What Does a Major Insider Sale Reveal About ACM Research's (ACMR) Evolving Risk Narrative?

- On December 3, 2025, 10% shareholder Wang David H reported selling 130,000 ACM Research shares for about US$4.36 million, as disclosed in a federal securities filing.

- This sizeable insider sale highlights a meaningful shift in ownership that many investors track as a potential signal of changing insider sentiment.

- We’ll explore how this significant insider sale by a major shareholder could influence ACM Research’s existing investment narrative and risk profile.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

ACM Research Investment Narrative Recap

To own ACM Research, you need to believe its wafer cleaning and plating tools can keep winning share as chip complexity and China-focused capacity grow, despite export controls and customer concentration risks. The recent US$4.36 million insider sale by a 10% shareholder is sizeable, but on its own does not clearly change the near term focus on execution against 2025 revenue guidance or the key risk around China exposure and potential further trade restrictions.

The company’s updated 2025 guidance, narrowing expected revenue to US$875 million to US$925 million, is the most relevant context for this insider sale because it frames how much operational visibility management currently has. Against that backdrop, investors may view the transaction alongside ACM’s recent first shipments of panel-level tools and the ongoing need to convert a growing product portfolio and capacity investments into sustainable orders outside China.

Yet while growth opportunities in China remain central, investors should be aware that tighter export controls or weaker domestic fab spending could...

Read the full narrative on ACM Research (it's free!)

ACM Research's narrative projects $1.4 billion revenue and $189.6 million earnings by 2028. This requires 19.1% yearly revenue growth and about a $77.5 million earnings increase from $112.1 million today.

Uncover how ACM Research's forecasts yield a $40.81 fair value, a 16% upside to its current price.

Exploring Other Perspectives

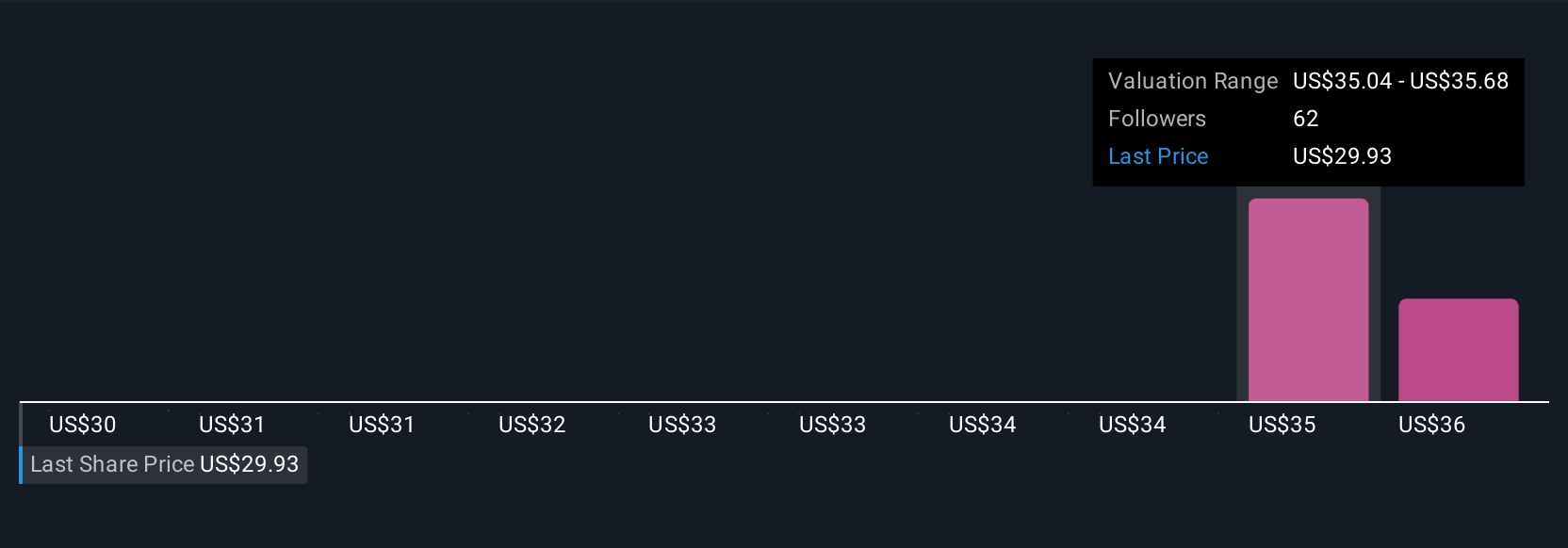

Five fair value estimates from the Simply Wall St Community span roughly US$29.90 to US$40.81 per share, highlighting a wide band of expectations. Set against this, the concentration in China and exposure to shifting export rules could materially influence how those different views on ACM Research’s future play out, so it is worth considering several of these perspectives side by side.

Explore 5 other fair value estimates on ACM Research - why the stock might be worth 15% less than the current price!

Build Your Own ACM Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACM Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ACM Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACM Research's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com