Will Alight’s New CEO Shift ALIT’s Story From Transformation Promises To Execution Reality?

- Alight, Inc. has announced that Rohit Verma, currently president and CEO of Crawford & Company, will become its chief executive officer and join its board on January 1, 2026, succeeding Dave Guilmette, who will step down on December 31, 2025.

- Investors are focused on how Verma’s history of reshaping business models and emphasizing client-centric operations could influence Alight’s transformation and growth ambitions.

- Next, we’ll explore how Verma’s appointment as incoming CEO may influence Alight’s investment narrative built around automation, partnerships and recurring revenue.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Alight Investment Narrative Recap

To own Alight, you have to believe in its shift toward automation-driven, recurring revenue and deeper relationships with large employers, even as profit remains elusive. The CEO transition to Rohit Verma does not materially change the most immediate catalyst, which is improved commercial execution on a strong late stage pipeline, nor the biggest risk around prolonged sales cycles and delayed revenue timing.

The most directly relevant development is Verma’s appointment to both the CEO role and the board from January 2026, pairing his client centric background with Alight’s push into AI enabled services, partnerships and higher margin recurring models. Investors may also watch the upcoming UBS Global Technology and AI Conference appearance by CFO Jeremy Heaton for any incremental detail on how leadership changes align with the automation and margin improvement story.

Yet behind this transformation story, investors should also be aware of the risk that increasingly complex sales cycles could...

Read the full narrative on Alight (it's free!)

Alight's narrative projects $2.5 billion revenue and $142.2 million earnings by 2028. This requires 3.0% yearly revenue growth and about a $1.24 billion earnings increase from -$1.1 billion today.

Uncover how Alight's forecasts yield a $5.86 fair value, a 179% upside to its current price.

Exploring Other Perspectives

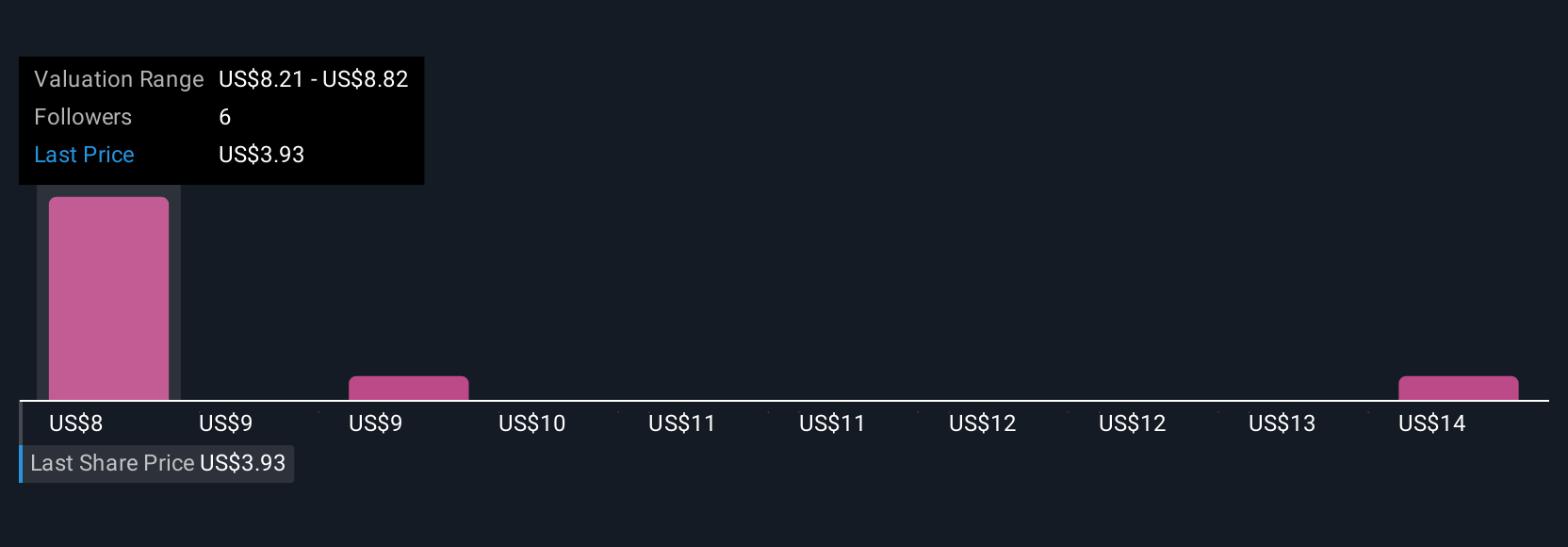

Six members of the Simply Wall St Community currently see Alight’s fair value between US$5.86 and US$11, underscoring how widely opinions can differ. When you weigh those views against the risk that elongated, complex sales cycles may keep revenue timing under pressure, it becomes even more important to compare several perspectives before forming your own view on the company’s prospects.

Explore 6 other fair value estimates on Alight - why the stock might be worth just $5.86!

Build Your Own Alight Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alight research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alight research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alight's overall financial health at a glance.

No Opportunity In Alight?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com