What lululemon athletica (LULU)'s Slowing U.S. Sales and Tariff Pressures Mean For Shareholders

- In recent months, lululemon athletica reported mixed results, with strong international growth but sluggish U.S. sales, prompting management to lower full-year revenue guidance while also facing higher tariffs and the removal of the de minimis duty exemption that threaten profit margins.

- These pressures, combined with elevated inventory levels and shifting consumer demand, have created a split view among analysts and options traders, who now see lululemon as a quality brand in transition rather than a straightforward growth story.

- We’ll now examine how stalled U.S. revenue and tariff-driven margin pressure may reshape lululemon’s previously optimistic investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

lululemon athletica Investment Narrative Recap

To stay invested in lululemon today, you have to believe the brand can reinvigorate its core U.S. business while using international growth and product innovation to offset tariff pressure on margins. The latest guidance cut and tariff headwinds directly affect the near term catalyst of a U.S. sales recovery, while also sharpening the main risk that discounting and slower demand could weigh on profitability if new products do not land quickly enough.

The most relevant recent update is lululemon’s reduced FY2025 revenue guidance to US$10.85 billion to US$11.00 billion, which explicitly builds in about US$240 million of net gross profit impact from tariffs and sourcing changes. This reinforces how central margin management has become to the story and sets a clearer bar for whether product resets, cost actions, and international expansion can collectively stabilize earnings in the next few quarters.

But behind the brand strength, investors should be aware of how higher tariffs and the lost de minimis relief could...

Read the full narrative on lululemon athletica (it's free!)

lululemon athletica's narrative projects $12.8 billion revenue and $1.9 billion earnings by 2028.

Uncover how lululemon athletica's forecasts yield a $190.19 fair value, in line with its current price.

Exploring Other Perspectives

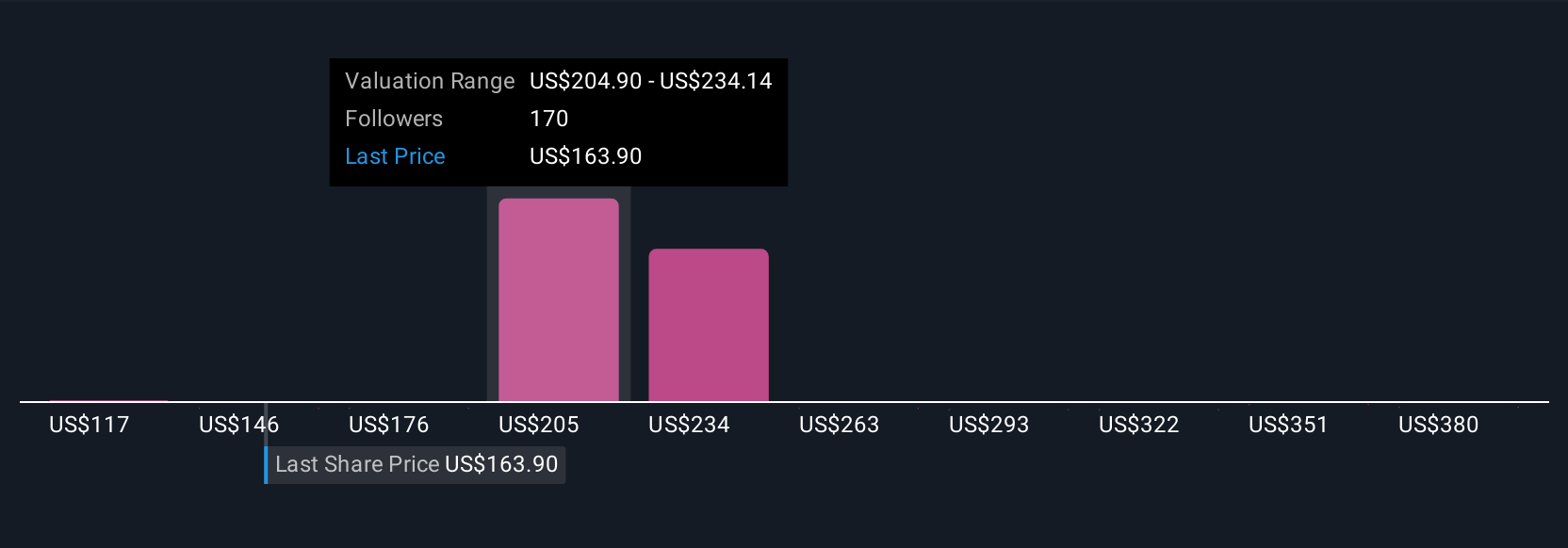

Simply Wall St Community members see lululemon’s fair value anywhere from about US$117 to over US$410 across 46 different views, highlighting very different expectations. Many of these investors are weighing that wide valuation spread against the same near term pressure points around U.S. softness and tariff driven margin risks, which could shape how the company performs relative to those expectations over time.

Explore 46 other fair value estimates on lululemon athletica - why the stock might be worth 38% less than the current price!

Build Your Own lululemon athletica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your lululemon athletica research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free lululemon athletica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate lululemon athletica's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com