TSX Penny Stocks To Consider In December 2025

As we approach the end of 2025, Canadian markets have continued their upward trajectory, with the TSX delivering impressive double-digit gains. In this context, investors are keenly observing central bank decisions and labor market reports to gauge future economic conditions. While penny stocks might seem like a throwback to earlier market days, they still represent an area where smaller or newer companies can offer significant value when backed by strong financials. These stocks can provide a blend of affordability and growth potential for those looking to explore promising opportunities in less-established firms.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.34 | CA$252.72M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.36 | CA$137.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.465 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.22 | CA$811.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.25 | CA$164.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.55M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Tartisan Nickel (CNSX:TN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tartisan Nickel Corp. is involved in the acquisition, exploration, and development of mineral properties in Canada and Peru, with a market cap of CA$18.34 million.

Operations: Tartisan Nickel Corp. has not reported any revenue segments.

Market Cap: CA$18.34M

Tartisan Nickel Corp. remains a pre-revenue company with a market cap of CA$18.34 million, focusing on advancing its Kenbridge Nickel-Copper-Cobalt Deposit through strategic drilling initiatives. Recent private placements raised CA$1.05 million, potentially extending its cash runway despite previous insufficiencies based on free cash flow estimates. The company's board is experienced with an average tenure of 5.3 years, yet it faces challenges such as high share price volatility and unprofitability, reflected in a negative return on equity of -7.14%. Although the debt to equity ratio has increased slightly over five years, it remains low at 0.2%.

- Click here to discover the nuances of Tartisan Nickel with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Tartisan Nickel's track record.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Roots Corporation, along with its subsidiaries, operates in the design, marketing, and sale of apparel, leather goods, footwear, and accessories under the Roots brand both in Canada and internationally with a market cap of CA$136.08 million.

Operations: The company's revenue is primarily derived from its Direct-To-Consumer segment, which generated CA$231.09 million, supplemented by CA$37.37 million from Partners and Other channels.

Market Cap: CA$136.08M

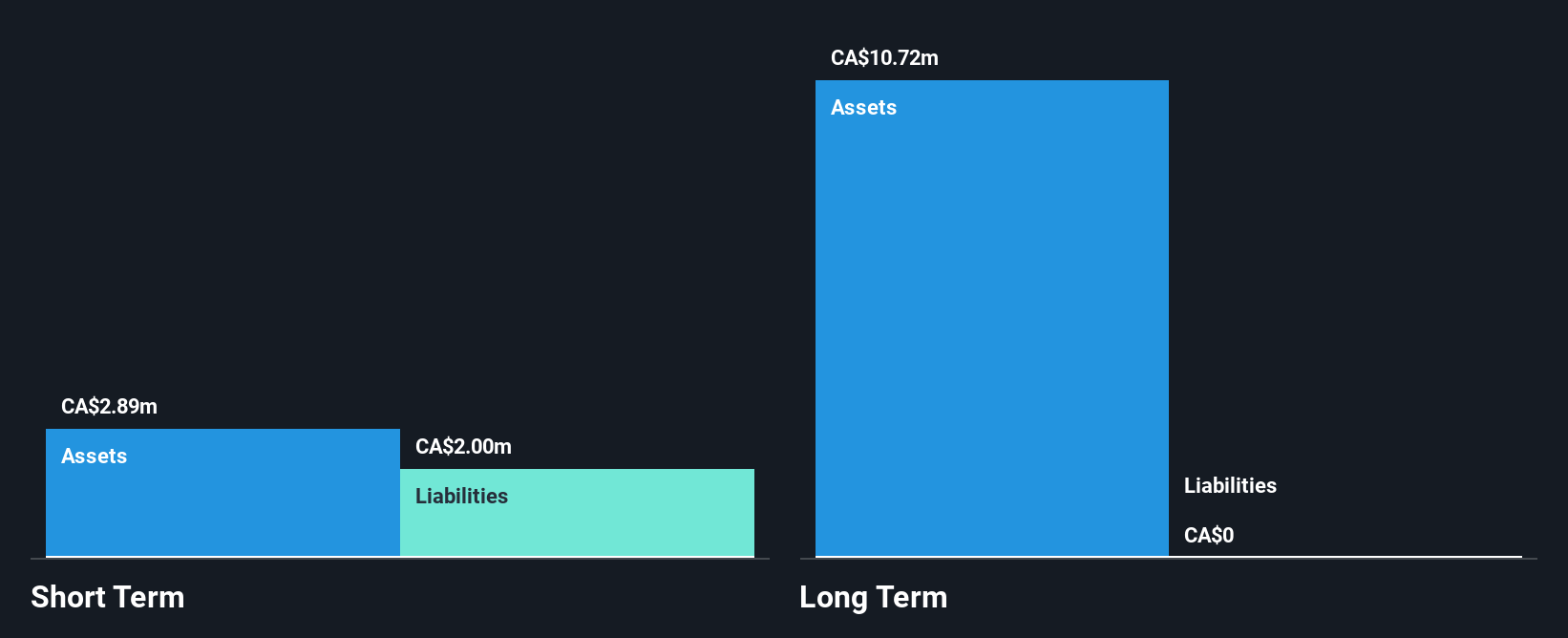

Roots Corporation, with a market cap of CA$136.08 million, is focusing on revitalizing its retail presence through store refreshes across Canada. Recent expansions include new concept stores in Vancouver and Toronto, integrating technology and community-driven experiences to enhance customer engagement. Despite these initiatives, the company remains unprofitable with a net loss of CA$4.39 million for the second quarter of 2025. Roots' financial stability is supported by satisfactory debt levels and short-term assets exceeding liabilities but challenged by long-term liabilities not fully covered by current assets. The company has also engaged in share buybacks, repurchasing 1.5% of its shares for CA$2.13 million as part of capital management efforts.

- Get an in-depth perspective on Roots' performance by reading our balance sheet health report here.

- Gain insights into Roots' outlook and expected performance with our report on the company's earnings estimates.

Western Energy Services (TSX:WRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Energy Services Corp. is an oilfield service company operating in Canada and the United States with a market cap of CA$74.45 million.

Operations: The company generates revenue primarily through its Contract Drilling segment, which accounts for CA$162.23 million, and its Production Services segment, contributing CA$56.86 million.

Market Cap: CA$74.45M

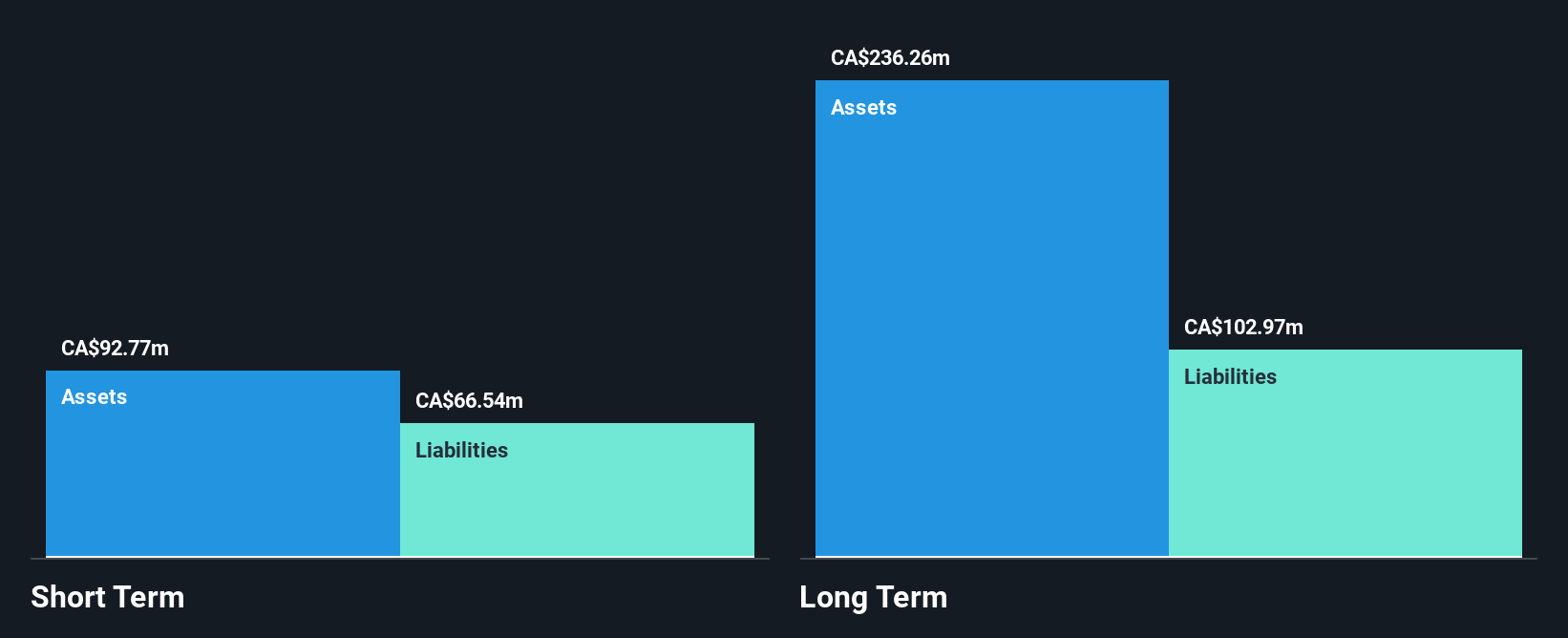

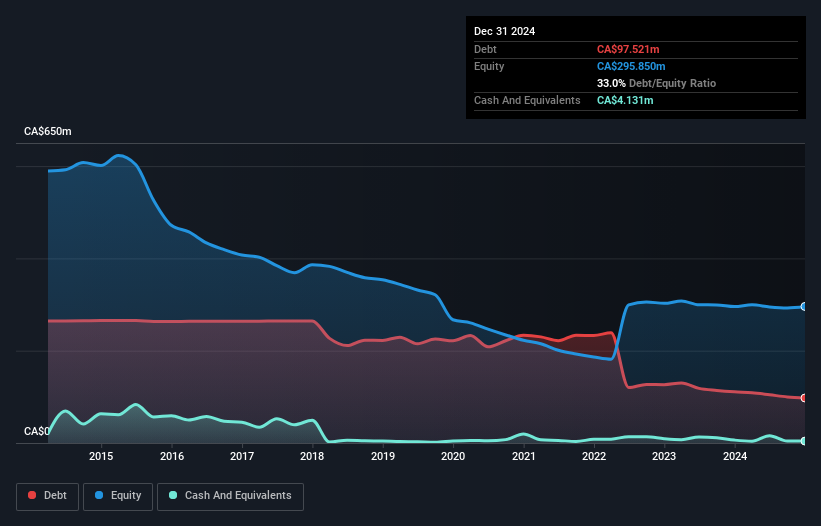

Western Energy Services Corp., with a market cap of CA$74.45 million, faces challenges typical of penny stocks, including recent unprofitability and declining quarterly sales from CA$58.34 million to CA$50.04 million year-over-year. Despite this, the company has managed to reduce its debt-to-equity ratio significantly over the past five years and maintains a sufficient cash runway for over three years due to positive free cash flow growth. While short-term assets cover short-term liabilities, long-term liabilities remain uncovered by current assets. The management team is relatively new with an average tenure of less than one year, contrasting with an experienced board averaging nine years in tenure.

- Unlock comprehensive insights into our analysis of Western Energy Services stock in this financial health report.

- Explore Western Energy Services' analyst forecasts in our growth report.

Taking Advantage

- Navigate through the entire inventory of 392 TSX Penny Stocks here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com