US Undiscovered Gems With Potential In December 2025

As the U.S. stock market navigates a week marked by anticipation of the Federal Reserve's decision on interest rates, major indices like the S&P 500 have experienced slight pullbacks after nearing record highs. In this environment, characterized by cautious optimism and strategic recalibrations, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Frequency Electronics (FEIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Frequency Electronics, Inc. specializes in the design and production of precision time and frequency control products for microwave integrated circuit applications, with a market capitalization of approximately $305.35 million.

Operations: The company generates revenue primarily from FEI-NY with $52.65 million and FEI-Zyfer contributing $18.11 million.

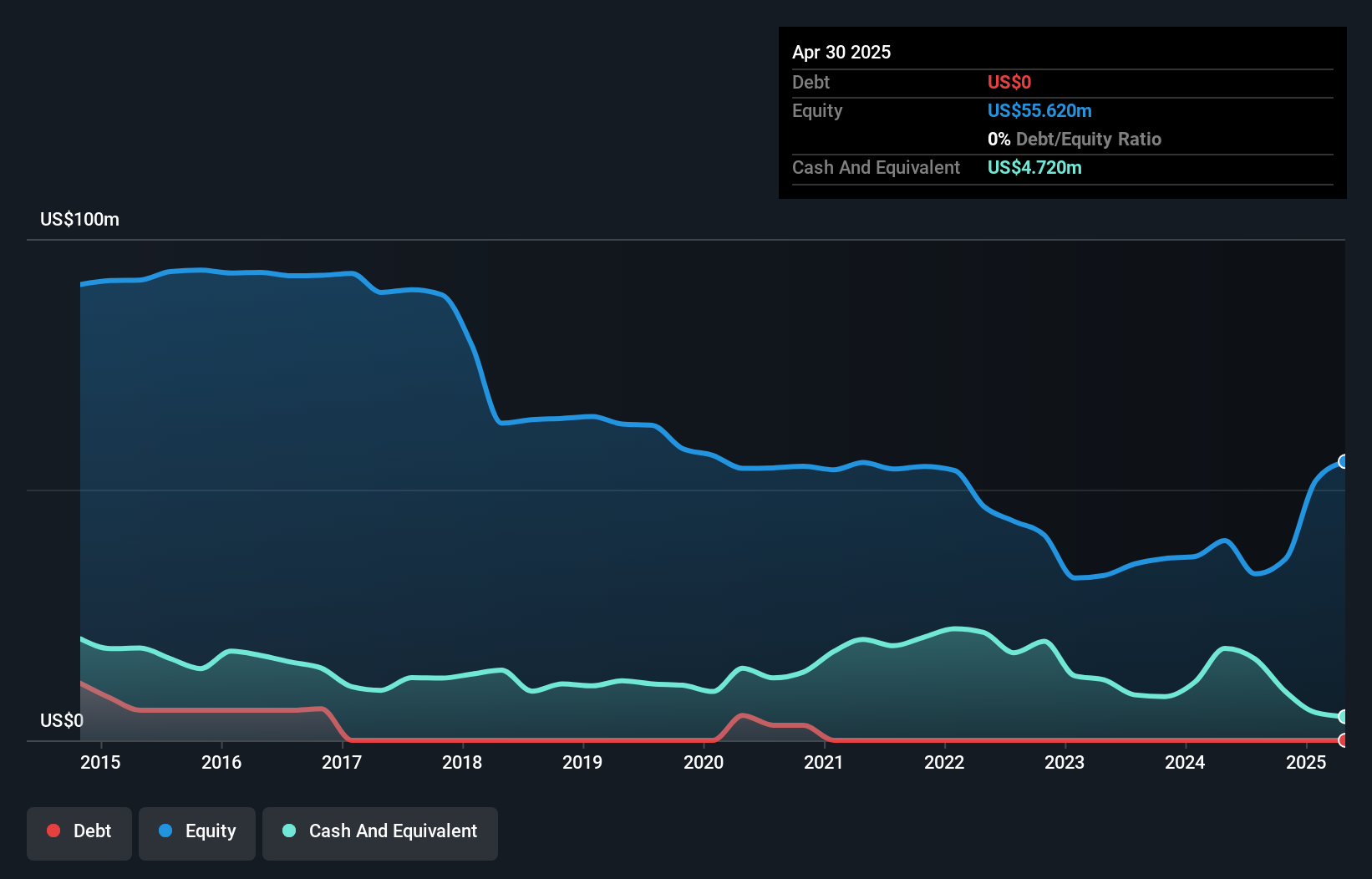

Frequency Electronics, a nimble player in the electronics sector, has seen its earnings surge by 265.9% over the past year, outpacing the industry’s 10.9% growth rate. Despite recent volatility in its share price, this debt-free company is trading at 26.9% below estimated fair value and boasts high-quality non-cash earnings. Recent buybacks saw the repurchase of 21,910 shares for US$0.58 million between May and July 2025. While first-quarter sales dipped to US$13.81 million from US$15.08 million last year, its strategic moves like index inclusion signal potential for future growth.

IBEX (IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-enabled customer lifecycle experience solutions both in the United States and internationally, with a market capitalization of $495.32 million.

Operations: IBEX generates revenue primarily from its Business Process Outsource segment, which accounts for $579.74 million. The company's market capitalization stands at $495.32 million.

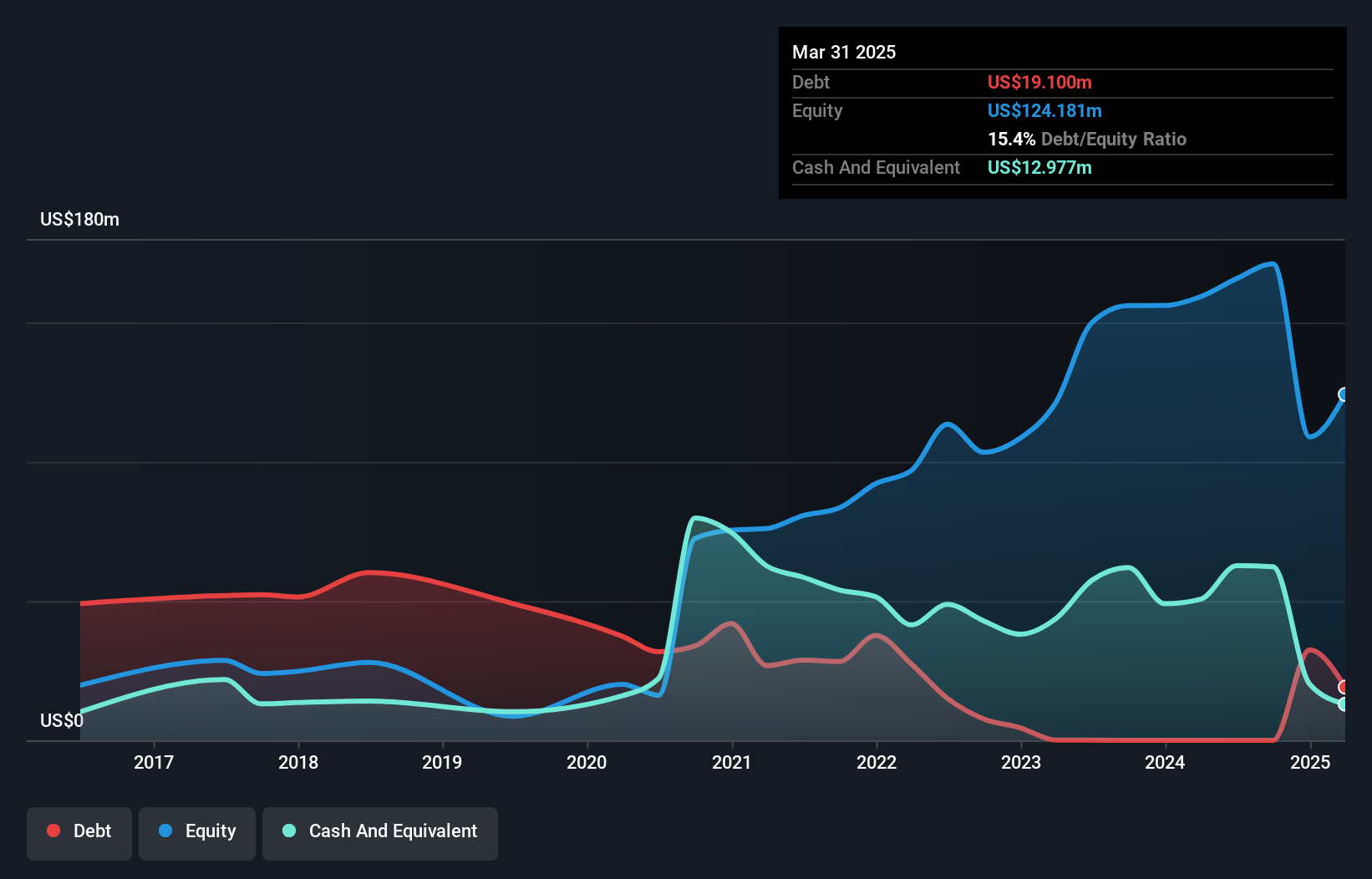

IBEX, a nimble player in the professional services sector, is debt-free, contrasting with its 46.7% debt-to-equity ratio five years ago. The company trades at 53.4% below its estimated fair value, suggesting potential undervaluation. Recent earnings showed a robust growth of 22.6%, outpacing the industry average of 14.4%. Despite significant insider selling over three months and share price volatility, IBEX's high-quality earnings and positive free cash flow indicate financial health. With $151 million in sales for Q1 2025 and net income climbing to $12 million from $7 million last year, IBEX appears poised for continued success amidst evolving governance structures and strategic buybacks totaling $4.35 million this year.

- Click to explore a detailed breakdown of our findings in IBEX's health report.

Gain insights into IBEX's past trends and performance with our Past report.

IRADIMED (IRMD)

Simply Wall St Value Rating: ★★★★★★

Overview: IRADIMED CORPORATION develops, manufactures, markets, and distributes MRI-compatible medical devices and related accessories, disposables, and services globally with a market cap of $1.20 billion.

Operations: IRADIMED generates revenue primarily from its patient monitoring equipment segment, totaling $80.51 million. The company's market cap stands at approximately $1.20 billion.

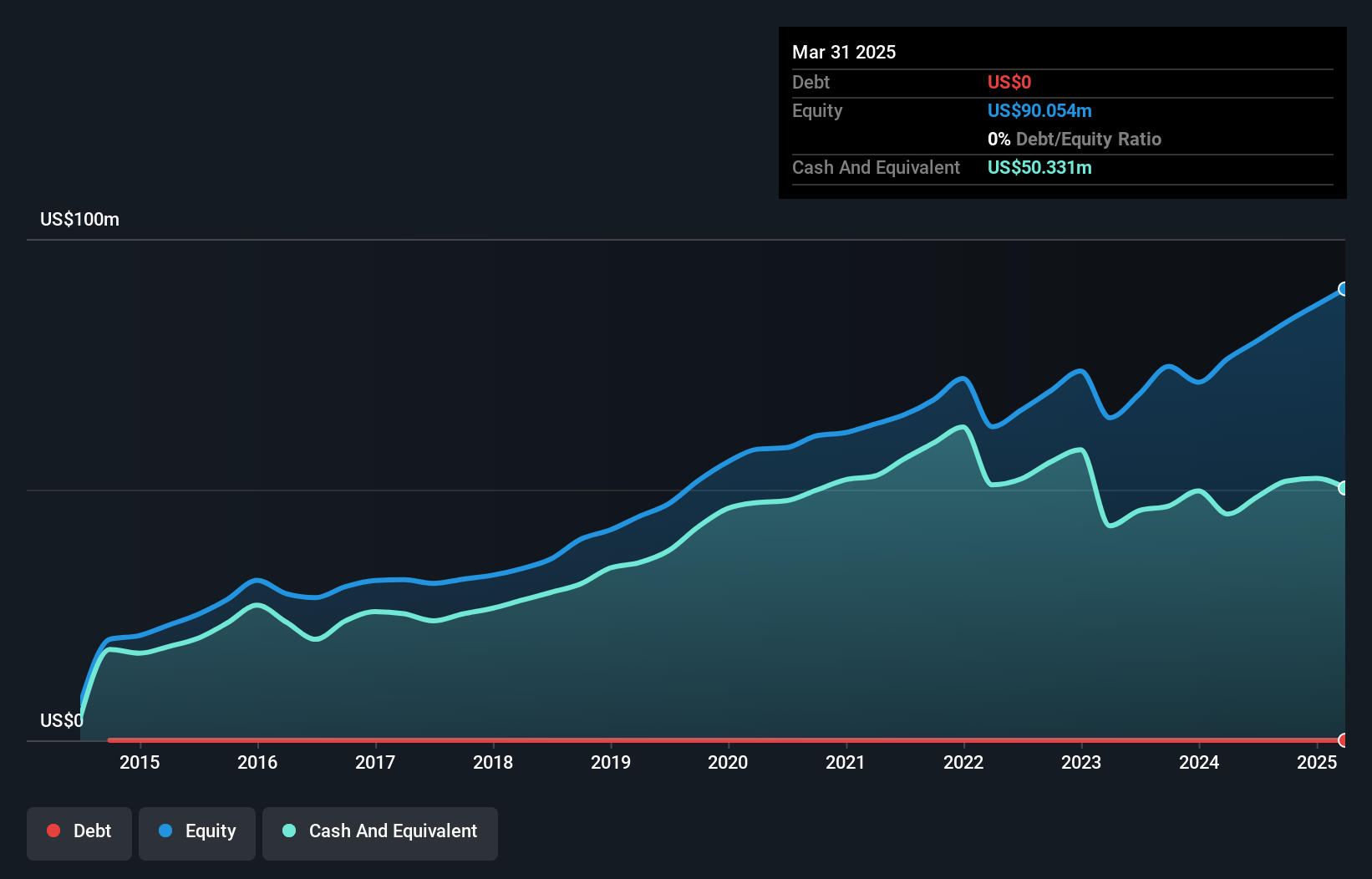

IRADIMED, a nimble player in the medical equipment sector, is riding high on its innovative MRI-compatible IV pump. This product's appeal seems to be driving replacement cycles and expanding its customer base. The company has no debt and enjoys high-quality earnings, with a 13.7% growth rate over the past year outpacing the industry average of 12.5%. Recent financials show third-quarter sales at US$21.2 million, up from US$18.33 million last year, while net income rose to US$5.58 million from US$5.05 million previously reported. However, reliance on a narrow product range poses risks if technological shifts occur swiftly in this competitive field.

Summing It All Up

- Click this link to deep-dive into the 299 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com