Metro (TSX:MRU) Valuation Check After New Share Buyback Authorization

Metro (TSX:MRU) just rolled out a new share buyback plan, authorizing repurchases of up to 10 million shares, roughly 5% of its float. This move signals management’s confidence and capital discipline.

See our latest analysis for Metro.

The new buyback comes after a steady climb, with the share price up about 10.7% year to date and a three year total shareholder return of roughly 34%, suggesting momentum is still quietly building rather than fading.

If Metro’s disciplined capital returns have your attention, it is also worth exploring fast growing stocks with high insider ownership that could be setting up for their next leg higher.

Yet with shares hovering near record highs, only a modest discount to analyst targets and solid but steady growth, investors have to ask whether Metro is still mispriced or whether the market is already baking in its next chapter.

Most Popular Narrative: 5.7% Undervalued

With Metro closing at CA$99.85, the most widely followed narrative points to a fair value just above CA$105, implying only a modest upside that hinges on disciplined execution.

The analysts have a consensus price target of CA$105.909 for Metro based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$118.0, and the most bearish reporting a price target of just CA$80.0.

Curious what justifies paying today for tomorrow's earnings power? This narrative leans on steady revenue gains, resilient margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $105.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying discount competition and rising input costs could squeeze margins and undermine the modest upside implied by today’s valuation.

Find out about the key risks to this Metro narrative.

Another Lens on Valuation

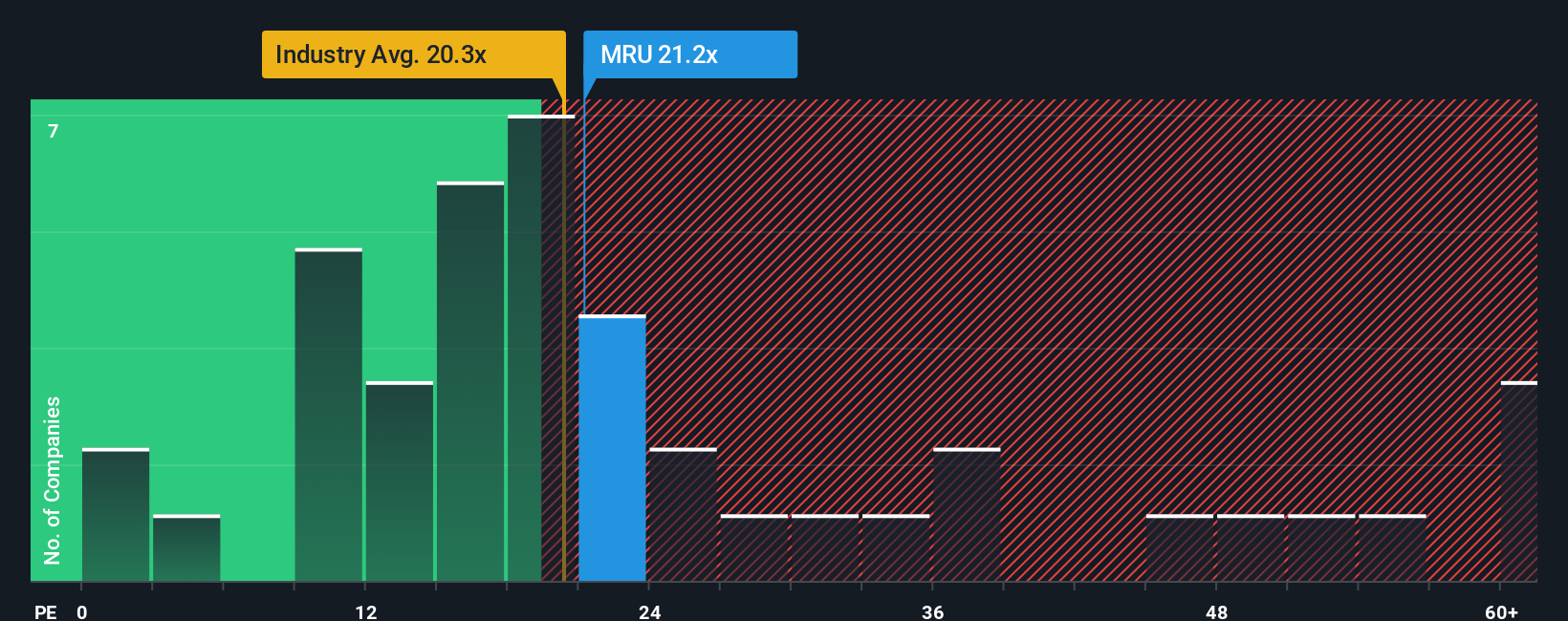

While analysts see only modest upside, our fair ratio suggests the current P/E of 21.1 times sits slightly above where the market could settle at 20.2 times, even if it still looks reasonable versus the industry at 21.9 times and peers at 22.5 times. Is that premium really worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Metro Narrative

If you see the story differently or want to dig into the numbers yourself, you can spin up a custom view in just minutes: Do it your way.

A great starting point for your Metro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Metro; sharpen your edge by using the Simply Wall Street Screener to uncover fresh stock ideas that match how you actually invest.

- Target potential bargains by scanning these 899 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Tap into powerful growth themes by reviewing these 27 AI penny stocks shaping how businesses use automation, data, and machine learning.

- Lock in potential income streams by checking these 15 dividend stocks with yields > 3% that offer attractive yields alongside solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com