay the profit rebound that underpins today’s undervaluation argument.

Find out about the key risks to this Starbucks narrative.

Another Lens on Value

On earnings based ratios, Starbucks looks far less forgiving. Its current P/E of 52.1x stands above both the US Hospitality average of 23.3x and the peer average of 48.9x, and well above a fair ratio of 35.2x, which points to potential downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Starbucks Narrative

If you see the story differently, or simply want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Starbucks research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Ready for more investing angles?

Do not stop at one coffee stock when the market is full of overlooked opportunities. Use the Simply Wall St Screener to target what truly fits you.

- Capture potential mispricing by scanning these 902 undervalued stocks based on cash flows that pair solid fundamentals with room for sentiment to improve.

- Ride structural tech trends by targeting these 26 AI penny stocks positioned to monetise machine learning, automation, and data driven products.

- Strengthen your income game by focusing on these 15 dividend stocks with yields > 3% that combine meaningful yields with the possibility of consistent payout growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com