Is UiPath’s 2025 Rally Justified After a 49.2% Surge and Lofty Valuation Multiples?

- Wondering if UiPath's recent rally is a real opportunity or just another hype cycle? This is where we unpack what the market might be getting right or wrong about the stock.

- UiPath has jumped 36.6% over the last week, 34.9% over the past month, and is now up 49.2% year to date. This suggests that sentiment has swung sharply toward optimism after a choppy few years.

- That momentum has been helped by steady buzz around automation and AI, including UiPath's push to deepen its AI powered workflow tools and expand partnerships with major cloud providers. This keeps it in the conversation as enterprises look to cut costs and boost productivity. At the same time, ongoing debates about competition from larger software players and how quickly automation budgets will grow are shaping how investors price both the upside and the risks.

- Despite all that excitement, UiPath only scores a 1/6 valuation check score, signaling that by traditional metrics the stock does not look broadly undervalued yet. We will dig into why that is across different valuation lenses and then wrap up with a more nuanced way to think about what UiPath might really be worth.

UiPath scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: UiPath Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes UiPath's expected future cash flows and discounts them back to today, aiming to estimate what the business is worth right now based on those projections rather than market sentiment.

UiPath is currently generating about $319.9 Million in free cash flow, with analyst and internal projections pointing to this rising to around $684.9 Million by 2035. The near term outlook includes forecast free cash flow of $471.2 Million by 2028, with intermediate years steadily climbing as the company scales. Estimates for the first five years draw on analyst forecasts, while later years are extrapolated to reflect a gradual slowdown in growth as UiPath matures.

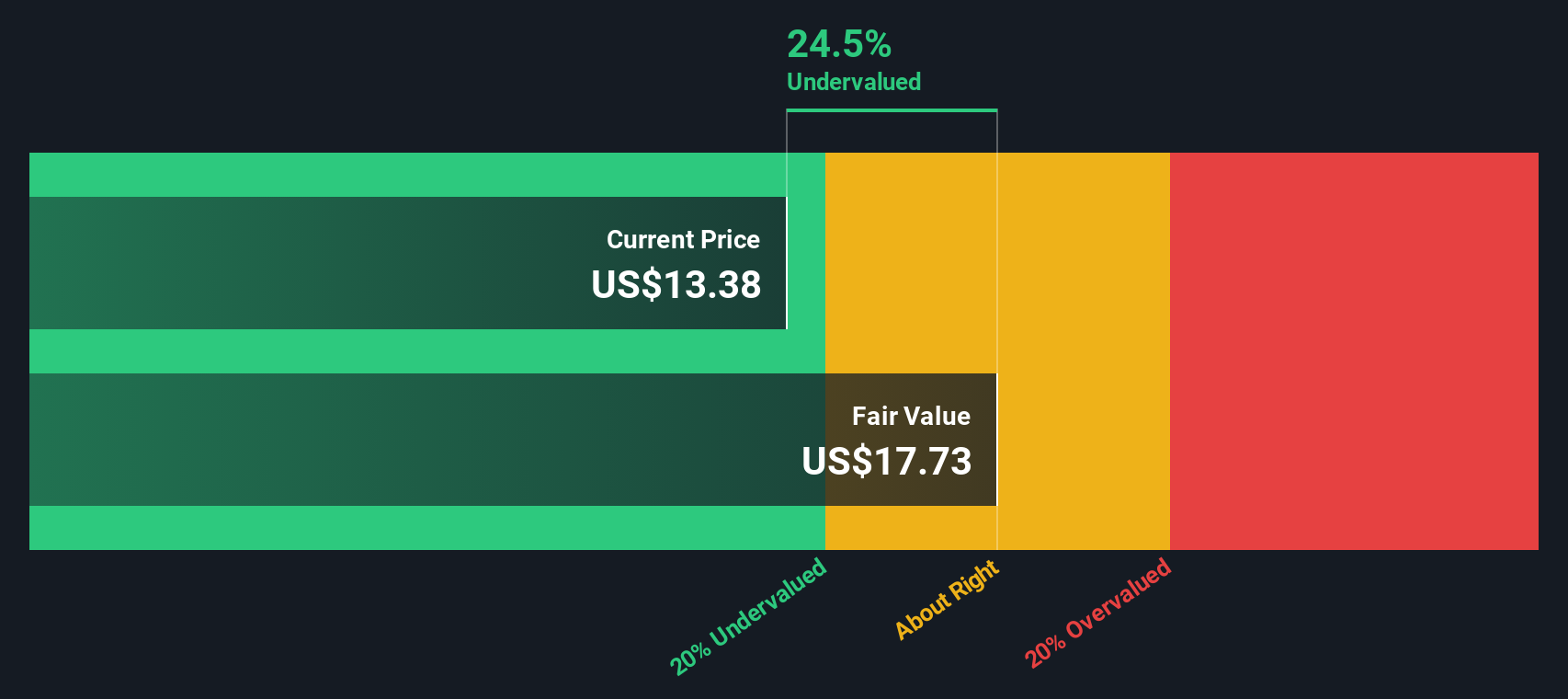

When these cash flows are discounted back, the DCF model arrives at an intrinsic value of roughly $17.79 per share. That implies the stock is about 8.4% overvalued relative to its current trading price, which is close enough that it looks broadly in line with fundamentals rather than significantly mispriced.

Result: ABOUT RIGHT

UiPath is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: UiPath Price vs Earnings

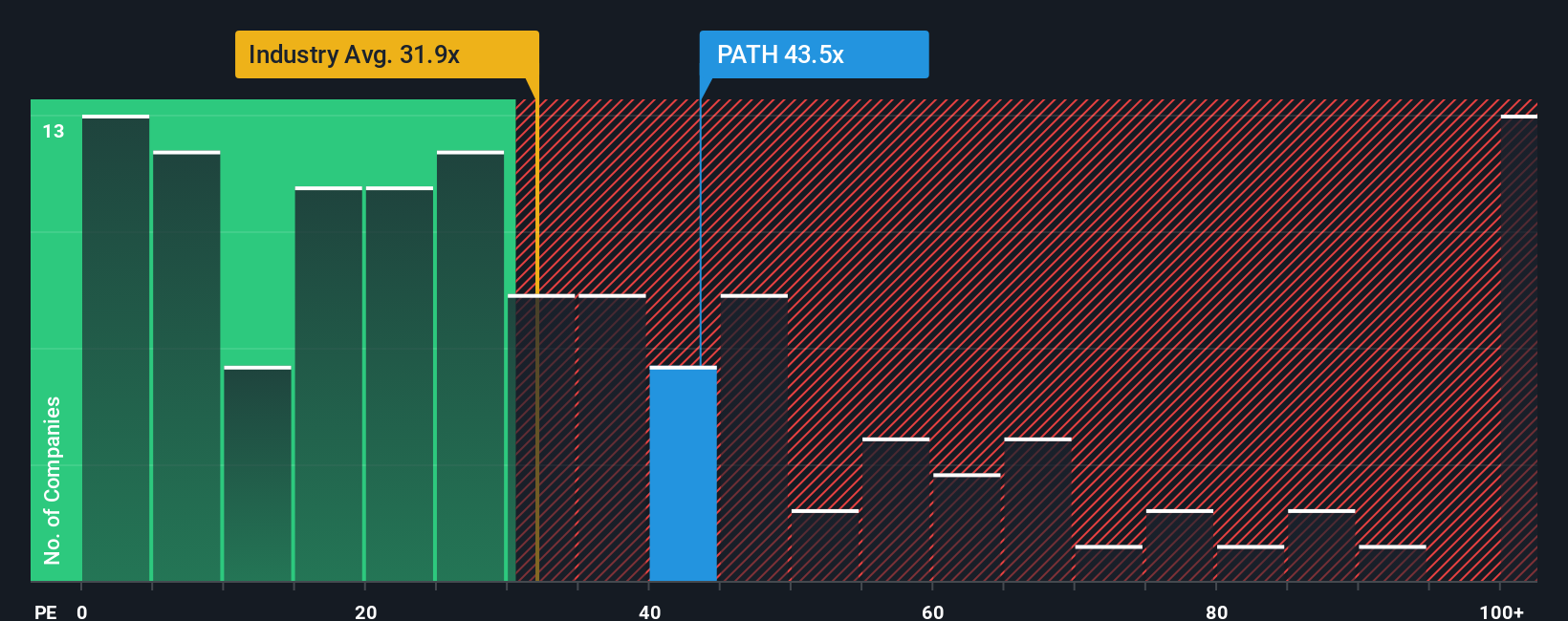

For a business that is now consistently profitable, the price to earnings ratio is a useful way to anchor valuation, because it links what investors are paying directly to the company’s current earning power. In general, faster growth and lower risk justify a higher PE multiple, while slower growth, lumpier profits, or greater uncertainty usually warrant a discount.

UiPath currently trades on a PE of about 44.6x, which is richer than the broader Software industry average of roughly 31.5x and also sits below the 63.1x average of its higher growth peers. To move beyond simple comparisons, Simply Wall St’s Fair Ratio framework estimates what a reasonable PE should be after accounting for factors like UiPath’s earnings growth outlook, profit margins, competitive position, market cap, and key risks. This produces a Fair Ratio of around 14.6x, suggesting that, given its fundamentals, UiPath’s present valuation multiple embeds a lot of optimism and leaves less room for error.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1452 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UiPath Narrative

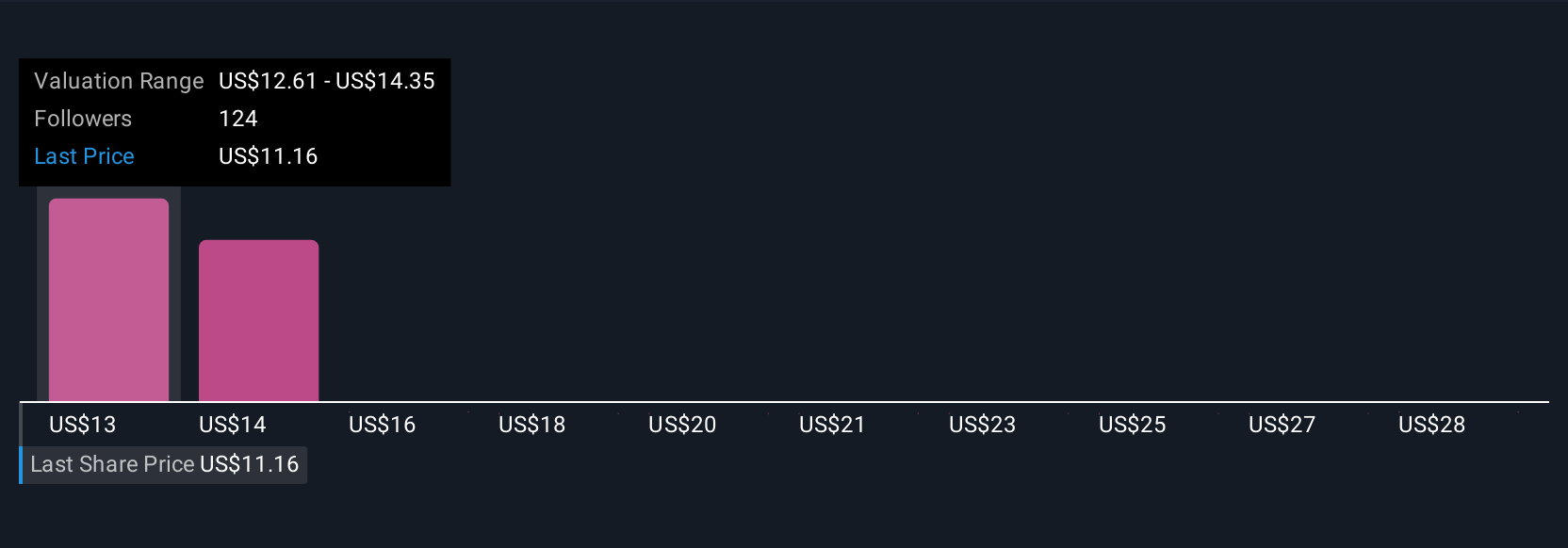

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives let you turn your view of UiPath into a clear story that connects its competitive position, AI partnerships, and growth runway to concrete forecasts for revenue, earnings, and margins, then distills that into a Fair Value you can compare with today’s share price to help inform your decision.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to express their own assumptions instead of relying on any single model. Each Narrative automatically updates when new information such as earnings, product launches, or major deals is released, so your fair value stays aligned with the latest data rather than going stale.

For UiPath, for example, one optimistic Narrative might focus on its expanding agentic automation products, cloud ARR, and collaborations with leaders like NVIDIA or Google to justify a higher Fair Value. A more cautious Narrative might emphasize execution risks, macro headwinds, and intense AI competition to arrive at a much lower Fair Value and suggest that the stock may be less attractive at today’s price.

Do you think there's more to the story for UiPath? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com