Discovering Undiscovered Gems in the Middle East December 2025

As Gulf markets end mixed ahead of an anticipated Federal Reserve meeting, the Middle East's financial landscape is seeing varied responses, with some indices buoyed by potential U.S. monetary easing and others weighed down by fluctuating oil prices. Amid these dynamics, identifying promising stocks involves looking for companies with strong fundamentals and resilience to external economic pressures, which could position them as undiscovered gems in the region's evolving market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★★★

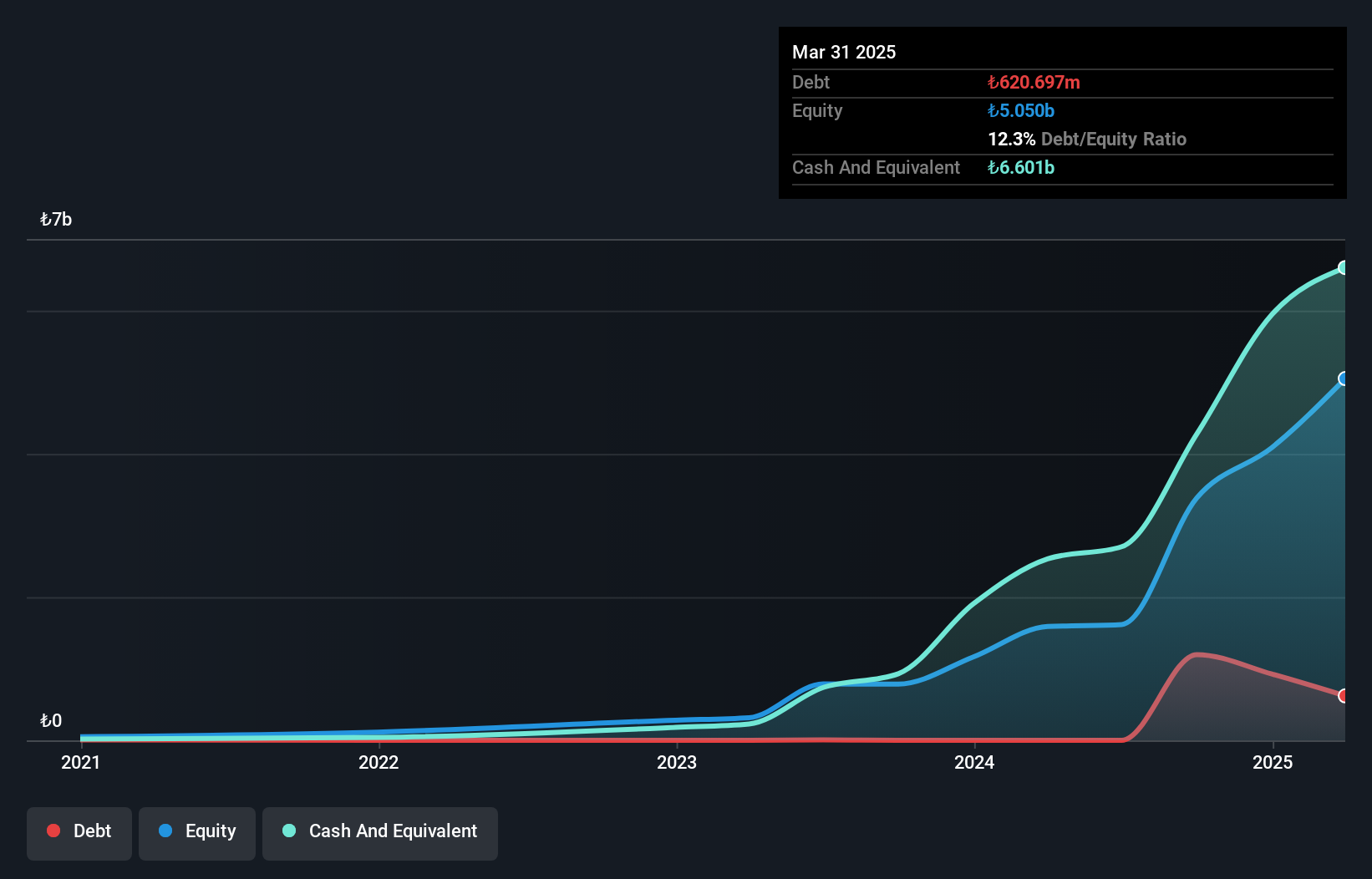

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi specializes in offering interest-free and maturity-free car financing services in Türkiye, with a market capitalization of TRY37.76 billion.

Operations: Katilimevim generates revenue primarily through its financial services for consumers, amounting to TRY11.36 billion. The company's net profit margin is a key metric to consider when evaluating its financial performance.

Katilimevim Tasarruf Finansman Anonim Sirketi, a financial player in the Middle East, has shown impressive growth with earnings surging by 284% over the past year, far outpacing the Consumer Finance industry's 13.7%. The company's debt-free status eliminates concerns about interest payments and positions it as a solid value option with a Price-To-Earnings ratio of 6x compared to the TR market's 17.6x. Recent earnings announcements revealed net income for Q3 at TRY 2,465.93 million, up from TRY 459.13 million last year, highlighting its robust performance and potential for future growth within the S&P Global BMI Index inclusion context.

Saudi Steel Pipes (SASE:1320)

Simply Wall St Value Rating: ★★★★★★

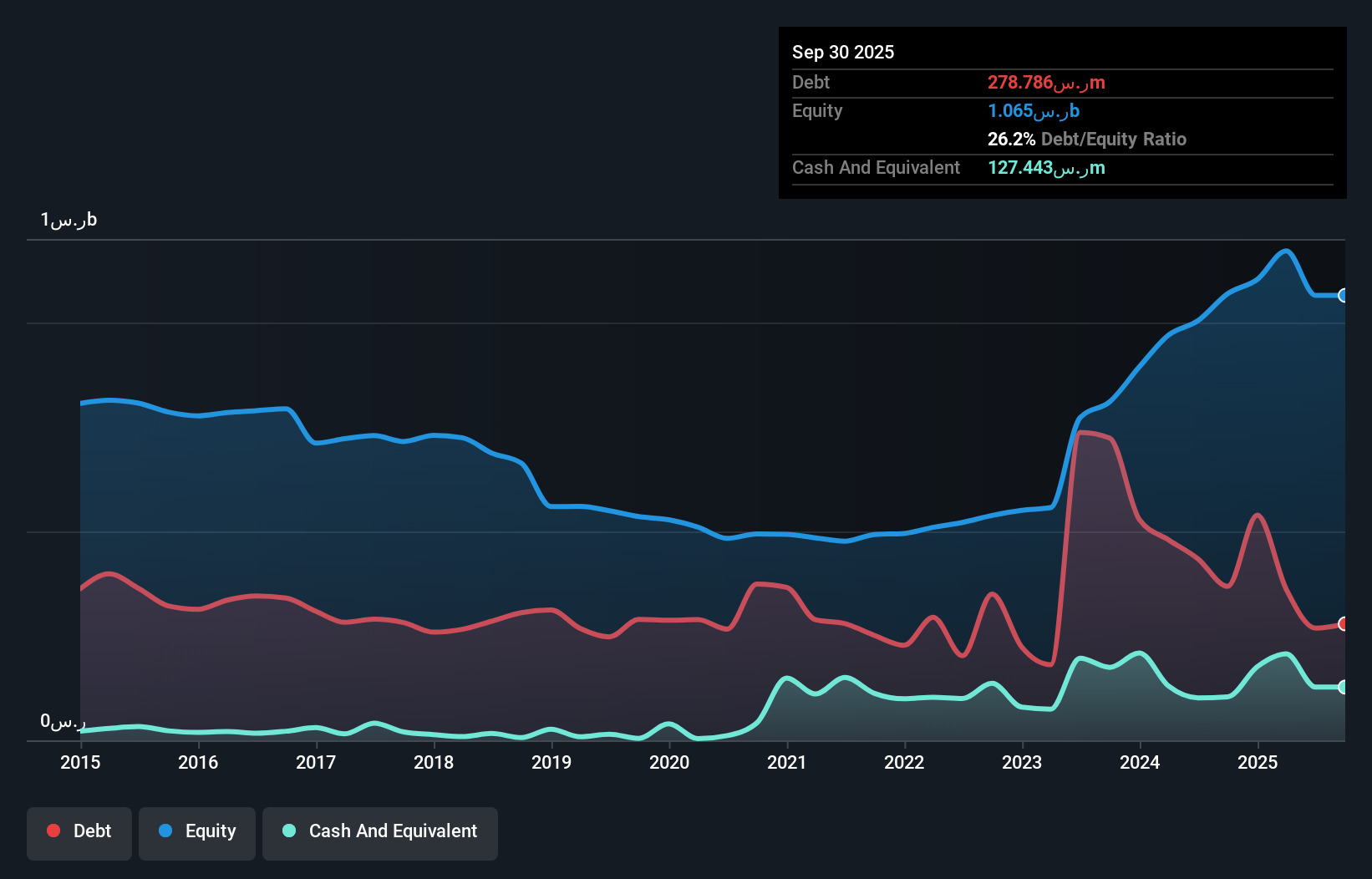

Overview: Saudi Steel Pipes Company is engaged in the manufacturing and distribution of steel pipes both domestically within the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR2.15 billion.

Operations: Saudi Steel Pipes generates revenue primarily from the sale of steel pipes, amounting to SAR1.29 billion. The company's financial performance is influenced by its cost structure and market dynamics within the steel industry.

Saudi Steel Pipes, a smaller player in the Middle East's industrial scene, has been trading at nearly 60% below its estimated fair value, suggesting potential for investors. The company's debt-to-equity ratio impressively dropped from 75.7% to 26.2% over five years, reflecting better financial health. Despite a notable one-off gain of SAR53.7M affecting recent results and negative earnings growth of -16.4%, its interest payments are well covered by EBIT at 11.7 times coverage, indicating solid operational efficiency amidst industry challenges and future revenue is expected to grow by over 8% annually providing some optimism for recovery prospects.

- Take a closer look at Saudi Steel Pipes' potential here in our health report.

Evaluate Saudi Steel Pipes' historical performance by accessing our past performance report.

East Pipes Integrated Company for Industry (SASE:1321)

Simply Wall St Value Rating: ★★★★★★

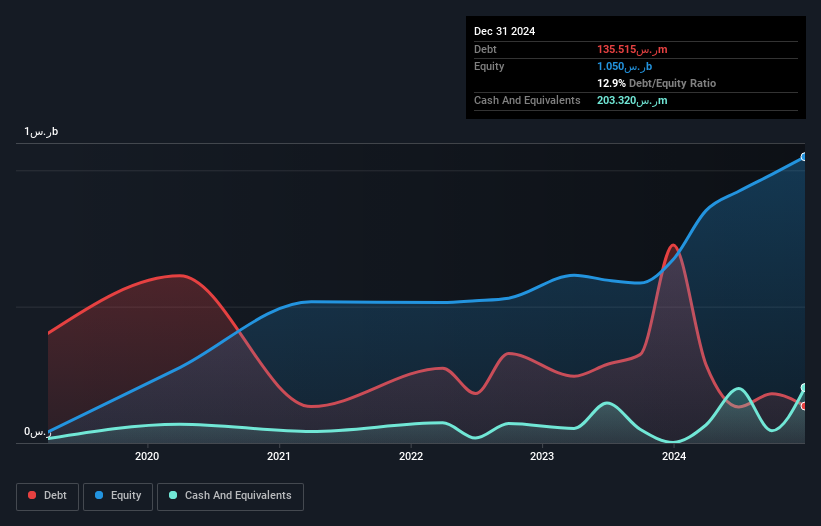

Overview: East Pipes Integrated Company for Industry specializes in providing coating services on customer-supplied pipes and has a market capitalization of SAR4.37 billion.

Operations: East Pipes generates revenue primarily through its coating services for customer-supplied pipes. With a market capitalization of SAR4.37 billion, the company operates within the industrial sector, focusing on enhancing the durability and performance of pipes through specialized coatings.

East Pipes Integrated Company for Industry, a smaller player in the Middle East market, has demonstrated notable financial resilience. Over the past five years, its debt-to-equity ratio impressively decreased from 93.8% to 5.1%, indicating strong financial management. The company reported second-quarter sales of SAR 570.88 million and net income of SAR 158.58 million, reflecting solid growth compared to last year’s figures of SAR 540.15 million and SAR 112.85 million respectively. With a price-to-earnings ratio of 9.8x below the SA market average, it seems undervalued yet poised for potential growth given its high-quality earnings and positive free cash flow status.

Where To Now?

- Unlock our comprehensive list of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com