Evaluating Pentair (PNR) After Barclays’ Downgrade: Is the Stock’s Growth Story Fully Priced In?

Barclays just took Pentair (PNR) down a notch, shifting its rating to Equal Weight and indicating that the easy margin gains might be behind it. This puts more pressure on future revenue growth.

See our latest analysis for Pentair.

That cooler tone from Barclays seems to have taken some of the heat out of Pentair’s recent momentum, with a roughly flat year to date share price return but a striking three year total shareholder return of about 135 percent showing the longer term story is still firmly intact.

If this downgrade has you rethinking where growth and conviction might come from next, it could be a good time to explore fast growing stocks with high insider ownership.

With shares treading water this year but still trading at a modest discount to average analyst targets, investors now face a key question: is Pentair quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 14.5% Undervalued

With Pentair last closing at $104.25 against a narrative fair value near $121.89, the current price implies a sizable gap to that long term outlook.

The analysts have a consensus price target of $115.368 for Pentair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $95.0.

Curious what kind of revenue climb, margin reset, and future earnings multiple are baked into that fair value, and how bold those assumptions really are?

Result: Fair Value of $121.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat narrative could unravel if residential pool demand stays sluggish or if pricing power fades as competition intensifies and cost pressures persist.

Find out about the key risks to this Pentair narrative.

Another Lens on Value

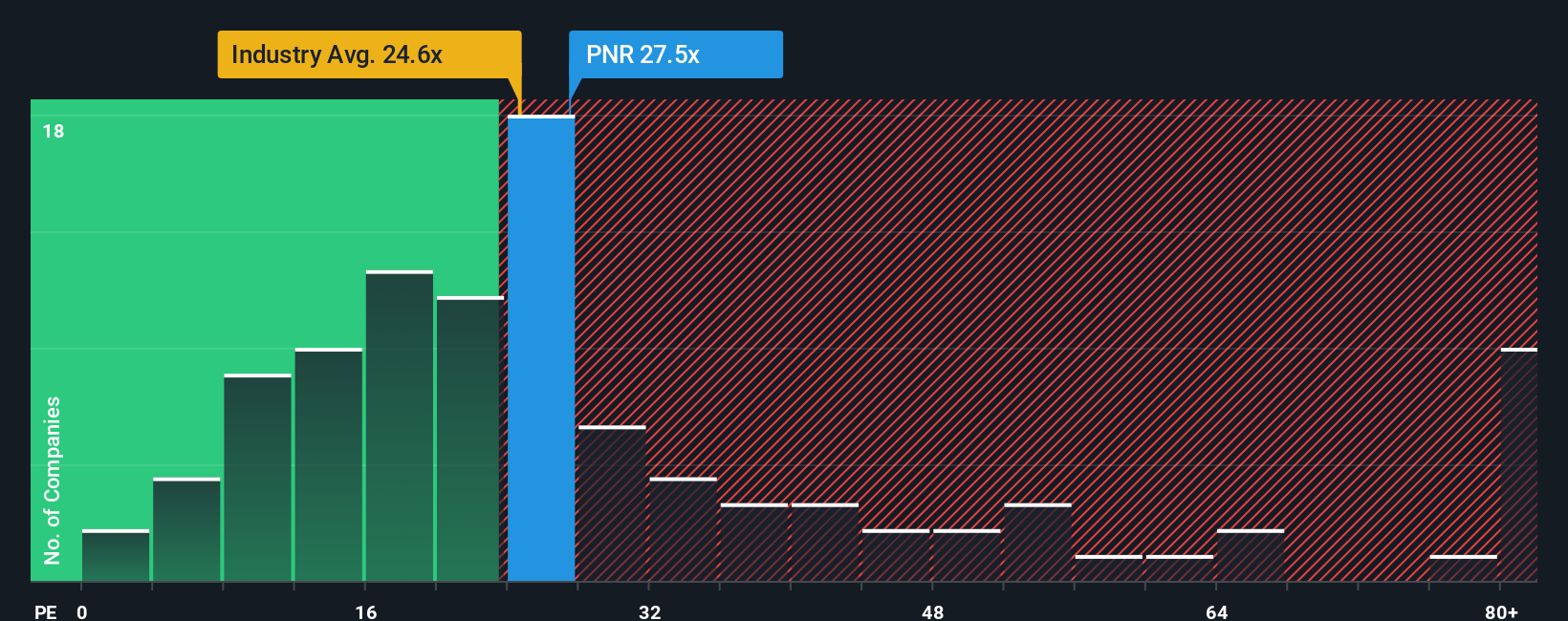

On simple earnings multiples, Pentair looks anything but cheap. Its P/E of 26.1 times sits above peers at 23.2 times, the wider US Machinery group at 25.5 times, and even our 25.9 times fair ratio, suggesting little margin of safety if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

If this view does not quite line up with your own thinking, dive into the numbers yourself and craft a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Ready for more high conviction ideas?

Step up your research and lock in your next move with curated stock ideas from the Simply Wall St Screener before the market fully catches on.

- Capture potential mispricings early by scanning these 898 undervalued stocks based on cash flows that strong cash flow analysis suggests the market is overlooking.

- Position ahead of the next tech wave by targeting these 27 AI penny stocks riding structural demand for automation, data insights, and intelligent software.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that can help support reliable cash returns alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com