Biogen (BIIB): Assessing Valuation After Promising New Zorevunersen Data in Dravet Syndrome

Biogen (BIIB) shares are back in focus after new long term data on zorevunersen, presented at the American Epilepsy Society meeting, pointed to sustained seizure reductions and cognitive gains in Dravet syndrome.

See our latest analysis for Biogen.

The latest zorevunersen update lands after a strong run, with Biogen’s 1 month share price return of 16.6 percent helping lift its 1 year total shareholder return to 15.9 percent, even though the 3 year total shareholder return remains sharply negative.

If this kind of pipeline driven move has your attention, it could be a good moment to explore other innovative names across healthcare stocks as potential additions to your watchlist.

With Biogen still trading at a steep discount to some intrinsic value estimates, yet hovering just above the Street’s average target, are investors staring at a mispriced growth story, or has the market already banked on these pipeline wins?

Most Popular Narrative: 1.8% Overvalued

Compared with Biogen's last close near 181 dollars, the most popular narrative sees fair value only slightly lower, suggesting a finely balanced setup.

Enhancements in operational efficiency through ongoing "Fit for Growth" initiatives, disciplined cost management, and portfolio prioritization are expected to improve cost control, drive higher net margins over time, and support stronger earnings. Robust late-stage and diversified neurodegenerative and specialty disease pipelines including Phase III launches in SMA, lupus, and kidney indications capitalize on regulatory momentum to address high unmet needs, creating multiple shots on goal that reduce future revenue volatility and support long-term earnings stability.

Want to see what happens when shrinking revenues meet rising margins and a future earnings multiple below sector darlings? The full narrative reveals the tension.

Result: Fair Value of $178.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory uncertainty around key launches and intensifying MS competition could quickly undermine the margin expansion story that is embedded in this narrative.

Find out about the key risks to this Biogen narrative.

Another View: Multiples Point to Deep Value

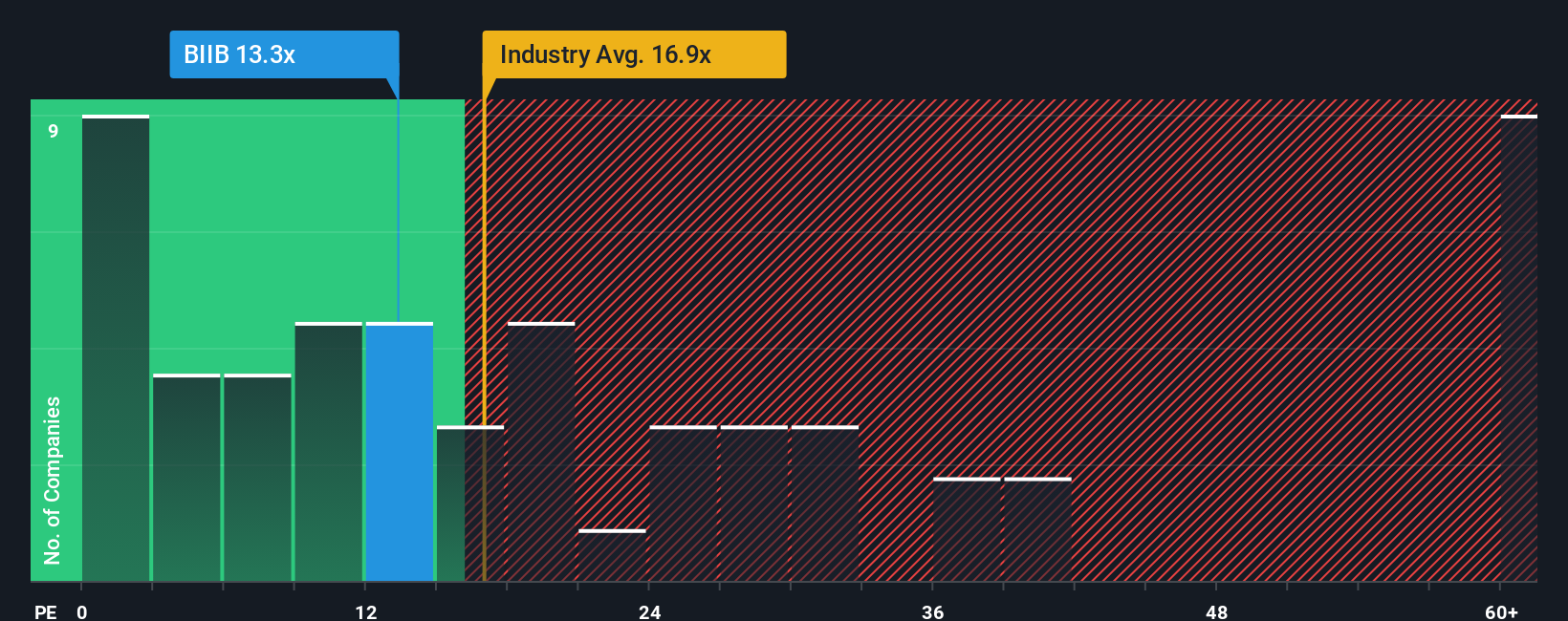

While the most popular narrative calls Biogen slightly overvalued versus its 178.07 dollars fair value, the market tells a different story on earnings. At 16.5 times earnings versus a 23.3 times fair ratio and richer peer and industry averages, the gap hints at a possible value opportunity rather than froth. Which signal should investors trust more right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Biogen Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A great starting point for your Biogen research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the next headline moves the market, secure your edge by uncovering fresh opportunities from powerful screeners that surface quality, growth, and income in seconds.

- Explore potential opportunities with these 3580 penny stocks with strong financials that pair low share prices with relatively strong balance sheets and improving fundamentals.

- Position your portfolio in the AI theme by targeting these 27 AI penny stocks that use data, automation, and intelligent software in their businesses.

- Focus on these 15 dividend stocks with yields > 3% that combine current yields with payout ratios and cash flows that appear more stable over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com