DraftKings (DKNG): Evaluating the Stock’s Valuation After Launching a Spanish-Language Sportsbook and Casino Experience

DraftKings (DKNG) is rolling out a Spanish language experience across its Sportsbook and Casino app for select users in the U.S. and Ontario, aiming to better serve Spanish speaking bettors and boost engagement.

See our latest analysis for DraftKings.

The rollout of a Spanish language experience comes in a mixed but still bullish backdrop, with a 30 day share price return of 16.97 percent contrasting against a weaker 90 day share price return of minus 22.54 percent and a still impressive 3 year total shareholder return of 148.5 percent. This suggests long term momentum is intact even as sentiment moves around in the short term.

If you are watching how digital platforms compete for engagement, this is also a useful moment to scan fast growing stocks with high insider ownership as potential next wave beneficiaries.

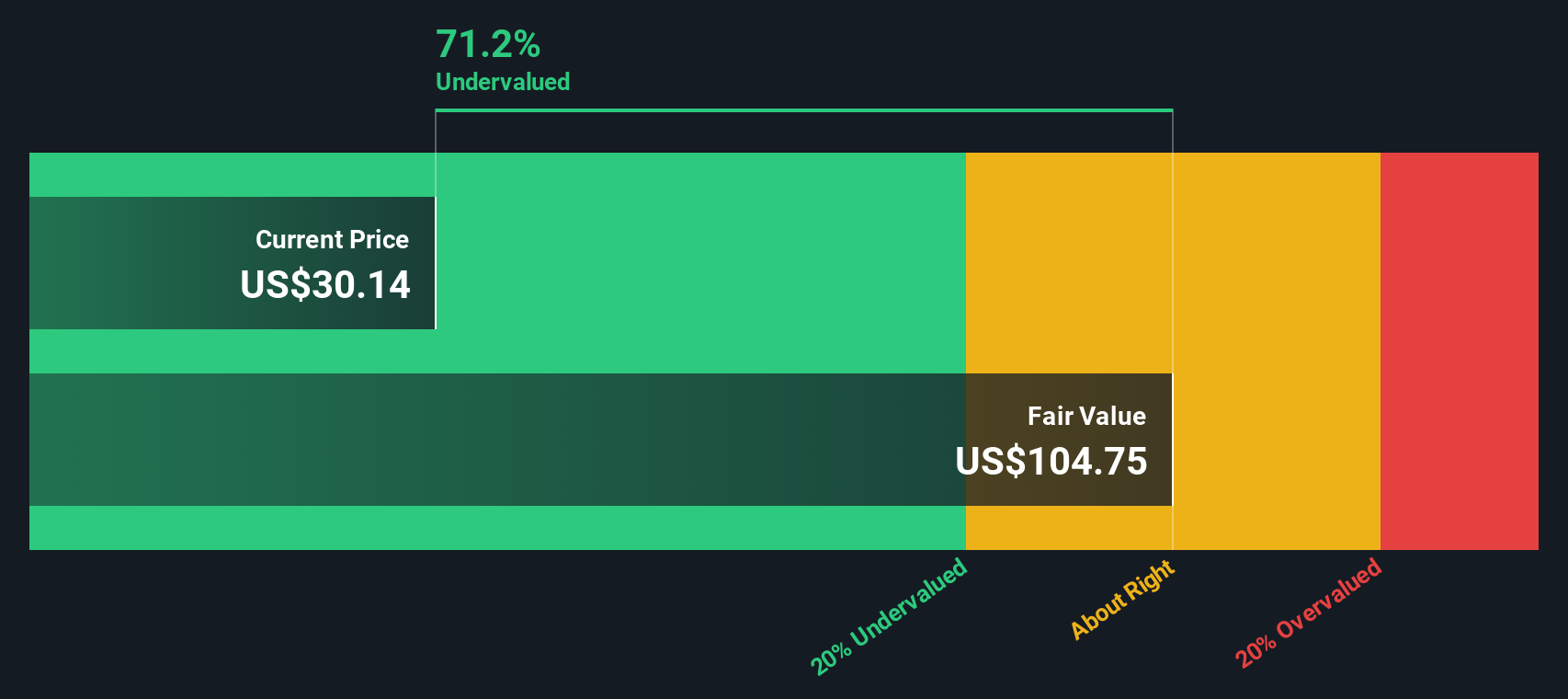

With shares still trading at a sizeable implied discount to both analyst targets and intrinsic value despite strong revenue and earnings growth, is DraftKings a mispriced growth story, or is the market already baking in the next leg of upside?

Most Popular Narrative Narrative: 20.6% Undervalued

With DraftKings last closing at $35.56 against a narrative fair value near $44.81, the spread implies investors might be underestimating its long term earnings power.

Ongoing product innovation in live betting, in game personalization, and AI driven trading is increasing user engagement and dynamic pricing opportunities, which should boost average revenue per user and improve long term earnings potential.

Curious how ambitious growth, rising margins, and a richer earnings profile all mesh into one price tag? Want to see the full playbook driving that valuation?

Result: Fair Value of $44.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising state level taxes and intensifying competition from prediction markets could squeeze margins and slow the earnings ramp embedded in this narrative.

Find out about the key risks to this DraftKings narrative.

Another Lens on Value

While the narrative fair value points to a modest undervaluation, our SWS DCF model is more optimistic, suggesting DraftKings could be around 63 percent undervalued at $95.98 per share. Is this a genuine long term opportunity, or is the cash flow outlook simply too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DraftKings Narrative

If you see the numbers differently or want to dig into the data yourself, you can build a custom view in minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DraftKings.

Ready for more investment ideas?

Before markets move on without you, put Simply Wall Street's Screener to work and line up your next round of high conviction opportunities beyond DraftKings.

- Capture early stage potential by scanning these 3581 penny stocks with strong financials that combine speculative upside with solid underlying numbers instead of chasing hype alone.

- Ride structural tailwinds by targeting these 903 undervalued stocks based on cash flows where cash flow strength and sensible prices meet, giving you a margin of safety for long term compounding.

- Future proof your portfolio by zeroing in on these 30 healthcare AI stocks harnessing data, automation, and medical breakthroughs to reshape patient care and investor returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com