How Saint-Gobain’s 4.2 Million Share Cancellation Will Impact Compagnie de Saint-Gobain (ENXTPA:SGO) Investors

- On December 3, 2025, Saint-Gobain cancelled 4,243,098 treasury shares acquired on the market, reducing its share capital to 495 million shares and outstanding shares to 493 million, after allocating €402 million in 2025 to net share repurchases.

- This sizeable buyback and cancellation program tightens Saint-Gobain’s share base, which can enhance per‑share metrics and underlines management’s focus on capital return.

- We’ll now examine how this cancellation of over 4.2 million treasury shares shapes Saint-Gobain’s investment narrative and future capital allocation.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Compagnie de Saint-Gobain Investment Narrative Recap

To own Saint-Gobain, you need to believe that demand for energy‑efficient, sustainable building materials and renovation will remain robust enough to offset its cyclical, Europe‑heavy exposure and high fixed costs. The recent cancellation of 4.2 million treasury shares modestly tightens the share count but does not materially change the near term catalyst, which still hinges on execution in green renovation, or the key risk around margin pressure from rising input and energy costs.

The share cancellation follows a broader capital return framework that also includes a 5% dividend increase to €2.20 per share approved in June 2025. Taken together, the higher cash distribution and ongoing buybacks frame Saint‑Gobain as a company actively returning capital while continuing to invest in low carbon plants and efficiency, a balance that matters if renovation demand softens or cost inflation reaccelerates.

Yet, despite these shareholder friendly moves, the exposure to rising and volatile raw materials and energy costs is something investors should be aware of...

Read the full narrative on Compagnie de Saint-Gobain (it's free!)

Compagnie de Saint-Gobain's narrative projects €52.0 billion revenue and €3.8 billion earnings by 2028. This requires 3.5% yearly revenue growth and about a €1.0 billion earnings increase from €2.8 billion today.

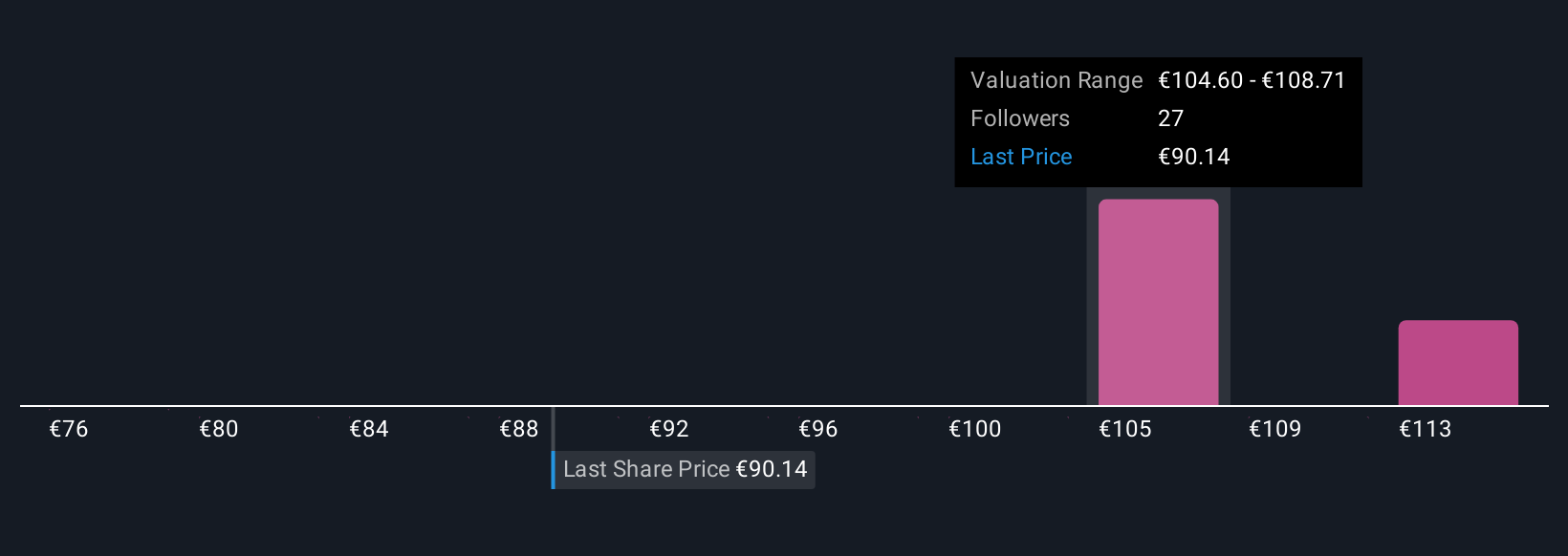

Uncover how Compagnie de Saint-Gobain's forecasts yield a €106.28 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span about €75 to roughly €115.94, showing how far apart individual views on Saint Gobain can be. You might weigh these opinions against the key risk that higher raw material and energy costs could pressure margins and influence how the business performs over time.

Explore 6 other fair value estimates on Compagnie de Saint-Gobain - why the stock might be worth 14% less than the current price!

Build Your Own Compagnie de Saint-Gobain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compagnie de Saint-Gobain research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Compagnie de Saint-Gobain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compagnie de Saint-Gobain's overall financial health at a glance.

No Opportunity In Compagnie de Saint-Gobain?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com