Assessing Phillips Edison’s (PECO) Valuation After a Year of Modest Share Price Declines

Phillips Edison (PECO) has quietly slipped about 9% over the past year, even as its grocery anchored shopping centers keep generating steady rent and growing revenue. That disconnect is what makes the stock interesting now.

See our latest analysis for Phillips Edison.

At around $34.51, the stock has seen a soft patch recently, with a roughly 6.6% year to date share price decline. Its three year total shareholder return of about 16% points to steady, if unspectacular, compounding rather than momentum trading.

If you like the steady, income oriented profile of grocery anchored REITs but want to see what else is out there, consider scanning fast growing stocks with high insider ownership for your next idea.

With revenue and earnings still growing, a double digit discount to analyst targets and an even deeper gap to some intrinsic value estimates, is PECO quietly undervalued or are investors already pricing in every bit of future growth?

Most Popular Narrative: 11.9% Undervalued

With Phillips Edison last closing at $34.51 versus a narrative fair value near $39.18, the storyline leans optimistic and sets up a bold growth case.

Active portfolio recycling and disciplined acquisitions of high growth, grocery anchored properties, often below replacement cost and at 6%+ cap rates with 9%+ target IRRs, enhance asset quality and earnings potential. At the same time, cash acquisitions and low leverage (5.4x EBITDAre, 5.7 years weighted avg. maturity, 95% fixed rate debt) allow for opportunistic external growth without the need for dilutive equity issuance, supporting long term FFO/EPS expansion.

Want to see why a neighborhood REIT gets a growth style price tag? The narrative hides aggressive revenue, margin and earnings assumptions that might surprise you.

Result: Fair Value of $39.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster e commerce adoption or a major grocery anchor stumbling could undercut leasing momentum and pressure the lofty growth assumptions embedded in today’s valuation.

Find out about the key risks to this Phillips Edison narrative.

Another Angle on Valuation

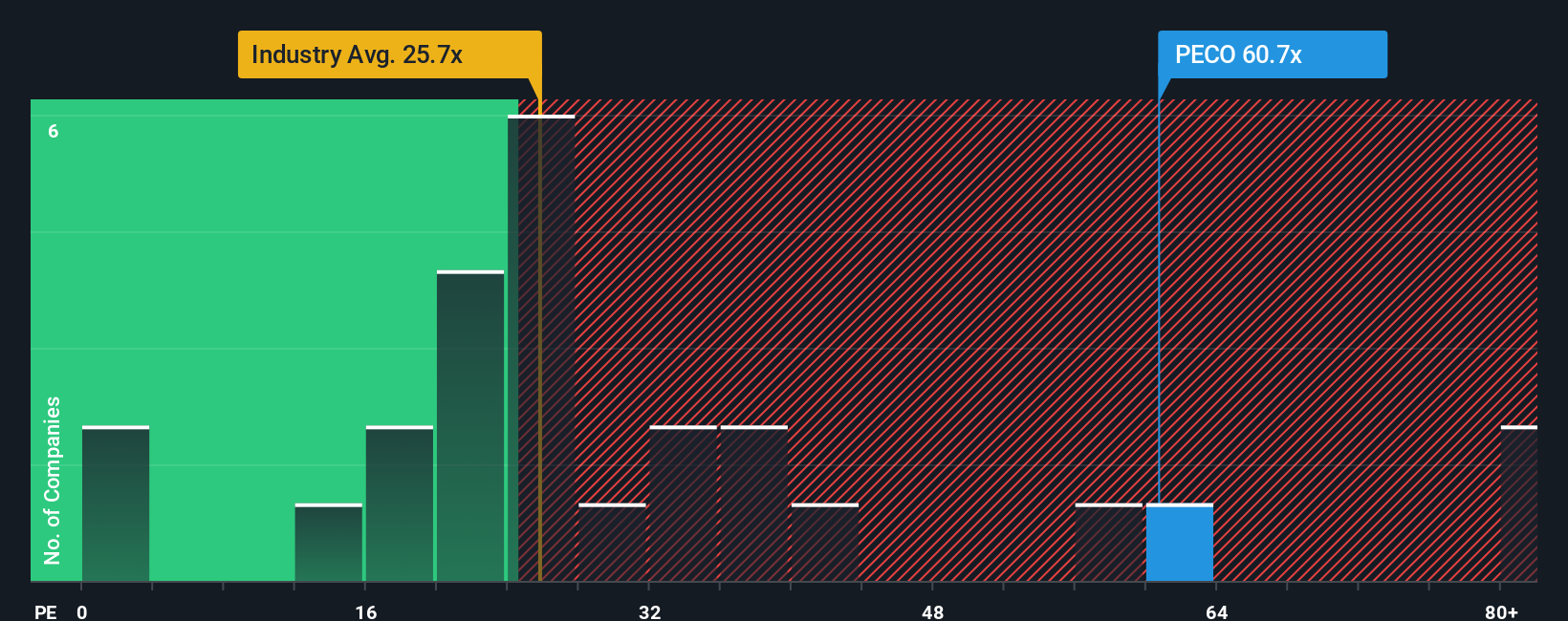

On earnings, the picture flips. PECO trades at about 53 times earnings, roughly double the US Retail REITs average of 26.5 times and well above a fair ratio of 33.9 times. That rich premium suggests little room for error, so what happens if growth simply returns to more typical levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips Edison Narrative

If you want to dig into the numbers yourself and shape a different storyline, you can build a complete narrative in just a few minutes, Do it your way.

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one REIT when the market is full of potential. Use the Simply Wall Street Screener now so you are not chasing returns later.

- Capture potential multi baggers early by targeting these 3581 penny stocks with strong financials that already show strong financial foundations instead of chasing crowded trades.

- Position yourself for the next technology wave by focusing on these 27 AI penny stocks poised to benefit from accelerating demand for AI solutions.

- Identify value prospects by scanning these 903 undervalued stocks based on cash flows that trade below their estimated cash flow based fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com