Lam Research (LRCX): Valuation Check as Optimism Builds Around Etch, Deposition and 3D DRAM Upside

Recent commentary around Lam Research (LRCX) has zeroed in on its leadership in etch and deposition tools just as 3D DRAM, advanced packaging, and rising wafer fab equipment spending start to inflect higher.

See our latest analysis for Lam Research.

That optimism has clearly filtered into the market, with Lam’s share price now at $162.8 after a powerful 90 day share price return of 54.21 percent and a three year total shareholder return of 263.15 percent. This indicates strong, still building momentum behind the story.

If Lam’s run has you rethinking your semiconductor exposure, it could be worth seeing which other chip names are popping up in high growth tech and AI stocks and reshaping the next wave of hardware growth.

But with management guiding to robust growth and the stock already trading slightly above analyst targets, investors now face a tougher call: Is Lam still mispriced for its AI upside, or is future growth already fully baked in?

Most Popular Narrative: 2% Overvalued

With Lam Research trading just above the most widely followed fair value estimate of $160.30, the current price embeds robust earnings and margin expectations.

Analysts expect earnings to reach $6.7 billion (and earnings per share of $5.68) by about September 2028, up from $5.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $7.8 billion in earnings, and the most bearish expecting $5.7 billion.

Want to see what powers this ambitious outlook? Behind the scenes are optimistic revenue ramps, resilient profit margins, and a punchy future earnings multiple. Curious which assumptions really move the fair value needle?

Result: Fair Value of $160.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, geopolitical tensions in China and lumpy, highly cyclical WFE spending could still derail Lam’s growth trajectory and challenge today’s optimistic assumptions.

Find out about the key risks to this Lam Research narrative.

Another Angle on Valuation

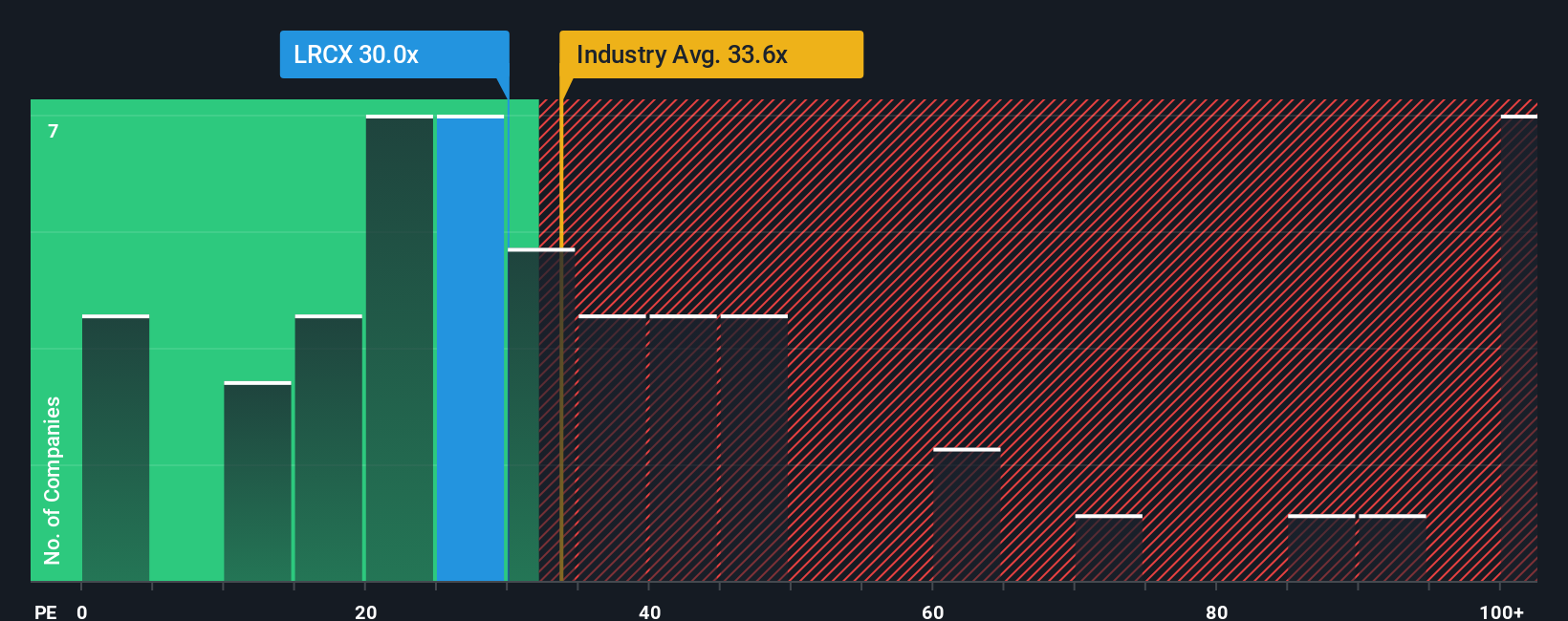

Analysts see Lam as about 2 percent overvalued versus a $160.30 fair value, but its price to earnings ratio tells a more nuanced story. At 35.2 times earnings versus 38 times for the US Semiconductor group and 40.5 times for peers, Lam actually trades at a relative discount.

Our fair ratio of 30.9 times suggests the market could still compress the multiple from here, which would cap upside even if earnings keep growing. Is Lam a quality name priced for perfection, or a solid operator that could simply grow into its tag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lam Research Narrative

If you see the story differently or want to test your own thesis with fresh data, you can build a custom view in just minutes: Do it your way.

A great starting point for your Lam Research research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with just one chip leader. Use the Simply Wall St Screener to uncover fresh opportunities before everyone else starts talking about them.

- Capture early momentum by scanning these 3581 penny stocks with strong financials that combine small size with strong financial underpinnings and significant potential for upside.

- Explore the AI infrastructure theme by targeting these 27 AI penny stocks positioned within algorithm training, data acceleration, and next generation compute demand.

- Seek potential mispricings by focusing on these 903 undervalued stocks based on cash flows that the market may not have fully appreciated based on their underlying cash flow characteristics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com