Dassault Systèmes (ENXTPA:DSY): Valuation Check After Deepening Mistral AI Partnership on OUTSCALE Sovereign Cloud

Dassault Systèmes (ENXTPA:DSY) just tightened its partnership with Mistral AI, embedding Mistral’s latest generative AI tools into the OUTSCALE sovereign cloud to serve heavily regulated European industries and public sector clients.

See our latest analysis for Dassault Systèmes.

The news lands against a tricky backdrop, with the share price sitting at €23.51 and a steep year to date share price return of around negative 29 percent. The one year total shareholder return has also fallen more than 30 percent, suggesting investors are still cautious even as management leans harder into regulated AI opportunities like this Mistral tie up.

If this kind of AI driven story interests you, it may be worth scanning other software names by exploring high growth tech and AI stocks and seeing which ones the market thinks could be next in line.

With revenues and profits still growing, but the share price well below analyst targets and past highs, is the market overlooking Dassault Systèmes’ AI optionality, or already baking in every ounce of its future growth potential?

Most Popular Narrative: 25.7% Undervalued

With the narrative fair value sitting around €31.66 against a last close of €23.51, the implied upside rests on a very specific earnings path.

The ongoing transition to SaaS and subscription models (83% of software revenues now recurring), combined with early and rapid commercialization of AI powered virtual twins and companions, offers both short term visibility and long term margin improvement, with substantial runway for earnings and free cash flow upside.

Curious how recurring revenue, rising profit margins, and a premium future earnings multiple all converge into that upside case? The growth maths behind this narrative is far from simple. Want to see which long term assumptions really carry the valuation weight? Dive in to unpack the full story.

Result: Fair Value of €31.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower 3DEXPERIENCE cloud adoption and persistent MEDIDATA weakness could undermine recurring revenue growth and delay the premium multiple that this upside case assumes.

Find out about the key risks to this Dassault Systèmes narrative.

Another Angle on Value

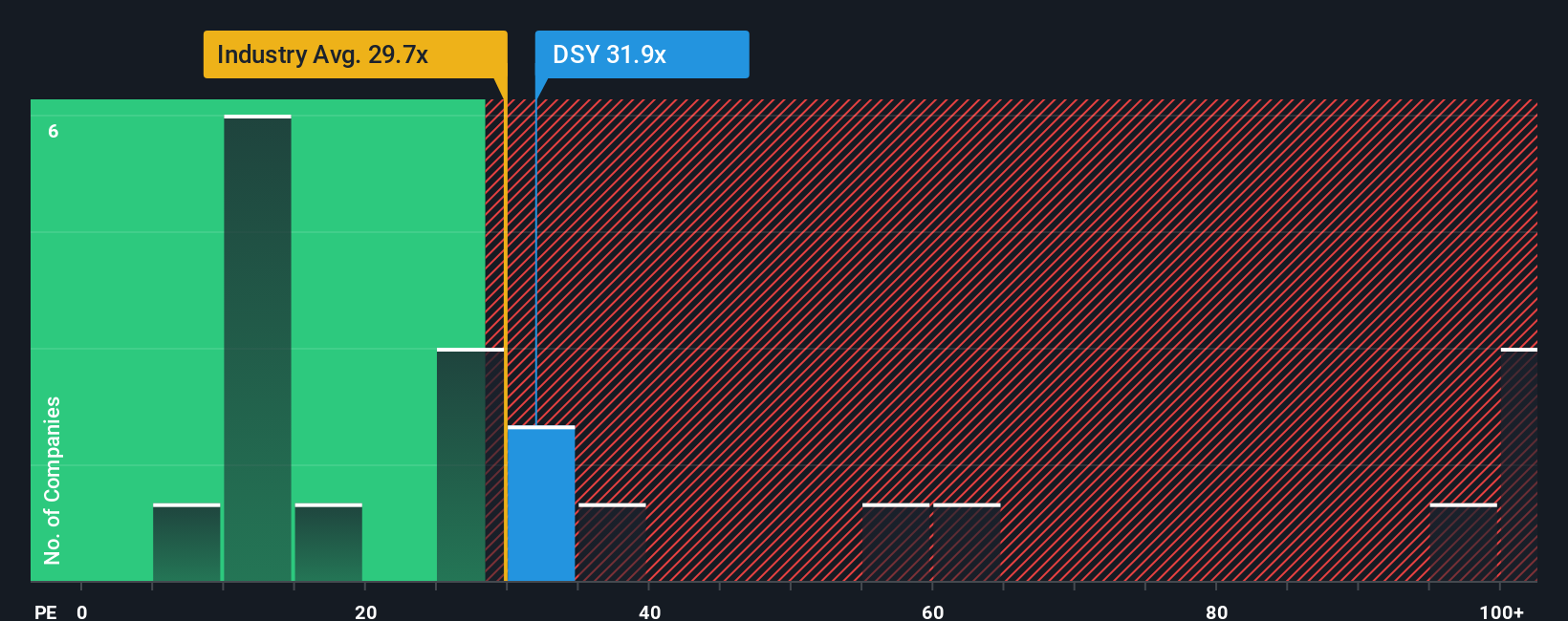

On simple earnings metrics, the picture is less generous. Dassault Systèmes trades on a 26.4x P E ratio, slightly above both its 25.5x fair ratio and the European software average of 25.8x, which hints at limited valuation cushion if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dassault Systèmes Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dassault Systèmes.

Ready to act on your next idea?

Before you move on, you can look for fresh opportunities on the Simply Wall St Screener, where the data does the heavy lifting.

- Review these 3580 penny stocks with strong financials to explore smaller companies that combine higher risk with robust underlying fundamentals.

- Use these 27 AI penny stocks to find businesses operating in areas linked to machine learning and related technologies.

- Explore these 898 undervalued stocks based on cash flows to identify companies that the market may be pricing below their estimated value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com