Guardian Pharmacy Services (GRDN): Valuation Check After Q3 Beat, Insider Buying and Analyst Upgrades

Guardian Pharmacy Services (GRDN) just delivered Q3 2025 numbers that topped market expectations, with revenue and adjusted EBITDA both up solidly, and director Steven Cosler backing that strength by buying 3,370 shares himself.

See our latest analysis for Guardian Pharmacy Services.

The Q3 beat and insider buying have helped keep momentum on Guardian’s side, with the share price at $29.76 and a year to date share price return of almost 50 percent alongside a 1 year total shareholder return above 23 percent.

If this kind of steady healthcare execution appeals to you, it could be worth exploring other specialised healthcare stocks that might be quietly building similar momentum.

With the shares up almost 50 percent year to date and trading only modestly below analyst targets, investors now face a key question: Is Guardian Pharmacy still undervalued, or is the market already pricing in its next leg of growth?

Price-to-Earnings of 107.8x: Is it justified?

Guardian Pharmacy Services trades on a steep 107.8x price-to-earnings multiple at $29.76, signaling the market is paying a premium for every dollar of profit.

The price-to-earnings ratio compares a company’s share price with its earnings per share. It is a quick way to gauge how much investors are willing to pay for current profitability in a sector where steady cash generation often commands higher-than-average valuations.

In Guardian’s case, that 107.8x multiple looks stretched because it sits not only well above direct peers on average at 55.7x, but also far beyond the SWS fair ratio estimate of 34.5x. This implies investors are pricing in a very optimistic earnings trajectory that could compress if growth expectations slip.

Relative to the broader US Healthcare industry, which trades around 22.2x earnings, Guardian’s current valuation looks even more extreme. This underscores how far sentiment has run ahead of both the sector and the level our fair multiple analysis suggests prices could eventually revert toward.

Explore the SWS fair ratio for Guardian Pharmacy Services

Result: Price-to-Earnings of 107.8x (OVERVALUED)

However, a stretched valuation and any slowdown in earnings growth or LTCF spending could quickly pressure sentiment and trigger a sharp multiple correction.

Find out about the key risks to this Guardian Pharmacy Services narrative.

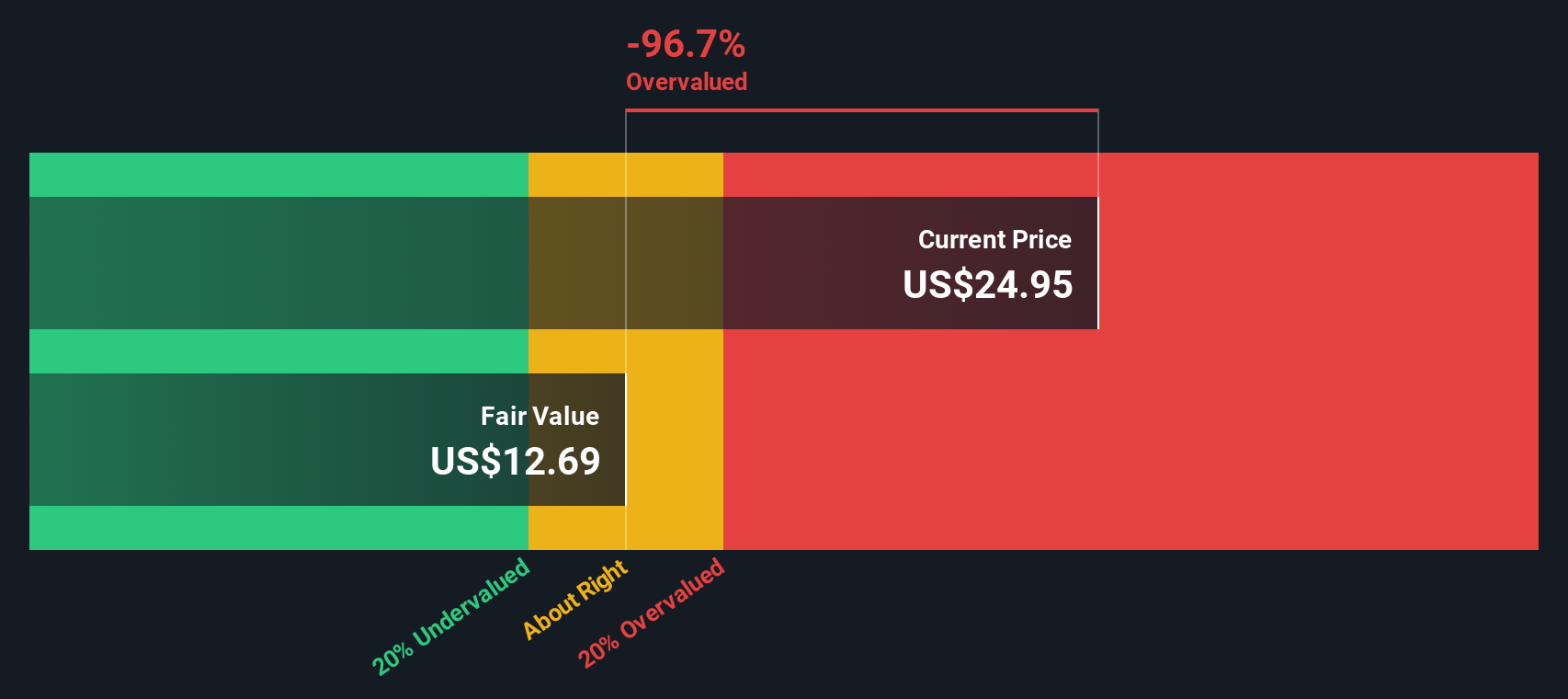

Another View, Fair Value and Cash Flows

Our DCF model points to a fair value of about $29.05 per share, slightly below the current $29.76 price. This suggests Guardian is marginally overvalued rather than dramatically mispriced. If cash flows already back most of today’s valuation, how much upside is really left from here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardian Pharmacy Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardian Pharmacy Services Narrative

If you see the story differently or want to test your own assumptions using the same data, you can build a complete narrative yourself in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Guardian Pharmacy Services.

Looking for more investment ideas?

Use the Simply Wall Street Screener now to uncover focused opportunities you might otherwise miss, and make sure your next move matches your best investing ideas.

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Capitalize on market mispricing by scanning these 899 undervalued stocks based on cash flows where fundamentals suggest prices have room to run.

- Position yourself ahead of the next tech wave by assessing these 27 AI penny stocks poised to benefit from rapid advances in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com