Is Tesla’s Run After Autonomous Driving Push Justified by Fundamentals in 2025?

- If you are wondering whether Tesla's stock is still a smart buy after its massive run, you are not alone. This article is going to dig into whether the current price really matches the underlying value.

- After all, Tesla is trading around $455, with the share price up 5.8% over the last week, 5.9% over the last month, 20.0% year to date and 16.7% over the past year, on top of an eye catching 171.1% gain over three years and 113.3% over five years.

- Recent headlines have focused on Tesla's push into autonomous driving technology, expanding production capacity for its newer factories and high profile price cuts across key EV markets. All of these developments have influenced how investors see its growth runway. At the same time, ongoing regulatory debates around EV incentives and competition from legacy automakers have added a new layer of uncertainty to the story.

- Despite that buzz, Tesla currently scores just 0 out of 6 on our valuation checks, suggesting the market might be paying up for the narrative. From here we will walk through several valuation approaches, before finishing with a perspective that can be even more useful than any single model on its own.

Tesla scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tesla Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting its future cash flows and then discounting those back to the present. For Tesla, the model used here is a two stage Free Cash Flow to Equity approach that looks at analyst forecasts first, and then tapers growth in later years.

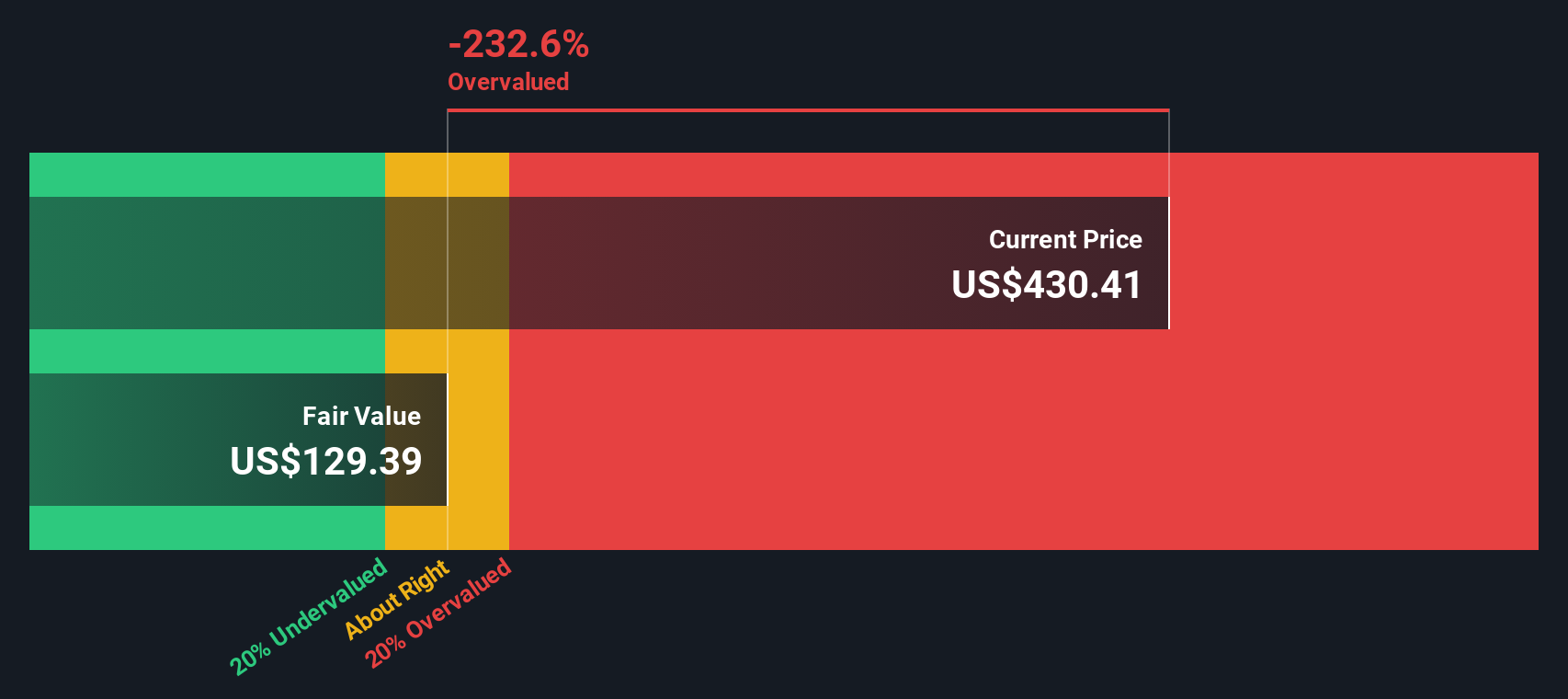

Tesla generated around $6.40 billion of free cash flow over the last twelve months. Analysts expect this to rise to about $20.91 billion by 2029, with further projections beyond that point extrapolated rather than directly forecast. Simply Wall St converts all these future $ figures back into today’s money using a required return, which gives an estimated intrinsic value of roughly $137.87 per share.

Against a recent share price of about $455, the DCF suggests Tesla is roughly 230.0% above its estimated fair value, indicating that the market price is far more optimistic than the cash flow analysis implies.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tesla may be overvalued by 230.0%. Discover 899 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tesla Price vs Sales

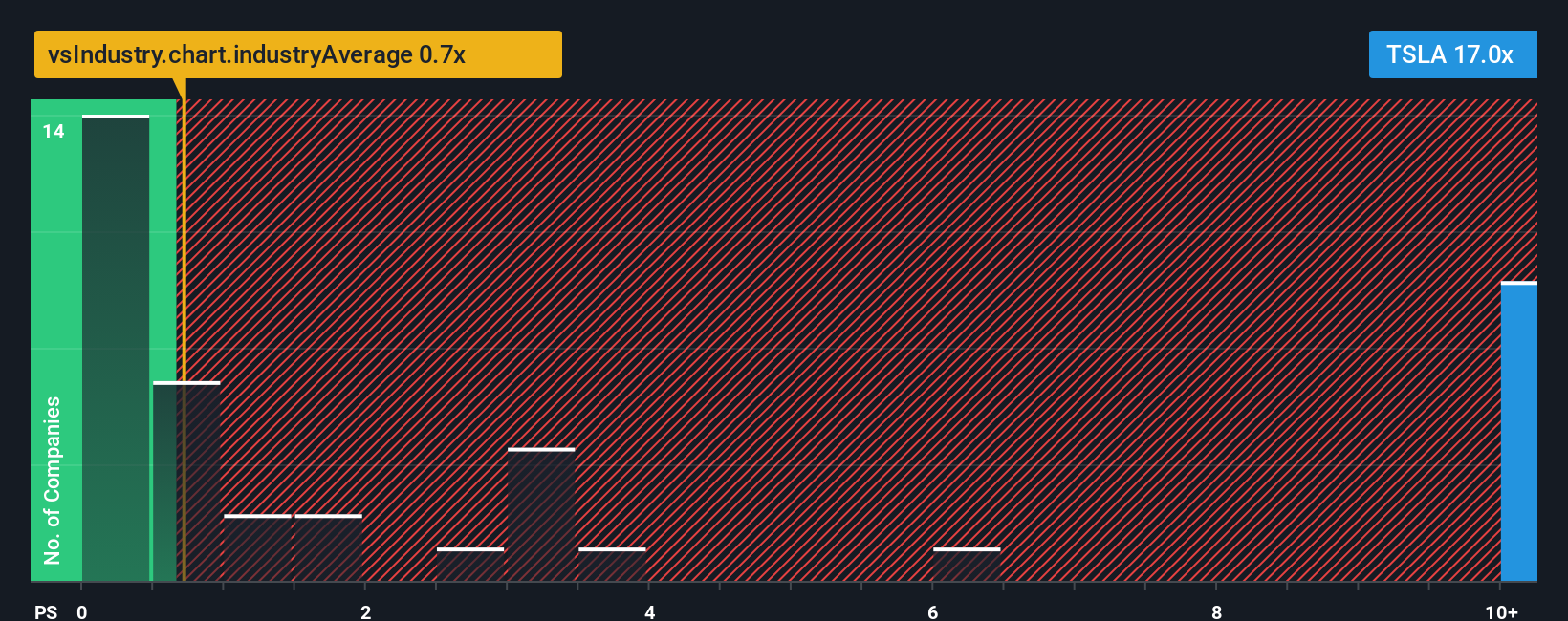

For a company like Tesla that is profitable but still heavily reinvesting for growth, the price to sales ratio is a useful way to gauge how much investors are willing to pay for each dollar of revenue. It is less distorted by short term swings in margins, which can be meaningful for a business scaling new factories and product lines.

In general, higher expected growth and lower perceived risk justify a higher normal multiple, while slower or less certain growth should command a lower one. Tesla currently trades on a price to sales ratio of about 15.82x, which is far richer than the Auto industry average of roughly 0.94x and above the peer group average of around 1.41x.

Simply Wall St’s Fair Ratio for Tesla, at about 2.87x, adjusts for the company’s specific growth outlook, profitability, industry, size and risk profile. This makes it more informative than simple comparisons with peers or an industry that includes slower growing, traditional automakers. Set against today’s 15.82x sales, the Fair Ratio implies Tesla’s valuation is significantly higher than what those fundamentals would typically support.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tesla Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you spell out the story you believe about a company, connect that story to specific forecasts for revenue, earnings and margins, and then translate those forecasts into a fair value you can compare to today’s share price.

On Simply Wall St’s Community page, millions of investors use Narratives to do exactly this, turning their view of Tesla into a structured forecast that updates dynamically as new news, earnings and data arrive. This helps them quickly see whether changes in the story mean it is time to buy, hold or sell, based on how their Fair Value compares to the current Price.

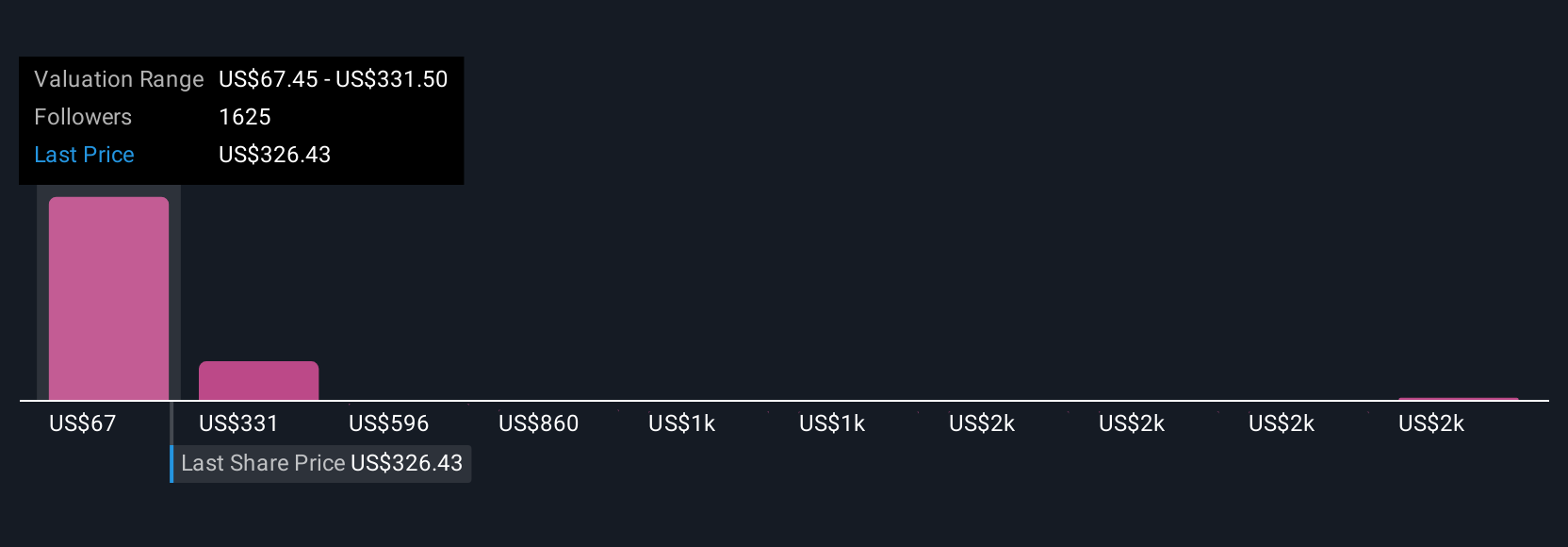

For Tesla, one investor might build a cautious Narrative that assumes limited self driving progress, rising Chinese competition and a Fair Value of about $67 per share. Another could model aggressive growth in AI, robotics and robotaxis that supports a Fair Value closer to $2,708. Narratives makes both perspectives transparent, quantifiable and easy to track over time.

For Tesla however we will make it really easy for you with previews of two leading Tesla Narratives:

Fair value: $2,707.91 per share

Implied undervaluation vs $455: approximately 83.2%

Revenue growth assumption: 77%

- Frames Tesla as a diversified technology platform across EVs, AI, robotics, energy storage and software, not just an automaker.

- Projects 2030 revenue of around $1.94 trillion with roughly $534 billion of net profit and a net margin near the high 20% range.

- Backs into today’s value using future P E scenarios and a discount rate, arriving at a current fair value in the low thousands per share, implying significant upside if the full vision is executed.

Fair value: $332.71 per share

Implied overvaluation vs $455: approximately 36.8%

Revenue growth assumption: 30%

- Acknowledges multiple product and software catalysts, from Cybertruck and a low cost Model 2 to FSD and Optimus, but stresses execution and timing risks.

- Builds a more moderate path to 2028 to 2030 with revenue in the roughly $120 billion to $150 billion range and profit margins around 18% to low 20% levels.

- Factors in fierce EV competition, regulatory and geopolitical risk and valuation multiple compression, leading to a fair value below today’s price and a more cautious outlook.

Taken together, these two Narratives show how reasonable investors, using different assumptions about growth, margins and valuation multiples, can reach very different views on what Tesla is worth, which is why making your own Narrative can be useful for deciding whether to buy, hold or sell.

Do you think there's more to the story for Tesla? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com