Is Agilent Technologies Still Priced for Perfection After Recent Share Price Weakness?

- Wondering if Agilent Technologies is quietly becoming good value, or if the market is still pricing in too much optimism? Let us unpack what the current share price really implies, in plain language.

- The stock has slipped recently, down 5.1% over the last week and 2.9% over the last month, even though it is still up 6.8% year to date and roughly flat over the last year.

- Recent headlines have focused on Agilent sharpening its focus on high growth areas like diagnostics, life sciences tools, and advanced lab automation. This reinforces its role as a picks and shovels supplier to research and biopharma customers. At the same time, macro concerns around funding cycles and lab spending have kept sentiment in check, helping explain the choppy share price.

- On our framework Agilent scores a 2/6 valuation score, passing two of six undervaluation checks. The big question is whether traditional methods like DCFs and multiples are missing something important about the story, which we will explore now and return to in a more nuanced way at the end of this article.

Agilent Technologies scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Agilent Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash Agilent Technologies is expected to generate in the future and then discounts those dollars back into today’s terms to estimate what the business is worth now.

Agilent currently generates about $1.19 billion in free cash flow (FCF). Analysts and model projections see this rising to around $1.56 billion by 2027, and the extrapolated forecast from Simply Wall St points to roughly $2.03 billion of FCF in 2035, implying modest, steady growth over the next decade.

Combining these cash flows in a 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value of about $114.80 per share. Compared with the current market price, this suggests Agilent is roughly 24.1% overvalued on a pure cash flow basis, indicating that investors may be paying a premium for quality, growth or both.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Agilent Technologies may be overvalued by 24.1%. Discover 902 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Agilent Technologies Price vs Earnings

For a consistently profitable business like Agilent, the Price to Earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. In general, faster growing and lower risk companies tend to justify a higher, or more generous, PE multiple, while slower growth or higher uncertainty calls for a lower, more conservative one.

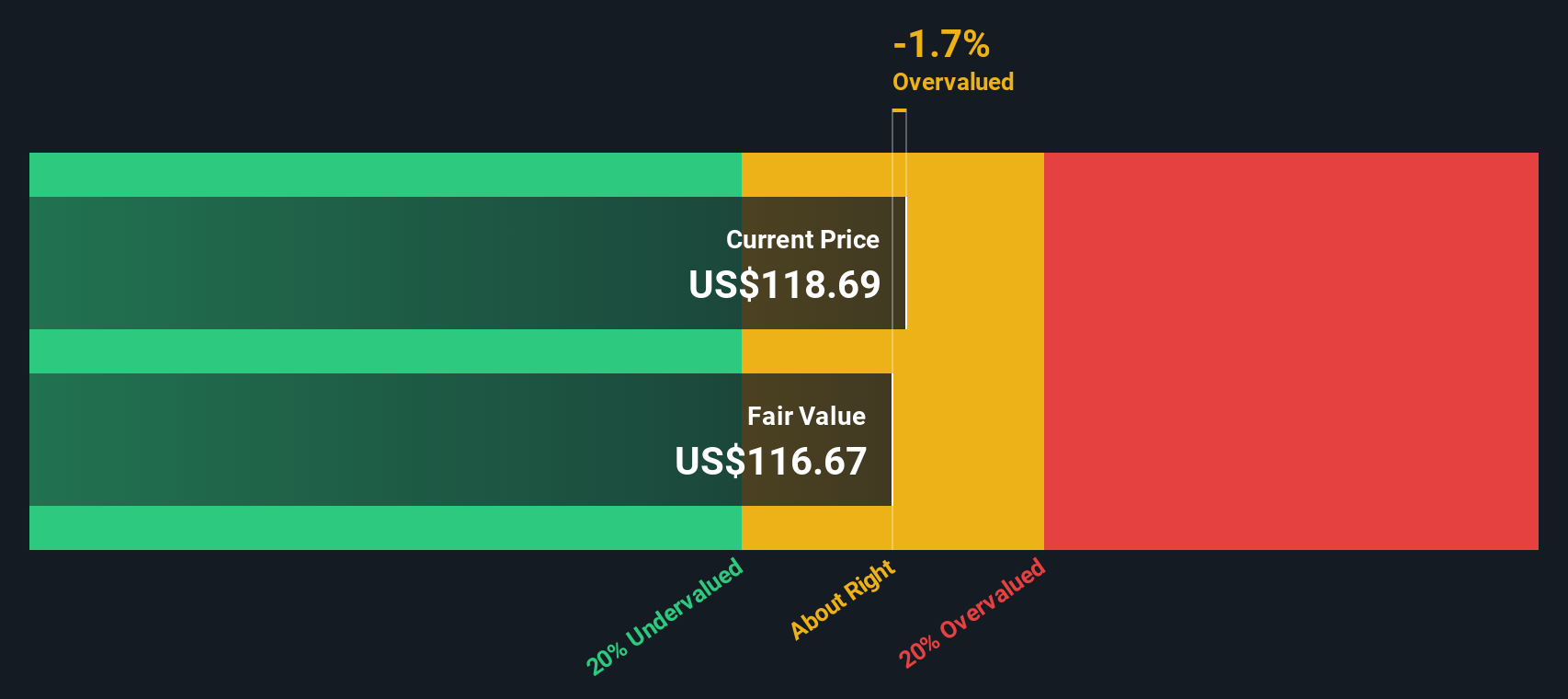

Agilent currently trades on about 30.9x earnings, which is below the broader Life Sciences industry average of roughly 34.2x and also under the 34.7x peer group average. On the surface that might suggest the stock is reasonably priced or even slightly cheap relative to its sector. However, Simply Wall St also estimates a company specific Fair Ratio of 24.9x, which is the PE you might expect given Agilent’s earnings growth outlook, profitability, size and risk profile.

This Fair Ratio is more informative than a simple comparison with peers, because it adjusts for differences in growth, margins, industry positioning and market cap. Setting the current PE of 30.9x against the Fair Ratio of 24.9x points to Agilent trading at a premium to what its fundamentals alone would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1453 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Agilent Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Agilent’s story with a concrete forecast and Fair Value estimate.

A Narrative on Simply Wall St is your story behind the numbers, where you set assumptions for Agilent’s future revenue, earnings and margins and tie them directly to a fair value you believe is reasonable.

Rather than just accepting a single DCF or PE outcome, Narratives let you link the company’s key drivers, like new diagnostic solutions or tariff risks, to a financial model and then instantly see what price those beliefs imply.

These Narratives are easy to use and live within the Community page on Simply Wall St, where millions of investors already share and compare their views.

They also stay dynamic, automatically updating as new information such as earnings releases, guidance changes or major news hits the market, helping you decide when Fair Value is meaningfully above or below the current share price.

For Agilent, one investor might build a Narrative that supports a fair value near the high target of about $165. In contrast, a more cautious investor could land closer to the low target of roughly $120 based on more conservative growth and margin assumptions.

Do you think there's more to the story for Agilent Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com