Does Diebold Nixdorf’s New DM7V ATMs Deepen Its Services Moat In Cash Automation (DBD)?

- Diebold Nixdorf recently launched its DN Series 300 and 350 self-service cash dispensers, built on the new DM7V dispensing module to boost availability, security, and cash-handling efficiency while integrating with its branch automation and managed services platform.

- The new ATMs’ shared cassette infrastructure, higher-capacity dispensing, and sustainability-focused modular design aim to cut operating costs for banks and extend product lifecycles, potentially strengthening Diebold Nixdorf’s service-led cash automation ecosystem.

- We’ll now explore how this next-generation DM7V-powered ATM platform could influence Diebold Nixdorf’s investment narrative around automation and services.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Diebold Nixdorf Investment Narrative Recap

To own Diebold Nixdorf, you need to believe that physical cash access and branch automation will remain essential even as digital payments grow, and that the company can steadily tilt its business toward higher-margin software and services. The new DM7V-powered DN Series 300 and 350 ATMs modestly support that story by deepening the service-led cash automation platform, but they do not remove the key short term risk around execution in the services transition and margin stability.

The recent launch of the DN Series 300 and 350 ties directly into the Branch Automation Solutions platform introduced in August 2025, which is built to connect ATMs, recyclers, and teller systems under one cloud-native, service-centric umbrella. Together, these offerings reinforce the main catalyst many investors are watching: whether Diebold Nixdorf can convert its installed hardware base into more recurring, software-enabled service revenue, amid ongoing pressure from digital-only banking and alternative payment solutions.

Yet while the technology story is appealing, investors should be aware that...

Read the full narrative on Diebold Nixdorf (it's free!)

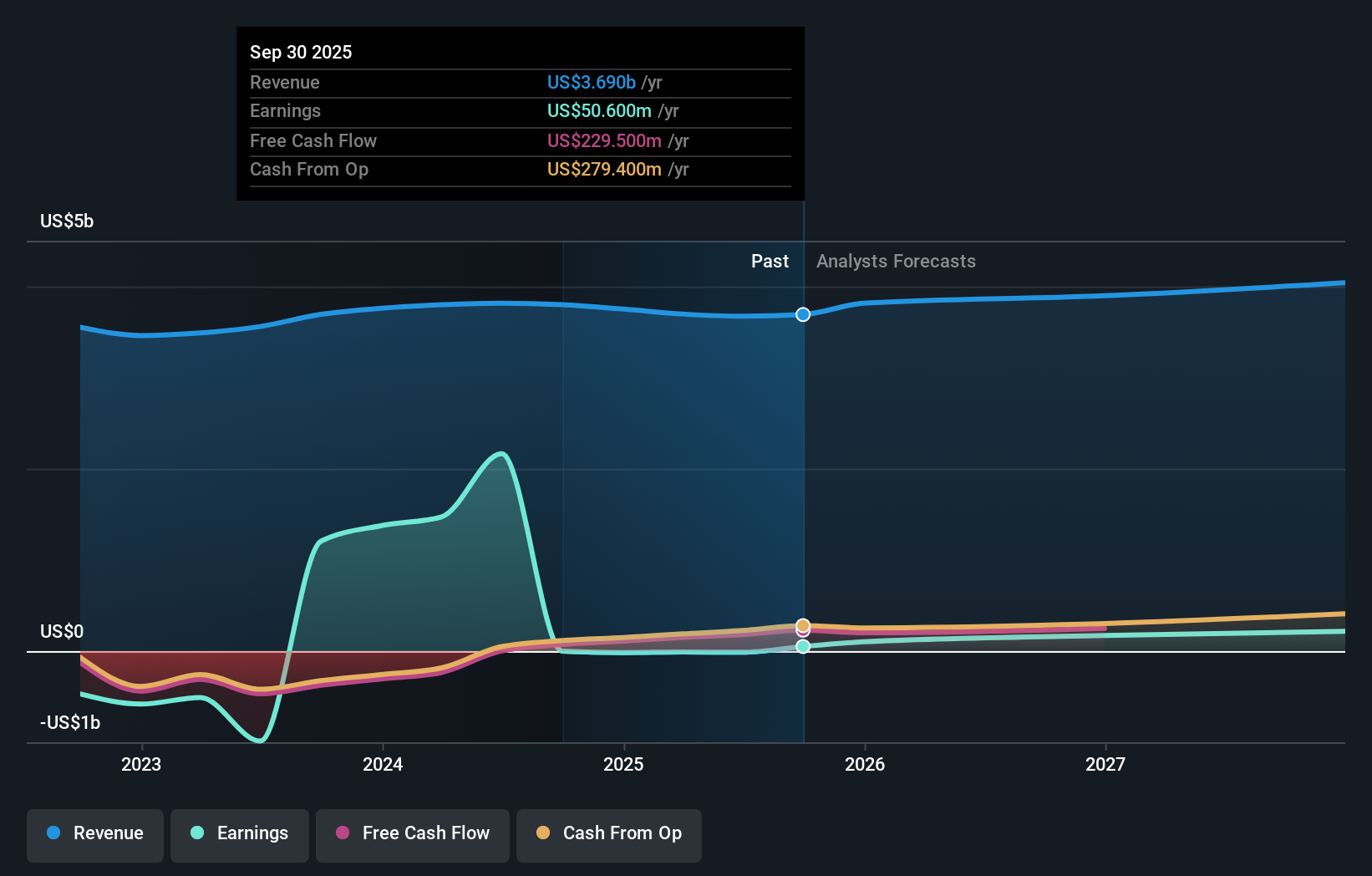

Diebold Nixdorf's narrative projects $4.2 billion revenue and $312.7 million earnings by 2028. This requires 4.3% yearly revenue growth and about a $325.6 million earnings increase from -$12.9 million today.

Uncover how Diebold Nixdorf's forecasts yield a $79.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates, ranging from US$79 to about US$115.84, highlight how far apart views on Diebold Nixdorf can be. When you set these against the execution risk in shifting from hardware sales to higher-margin services, it becomes even more important to compare several independent viewpoints before deciding how much of the company’s future performance you want to be exposed to.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth as much as 77% more than the current price!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com