Is Hannon Armstrong (HASI) Fairly Valued After Its Recent 21% Three-Month Share Price Gain?

HA Sustainable Infrastructure Capital (HASI) has quietly delivered a 21% gain over the past 3 months, outpacing many income-focused peers as investors revisit climate infrastructure as a long-term cash flow story.

See our latest analysis for HA Sustainable Infrastructure Capital.

That recent 21% 3 month share price return comes on top of a solid year to date share price gain, even though the 5 year total shareholder return is still negative. This suggests momentum is rebuilding as investors reassess climate infrastructure valuations.

If this renewed interest in sustainable assets has caught your eye, it could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

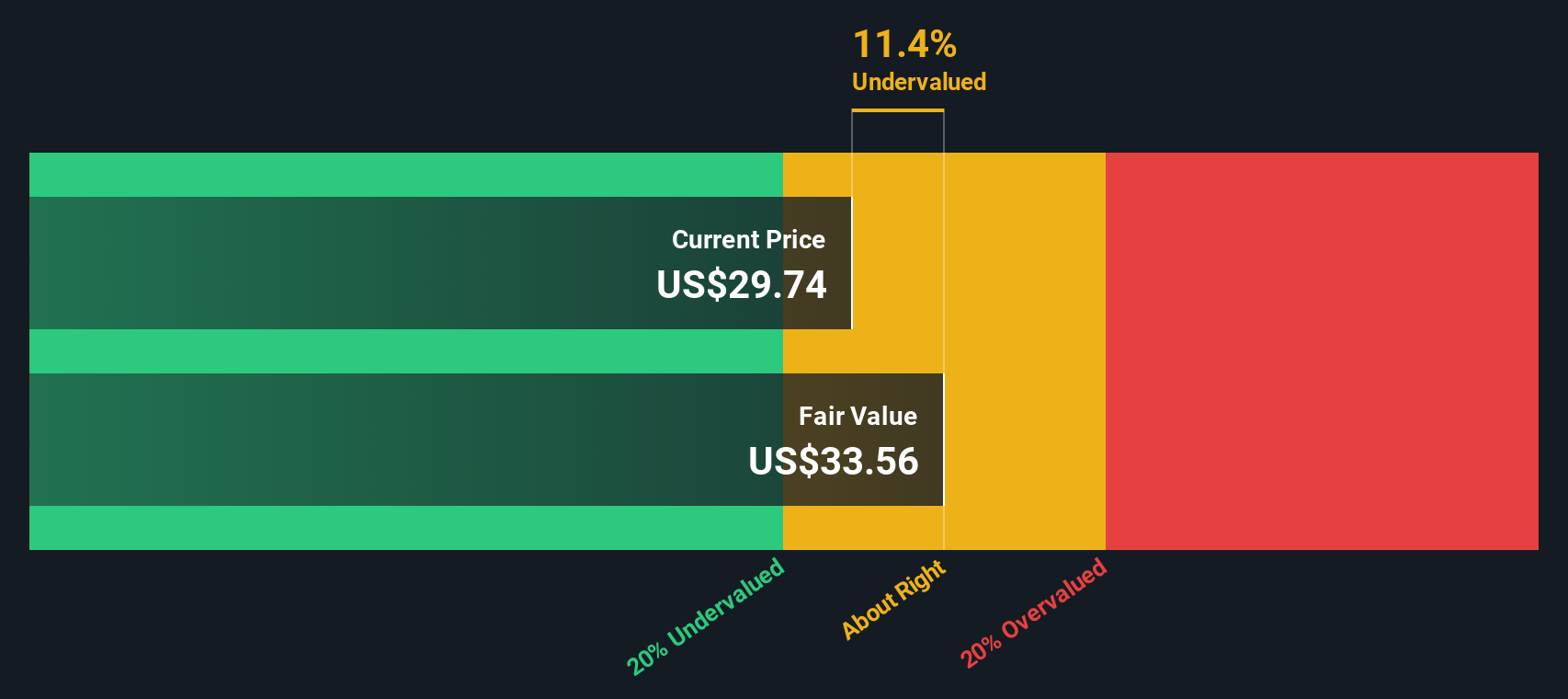

With earnings still growing, a modest intrinsic discount and Wall Street targets sitting nearly 18% higher than today’s price, should investors treat HASI as an undervalued climate cash flow play, or assume markets already see its next leg of growth?

Price-to-Earnings of 13.8x, is it justified?

HASI trades on a 13.8x price to earnings multiple at 33.42 dollars, a level that suggests the market is only modestly optimistic versus peers.

The price to earnings ratio compares what investors pay today with the company’s current earnings, a key lens for diversified financials where cash generation and profitability matter.

For HASI, a 13.8x multiple looks slightly higher than the broader US diversified financials industry average of 13.6x, yet still relatively conservative compared with a much higher peer average and close to an estimated fair price to earnings of 14.2x. This positioning indicates investors are paying a small premium to the sector, but one that remains close to where the multiple could reasonably trade if sentiment toward climate infrastructure and HASI’s earnings profile improves.

Explore the SWS fair ratio for HA Sustainable Infrastructure Capital

Result: Price-to-Earnings of 13.8x (ABOUT RIGHT)

However, investors still face policy uncertainty and higher rate risks, either of which could pressure financing costs and undermine the long term climate infrastructure cash flow story.

Find out about the key risks to this HA Sustainable Infrastructure Capital narrative.

Another View: DCF Says Slightly Undervalued

Our DCF model puts fair value for HASI around 36.51 dollars, roughly 8.5% above the current 33.42 dollars price. That points to a modest margin of safety rather than a screaming bargain and raises the question: is this enough upside for the policy and rate risk on the table?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HA Sustainable Infrastructure Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HA Sustainable Infrastructure Capital Narrative

If this view does not fully align with your own thinking, or you prefer to dive into the numbers yourself, you can build a custom narrative in just a few minutes, starting with Do it your way.

A great starting point for your HA Sustainable Infrastructure Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing stronger opportunities. Put Simply Wall Street’s powerful Screener to work and upgrade your watchlist now.

- Capture early-stage growth potential by scanning these 3580 penny stocks with strong financials that pair market excitement with improving fundamentals.

- Explore the AI theme by targeting these 27 AI penny stocks positioned at the heart of intelligent automation and data-driven innovation.

- Identify potential value opportunities by focusing on these 898 undervalued stocks based on cash flows that trade below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com