Assessing Sika (SWX:SIKA) Valuation After Launching Its Ambitious Fast Forward Efficiency and Digitalization Program

Sika (SWX:SIKA) just pulled back the curtain on its Fast Forward program, a multi year push to digitize its value chain, streamline operations, and reshape its footprint, especially in China.

See our latest analysis for Sika.

The Fast Forward announcement lands after a tough stretch, with the share price down sharply on a year to date basis and the one year total shareholder return also deeply negative. This suggests sentiment has cooled even as management signals a profitability reset.

If this kind of strategic repositioning has you thinking more broadly about where growth might come from next, it could be a good moment to explore fast growing stocks with high insider ownership.

With shares still well below their peak, and analysts and management touting a digital efficiency reset, the question now is whether Sika is quietly undervalued or if the market is already pricing in this next wave of growth.

Most Popular Narrative Narrative: 37.5% Undervalued

With Sika last closing at CHF158.25 against a narrative fair value near CHF253, the storyline leans heavily toward a significant upside rerating.

The significant backlog of infrastructure investment in key markets like Europe and the U.S., with German and U.S. government stimulus targeting upgrades and renovation, creates multi year visibility on demand for Sika's products. This positions the company for a potential acceleration in revenue and recurring repair or retrofit sales as these projects move past the current artificial implementation delays.

Want to see why this outlook assumes stronger sales, higher margins, and a richer earnings multiple than today? Curious which long term projections really drive that valuation gap?

Result: Fair Value of $253.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent construction weakness in China and ongoing integration risks from acquisitions like MBCC could easily derail those optimistic margin and growth assumptions.

Find out about the key risks to this Sika narrative.

Another Lens on Valuation

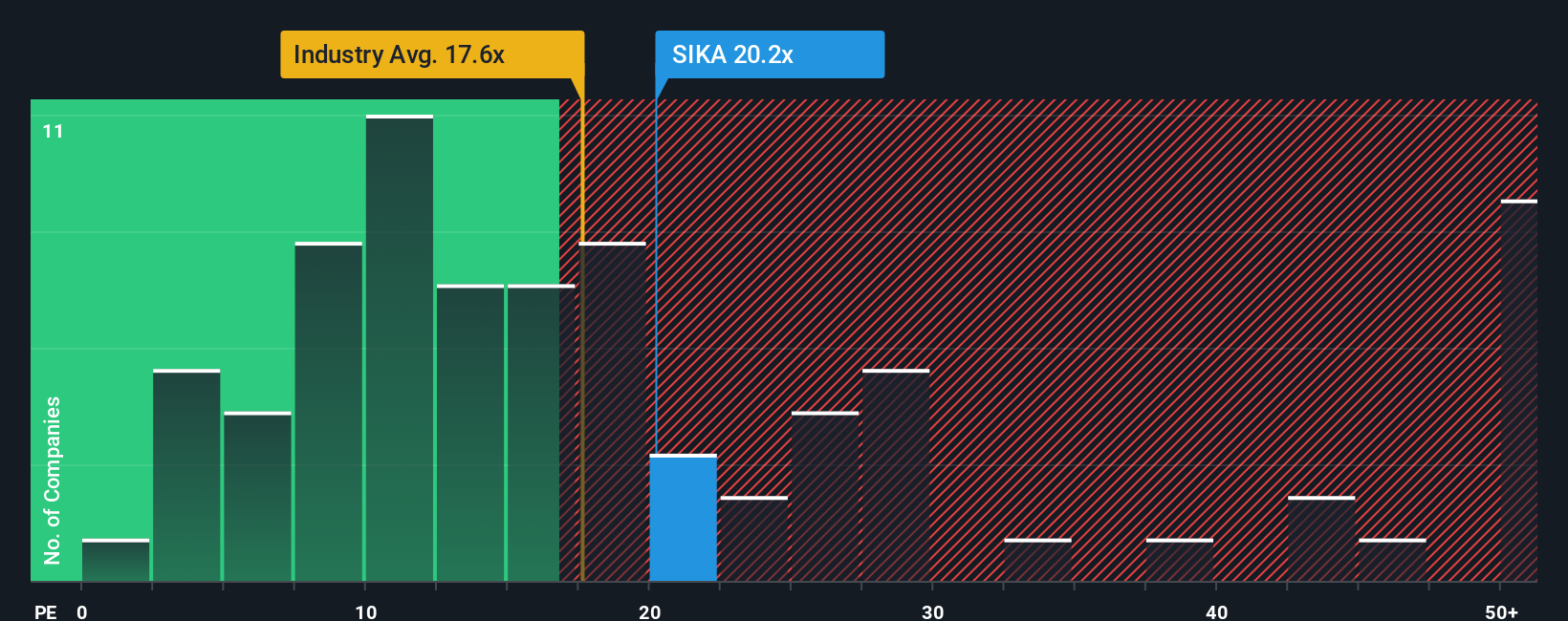

Our fair ratio work with the price to earnings metric paints a more cautious picture. Sika trades at 21.3 times earnings versus a 19.9 fair ratio, a 25.3 peer average, and 18.3 for the wider European chemicals sector, hinting at valuation risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sika Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A great starting point for your Sika research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning a few targeted stock lists on Simply Wall St that could sharpen and diversify your watchlist.

- Capture potential mispricings by reviewing these 902 undervalued stocks based on cash flows that may offer attractive upside based on future cash flows.

- Position yourself for the next wave of innovation by checking out these 27 AI penny stocks shaping the future of intelligent automation and data driven services.

- Boost your income potential by focusing on these 15 dividend stocks with yields > 3% that combine dependable payouts with solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com