How Investors May Respond To MINISO Group Holding (MNSO) Launching Its Immersive Sydney MINISO LAND Flagship

- In November 2025, MINISO opened Australia’s first and largest MINISO LAND at Westfield Chatswood in northern Sydney, an 800-square-meter flagship featuring more than 7,000 SKUs and immersive IP-themed zones including Disney and Sanrio collections.

- This highly experiential “Super IP + Super Store” concept, positioned as a new retail landmark, reinforces MINISO’s push to deepen its trendy toy and IP-focused brand presence in Australia and globally.

- We’ll now examine how this Sydney MINISO LAND flagship, with its heavy IP-led product mix and immersive format, reshapes MINISO’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MINISO Group Holding Investment Narrative Recap

To hold MINISO, you need to believe its IP heavy, experience led stores can offset recent earnings pressure and rising costs by driving durable global traffic and pricing power. The Sydney MINISO LAND adds brand heat and tests the “Super IP + Super Store” format in a premium overseas location, but does not yet change the key near term swing factors of margin recovery and cost control.

The most relevant recent update is MINISO’s November 2025 guidance for around 25% full year revenue growth and operating profit of RMB 3.65–3.85 billion, despite softer net income so far this year. The Sydney flagship fits that guidance narrative, leaning into higher quality, larger format stores and IP collaborations as potential levers for revenue growth and margin support if execution and store economics hold up.

Yet against this expansion push, investors should also be aware of the growing risk that store saturation and higher operating costs could...

Read the full narrative on MINISO Group Holding (it's free!)

MINISO Group Holding's narrative projects CN¥31.7 billion revenue and CN¥4.9 billion earnings by 2028. This requires 19.4% yearly revenue growth and an earnings increase of about CN¥2.5 billion from CN¥2.4 billion today.

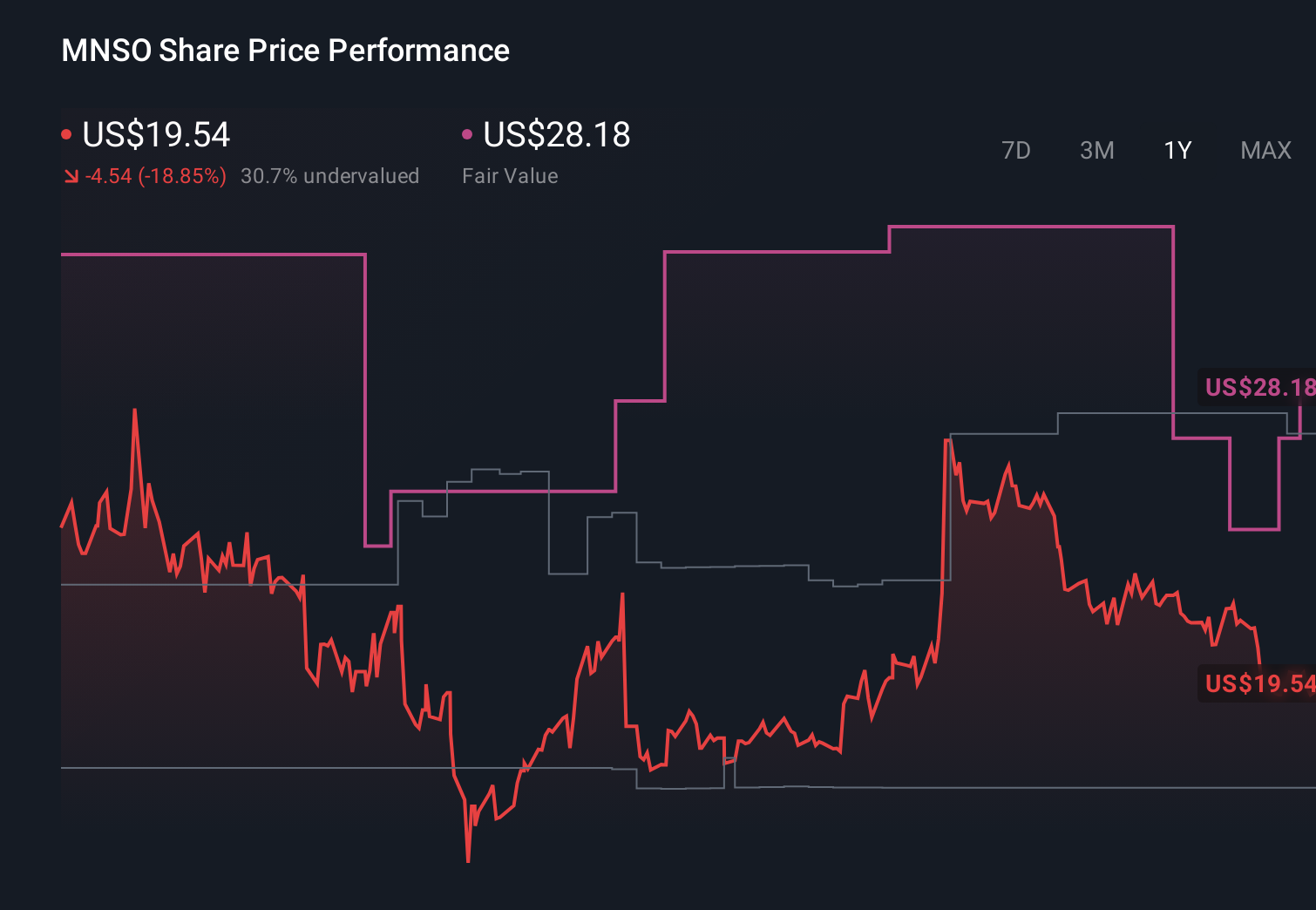

Uncover how MINISO Group Holding's forecasts yield a $26.83 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community now place MINISO’s fair value between US$26.59 and US$44.06, underlining how far opinions can diverge. Set that against the reliance on IP driven, experiential formats as a key growth engine, and it becomes even more important to compare several viewpoints on how sustainable that model really is.

Explore 5 other fair value estimates on MINISO Group Holding - why the stock might be worth just $26.59!

Build Your Own MINISO Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MINISO Group Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MINISO Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MINISO Group Holding's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com