Does CBL & Associates Properties' (CBL) New Buyback And Insider Sale Clarify Its Capital Priorities?

- Earlier this month, CBL & Associates Properties announced a new US$25.00 million stock buyback program and disclosed that Chief Legal Officer & Secretary Jeffery Curry sold 5,000 shares on December 2, 2025.

- The combination of this fresh repurchase authorization and new analyst coverage with a Buy rating highlights growing external and internal confidence in the REIT’s outlook.

- With these developments in mind, we’ll explore how the new US$25.00 million buyback program shapes CBL’s broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is CBL & Associates Properties' Investment Narrative?

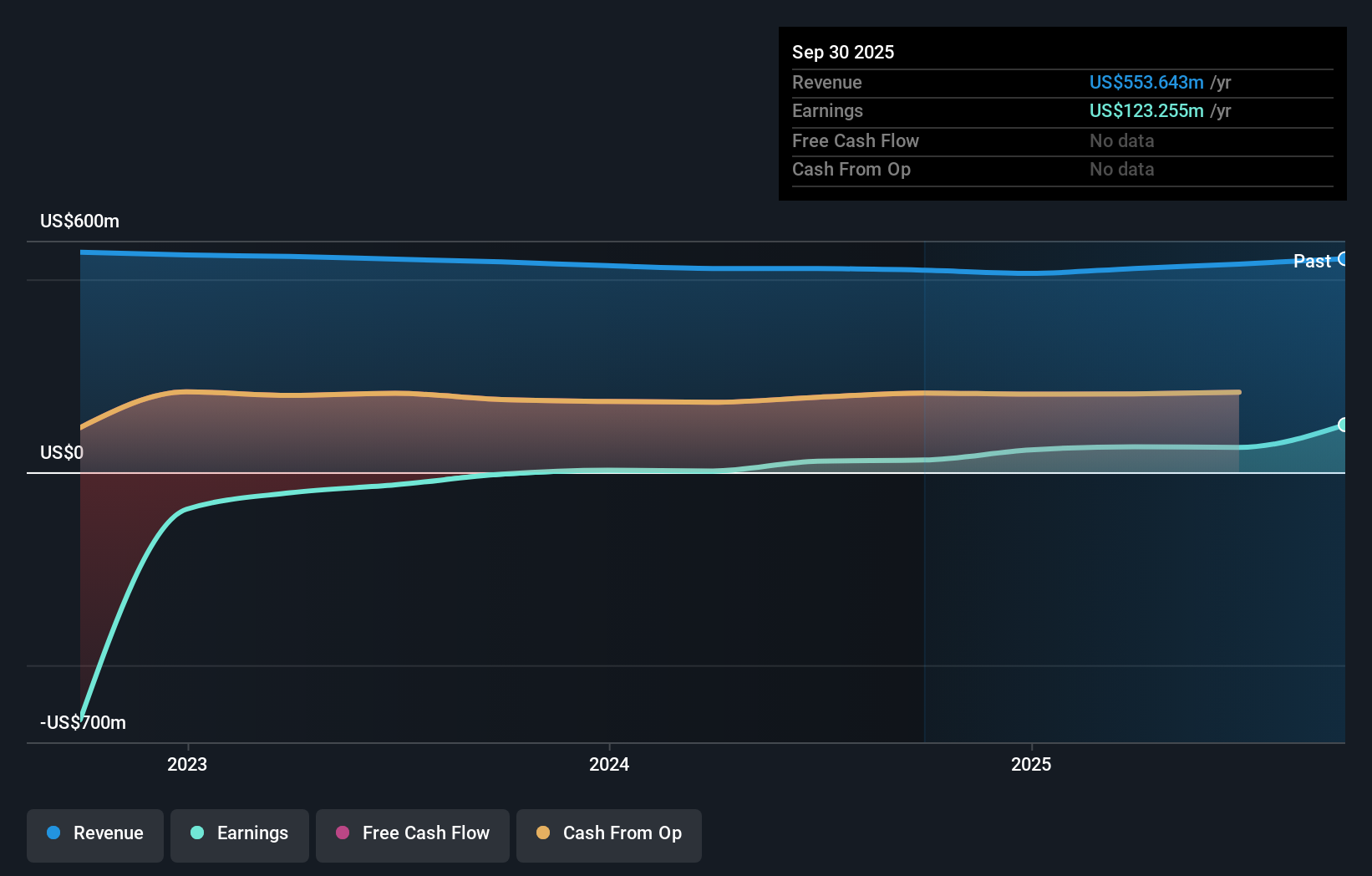

To own CBL & Associates Properties, you need to believe the REIT can convert its post-restructuring turnaround, recent profit jump and solid dividend track record into sustainable, repeatable cash flows, despite a retail real estate sector that still carries structural questions. The new US$25.00 million buyback slots neatly into this story: it reinforces management’s message that the balance sheet and cash generation can support both dividends and repurchases, but the absolute size is small enough that it does not radically alter the near term catalysts, which still center on lease spreads, occupancy trends and interest expense. The mixed pattern of insider trades, including Jeffery Curry’s recent sale, slightly sharpens an existing risk around how durable recent earnings really are, given large one off gains and forecasts for lower profits ahead.

However, one key risk around the quality and sustainability of recent earnings is easy to miss. CBL & Associates Properties' shares have been on the rise but are still potentially undervalued by 40%. Find out what it's worth.Exploring Other Perspectives

The Simply Wall St Community’s single fair value estimate sits at US$45, matching recent analyst coverage, which leaves you weighing buyback support and dividend continuity against forecasts for much lower future earnings and ongoing balance sheet pressure. With opinions already clustering around one number, it becomes even more important to look closely at how interest costs and one off gains could affect CBL’s longer term performance.

Explore another fair value estimate on CBL & Associates Properties - why the stock might be worth just $45.00!

Build Your Own CBL & Associates Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CBL & Associates Properties research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CBL & Associates Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CBL & Associates Properties' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com