Zscaler (ZS) Valuation After CFO Retirement News and Slower Growth Concerns

Zscaler (ZS) just pulled off the classic beat and raise on earnings, then watched its stock tumble anyway after CFO Remo Canessa announced his retirement and investors fixated on signs of moderating growth.

See our latest analysis for Zscaler.

At around $244.88 per share, Zscaler has swung from a sharp 1 month share price return of approximately negative 23% to still carrying a solid year to date share price return of nearly 35%. Its multiyear total shareholder returns suggest momentum is cooling rather than collapsing as investors reassess growth versus execution risk.

If this kind of volatility has you rethinking concentration in a single name, it may be worth scanning high growth tech and AI stocks to spot other growth stories in cloud and AI security before they get crowded.

With shares still up strongly year to date and trading at a premium to many security peers, the key question now is simple: is Zscaler undervalued after this pullback, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 25.4% Undervalued

With Zscaler last closing at $244.88 against a narrative fair value of $328.22, the spread reflects ambitious expectations for growth and margin expansion.

Explosive growth in AI/ML traffic and emerging threats is creating new security challenges that Zscaler is rapidly addressing with differentiated AI security and agentic operations products, positioning the company to capture a rising share of incremental cyber budgets and expand recurring ARR over the long term.

Want to see what kind of revenue trajectory and margin lift would need to materialize to back this gap in valuation? The assumptions behind this forecast lean heavily on accelerating cloud security adoption, rising earnings power, and a future profit multiple usually reserved for sector leaders. Curious how those moving parts fit together and what that implies for longer term upside?

Result: Fair Value of $328.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and deeper security integration from hyperscale clouds could limit Zscaler’s pricing power and reduce the upside implied by this narrative.

Find out about the key risks to this Zscaler narrative.

Another View: Rich On Sales, Even If Story Looks Cheap

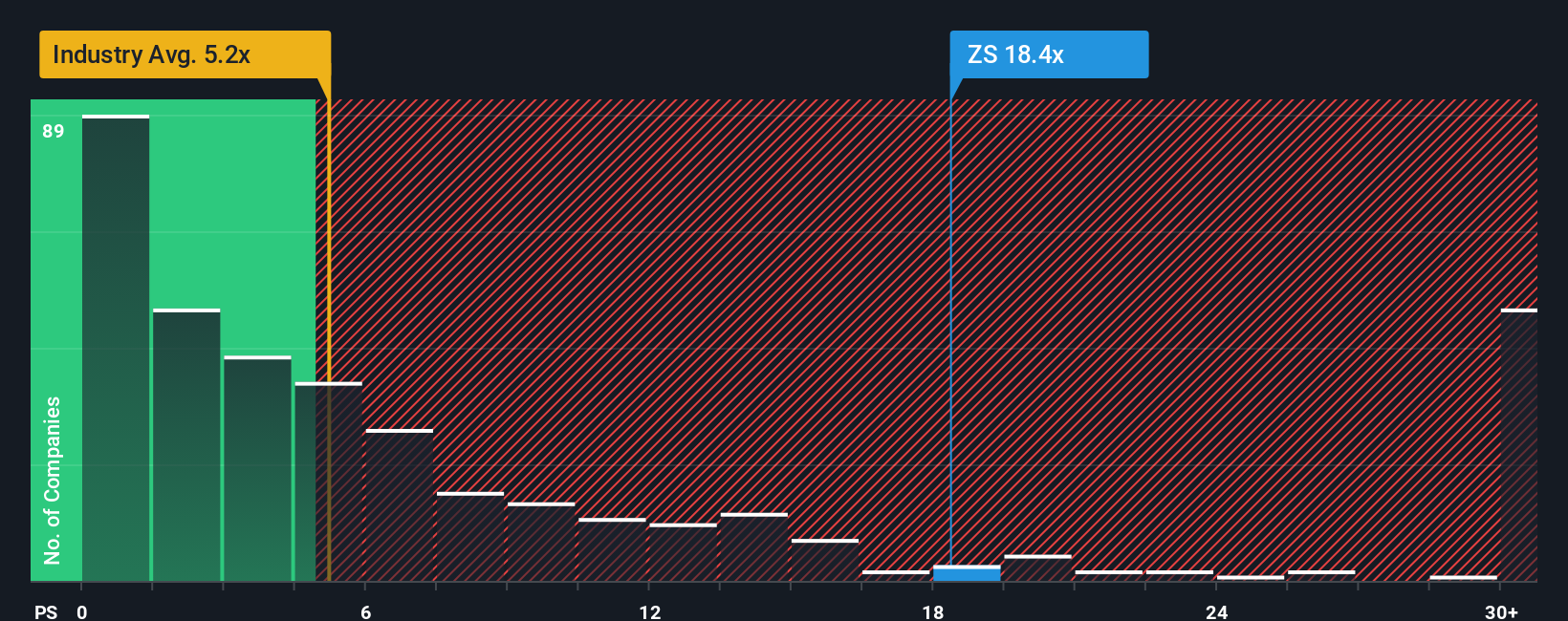

Our fair value lens suggests Zscaler is about 15.1% undervalued overall, yet the stock still trades at a steep 13.8 times sales versus 9.8 times for peers and 4.9 times for the wider US software space, above a fair ratio of 10.9 times that the market could drift toward over time.

That gap means the upside case leans heavily on Zscaler defending premium growth and margins. Any stumble could see multiples compress faster than fundamentals, leaving investors to decide if this is a premium worth paying today or a signal to wait for a better entry.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zscaler Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Zscaler research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors rarely stop at one opportunity, so use the Simply Wall St Screener today to uncover fresh stocks that match your strategy before everyone else notices.

- Capitalize on overlooked value by targeting companies trading below intrinsic worth through these 903 undervalued stocks based on cash flows, giving you a head start on potential re-rating stories.

- Ride structural trends in automation, data, and cybersecurity with these 27 AI penny stocks, where innovation can play a role in shaping your long term returns.

- Strengthen your income stream by focusing on reliable payers via these 15 dividend stocks with yields > 3%, helping you lock in yields while markets remain distracted elsewhere.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com