Praxis Precision Medicines (PRAX) Is Up 34.4% After Dual Neurology Milestones - Has The Bull Case Changed?

- Praxis Precision Medicines recently reported positive efficacy results from the registrational cohort of its EMBOLD trial of relutrigine in rare developmental and epileptic encephalopathies, and completed a pre-NDA FDA meeting for ulixacaltamide in essential tremor, with an NDA filing targeted for early 2026.

- Together, these programs highlight Praxis’s effort to build a focused neurology franchise that spans ultra-rare pediatric epilepsies and a large, underserved essential tremor population.

- We’ll now examine how the FDA-aligned NDA path for ulixacaltamide could shape Praxis Precision Medicines’ evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Praxis Precision Medicines' Investment Narrative?

To own Praxis Precision Medicines today, you have to believe that its precision neurology strategy can convert two late‑stage assets into commercial products before the cash burn and dilution become too painful. The stock’s very large move higher over the past quarter suggests the market already sees the FDA‑aligned NDA path for ulixacaltamide and the EMBOLD efficacy stop for relutrigine as material de‑risking events, effectively bringing forward the timing and visibility of potential revenue catalysts. At the same time, Praxis remains a small, loss‑making biotech with a projected multi‑year path to profitability, a high price‑to‑book multiple and a history of shareholder dilution. The EMBOLD news improves the near‑term narrative, but it also raises the stakes around regulatory decisions and the company’s ability to fund a broader neurology franchise.

However, investors also need to weigh the ongoing cash burn and dilution risk. Praxis Precision Medicines' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

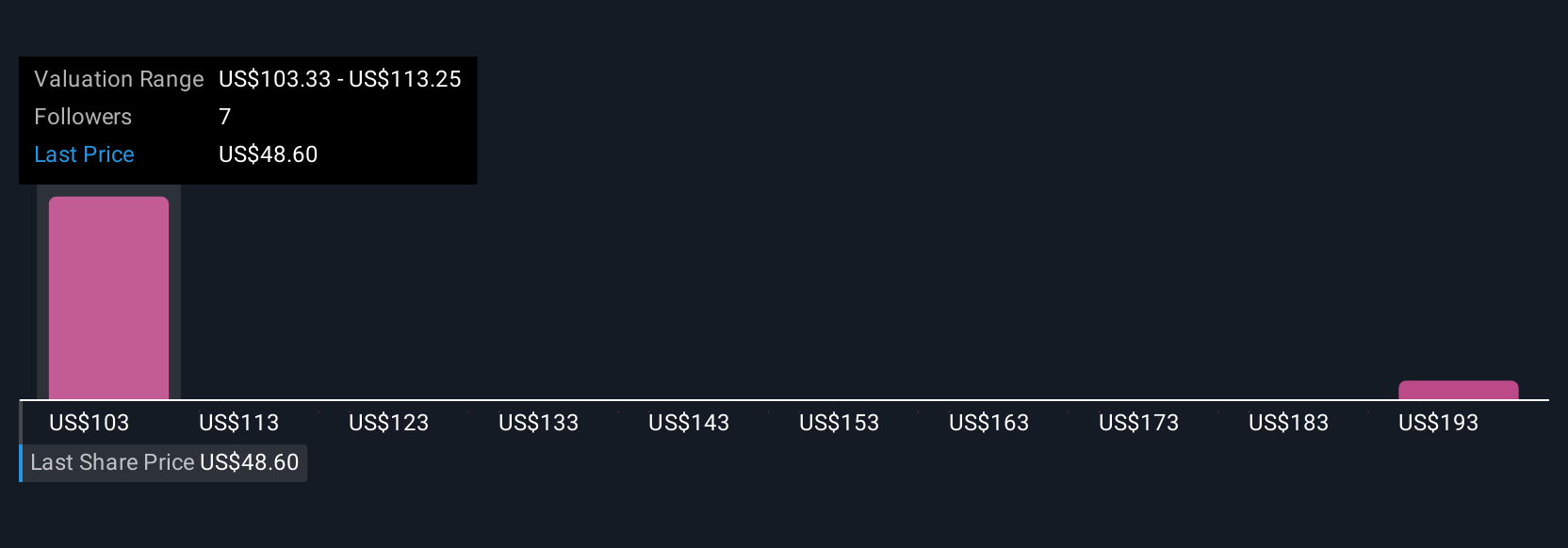

The Simply Wall St Community’s two fair value estimates for Praxis span roughly US$342 to more than US$2,500 per share, underlining how far apart individual views can be. Set against this, the recent EMBOLD and ulixacaltamide updates have sharpened the focus on regulatory outcomes and funding needs as key swing factors for Praxis’s future performance. Readers can benefit from comparing these community views with their own assessment of those risks and catalysts.

Explore 2 other fair value estimates on Praxis Precision Medicines - why the stock might be worth over 10x more than the current price!

Build Your Own Praxis Precision Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Praxis Precision Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Praxis Precision Medicines' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com