Silvercorp Metals (TSX:SVM): Valuation Check After Upgrade to Buy on Growth, Margin Gains and Copper Expansion

Silvercorp Metals (TSX:SVM) just earned an upgrade from Hold to Buy after delivering stronger production growth and healthier margins, with its push into copper shaping up as a key driver for future efficiency.

See our latest analysis for Silvercorp Metals.

The upgrade comes after a powerful run, with a 60.27% 3 month share price return and a 138.52% 1 year total shareholder return, signalling that momentum and confidence are clearly building.

If this kind of momentum has your attention, it could be a good time to broaden your watchlist and discover fast growing stocks with high insider ownership.

With earnings growing faster than revenue and the share price still sitting below analyst targets, the big question now is whether Silvercorp is still trading at a discount or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 15.8% Undervalued

With Silvercorp Metals last closing at CA$10.85 against a narrative fair value of CA$12.88, the valuation case leans firmly on aggressive growth and efficiency gains.

The company's investments in operational efficiency (ongoing ramp and tunnel development at Ying to shift to a trackless system) and cost-reduction initiatives are likely to enhance net margins and profitability as production volumes increase and economies of scale are realized.

Want to see the full playbook behind this premium valuation? The narrative leans on powerful revenue growth, rapidly expanding margins and a sharply lower earnings multiple. Curious how those moving parts combine into that fair value target?

Result: Fair Value of $12.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish path could be derailed by regulatory setbacks in China or permitting challenges in Ecuador that delay production ramp up and weaken growth.

Find out about the key risks to this Silvercorp Metals narrative.

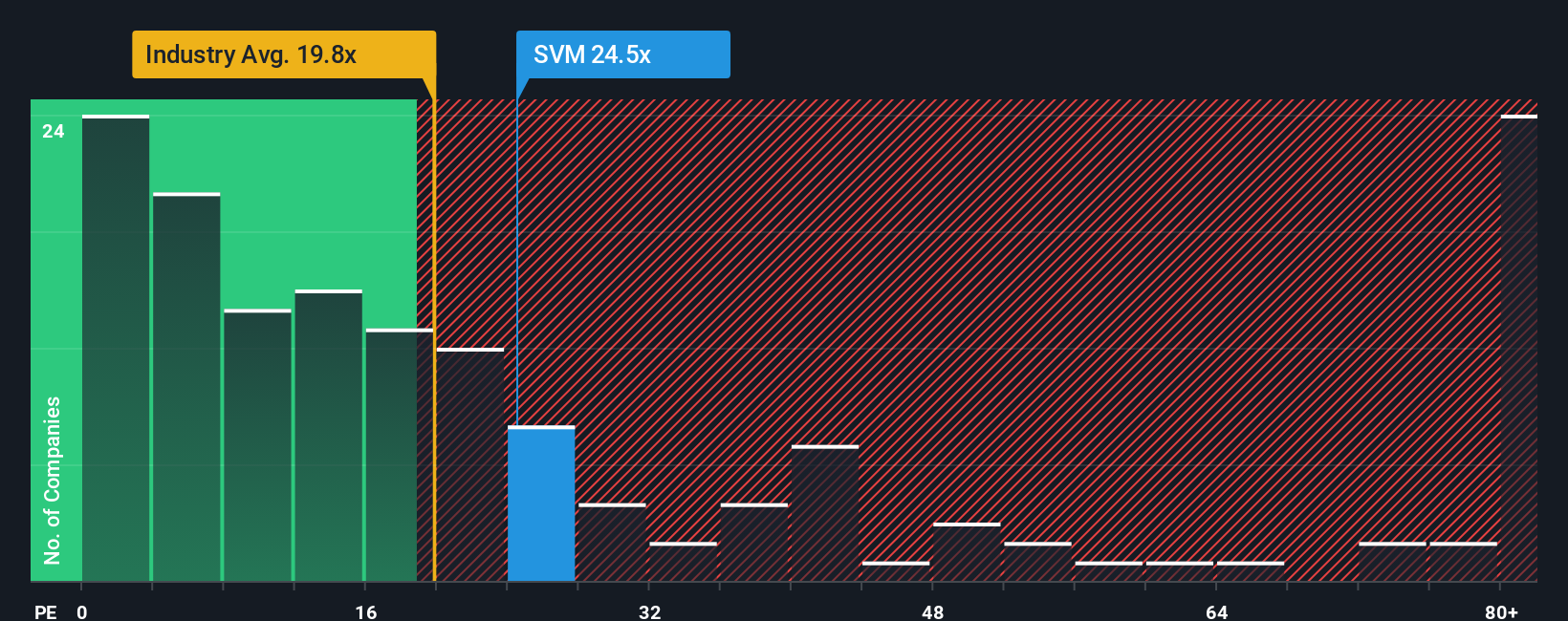

Another View: Market Ratios Paint a Hotter Picture

While the narrative fair value suggests upside, the earnings multiple tells a very different story. Silvercorp trades on about 68.6 times earnings, far above the Canadian metals and mining average of 21.2 times and a fair ratio of 35.4 times. This points to real valuation risk if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silvercorp Metals Narrative

If you view the story differently or want to dive into the numbers yourself, you can build a personalised narrative in just a few minutes: Do it your way.

A great starting point for your Silvercorp Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your opportunity set with fresh, data driven ideas on Simply Wall St's Screener so you do not miss the next wave of standout businesses.

- Capture potential rebound stories by scanning these 3581 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Position ahead of the next tech shift by reviewing these 27 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Secure attractive entry points by targeting these 903 undervalued stocks based on cash flows where current prices still trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com