Reassessing Intapp (INTA) Valuation After Optimistic Growth Outlook and Strategic Partnership Momentum

Intapp (INTA) is back in the spotlight as it heads to present at the UBS Global Technology and AI Conference in Scottsdale, a timely stage given growing enthusiasm around its recurring revenue engine.

See our latest analysis for Intapp.

The upcoming UBS appearance comes after a choppy stretch for the stock, with a roughly 13 percent 1 month share price return, a steep year to date share price decline, and a still impressive 3 year total shareholder return. This suggests that long term momentum may remain intact even as sentiment resets.

If Intapp’s niche in AI powered workflow tools has your attention, it might be worth exploring other high growth tech and AI names through high growth tech and AI stocks for additional ideas beyond this one.

With shares still trading at a discount to analyst targets despite robust recurring revenue and strong three year returns, the key question now is whether Intapp remains mispriced or if the market has already factored in its next leg of growth.

Most Popular Narrative: 24.4% Undervalued

With Intapp last closing at $43.20 against a narrative fair value of $57.13, the latest storyline leans toward a sizable upside if forecasts stick.

Intapp's commitment to cloud adoption, with 93% of clients having at least one cloud module, coupled with the upselling and cross-selling success, positions them to improve their net margins through increased cloud utilization and economies of scale.

Want to see what kind of revenue runway and profit margin shift are baked into that upside case? The core thesis hinges on bold growth, richer margins, and a future earnings multiple that assumes Intapp matures into a far more profitable SaaS leader than it looks today.

Result: Fair Value of $57.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, particularly around cloud migrations and partner delivery, where client churn or higher costs could quickly puncture the upside narrative.

Find out about the key risks to this Intapp narrative.

Another Lens on Valuation

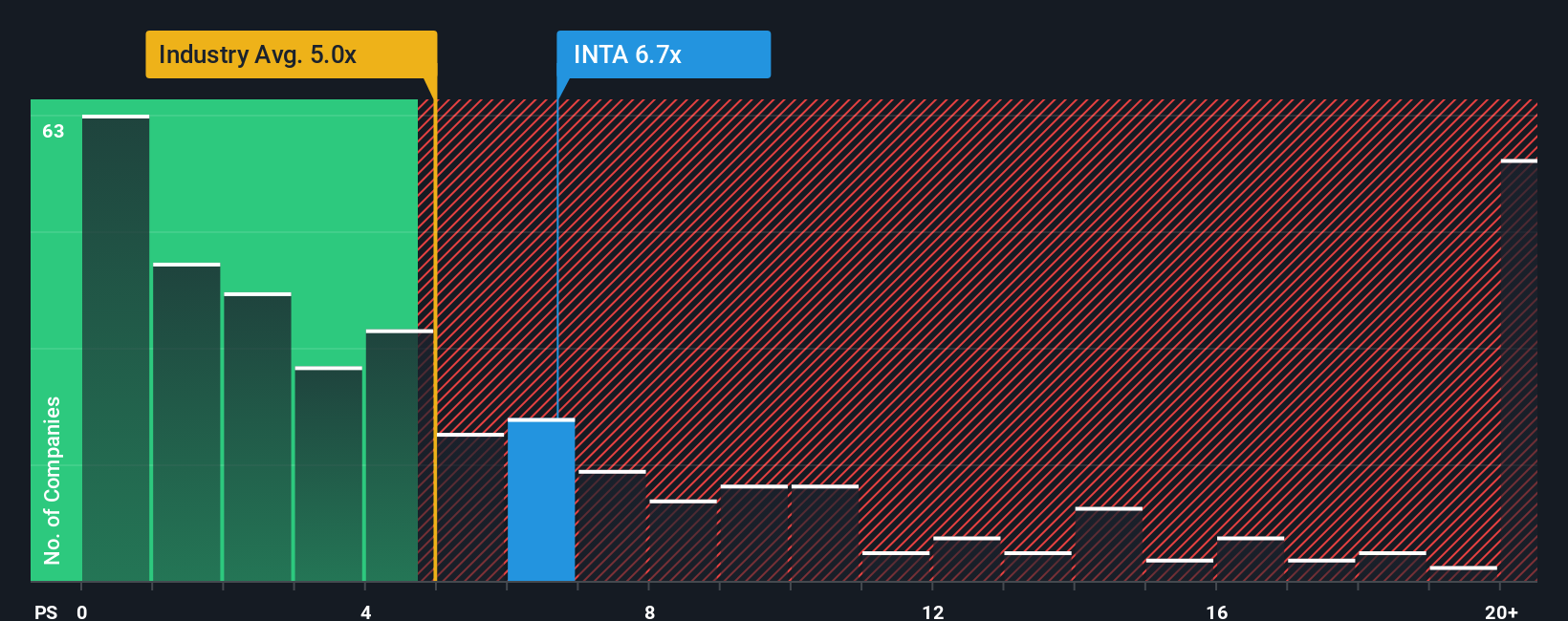

Step away from fair value models, and Intapp suddenly looks pricey, not cheap. Its price to sales sits near 6.7 times versus a 4.9 times fair ratio and wider software market, although still below peer averages around 7.6 times. Is the premium justified, or just hope priced in early?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intapp Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intapp.

Ready for more investing angles?

Before markets move on without you, put Simply Wall Street’s screener to work and uncover fresh, data backed ideas that could sharpen your next portfolio move.

- Capture the upside of mispriced opportunities by scanning these 899 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Ride powerful technology shifts by targeting these 27 AI penny stocks positioned at the front line of real world artificial intelligence adoption.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that offer attractive yields backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com