Middle Eastern Penny Stocks: 3 Promising Picks Under US$2B Market Cap

The Middle Eastern stock markets have been experiencing mixed performances, with Gulf markets reacting to global economic signals such as potential U.S. Federal Reserve interest rate changes. For investors willing to explore beyond established names, penny stocks—often representing smaller or newer companies—can still offer intriguing opportunities. Despite the term's somewhat outdated connotation, these stocks can present solid financial foundations and potential for growth, making them worth a closer look in today's market landscape.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.33 | SAR1.34B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.589 | ₪185.62M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.04B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED745.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.71 | AED313M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.44 | AED14.75B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.813 | AED2.32B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.833 | AED506.68M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.557 | ₪200.72M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 77 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

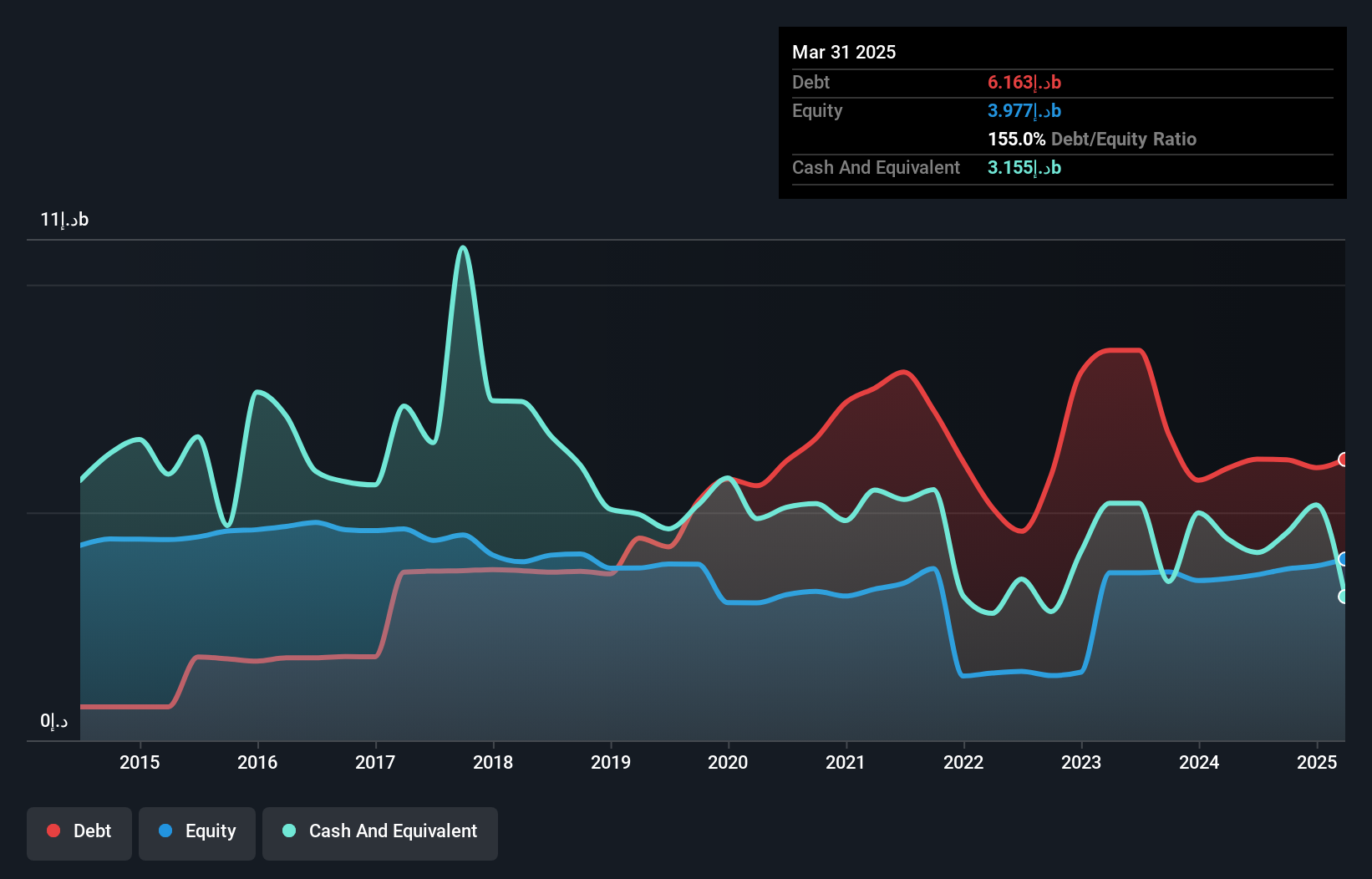

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C. offers commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED3.87 billion.

Operations: The company's revenue is primarily derived from its Commercial Banking segment, which generated AED450.68 million, and its Investment and Treasury segment, contributing AED326.19 million.

Market Cap: AED3.87B

Bank Of Sharjah P.J.S.C. has demonstrated robust earnings growth, with a 262.7% increase over the past year, surpassing the banking industry's growth rate of 15%. The company maintains an appropriate Loans to Assets ratio of 62% and primarily relies on low-risk funding sources like customer deposits. However, it faces challenges with a high level of bad loans at 6.6%. Recent financial results for Q3 show net interest income rising to AED194.67 million from AED115.28 million year-over-year, while net income increased to AED166.45 million from AED124.9 million, reflecting strong operational performance despite management's relatively short tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of Bank Of Sharjah P.J.S.C.

- Examine Bank Of Sharjah P.J.S.C's past performance report to understand how it has performed in prior years.

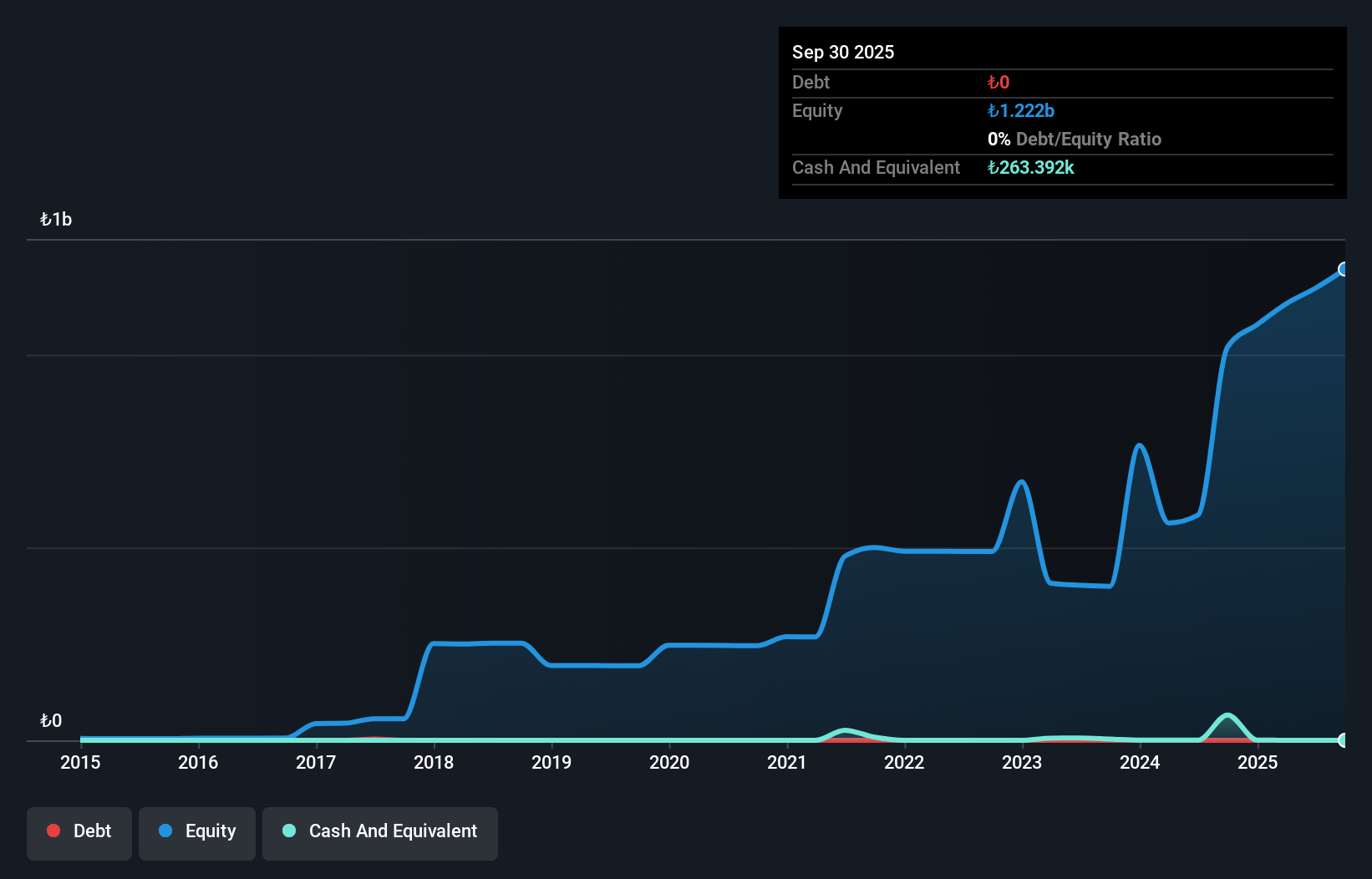

Yesil Yatirim Holding Anonim Sirketi (IBSE:YESIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yesil Yatirim Holding Anonim Sirketi is involved in technical planning, programming, budgeting, project planning, and financial organization with a market cap of TRY1.39 billion.

Operations: Yesil Yatirim Holding Anonim Sirketi has not reported any revenue segments.

Market Cap: TRY1.39B

Yesil Yatirim Holding Anonim Sirketi is currently pre-revenue with a market cap of TRY1.39 billion and has not reported any significant revenue segments. The company remains unprofitable, with a net loss of TRY 38.91 million in Q3 2025, an improvement from TRY 73.48 million the previous year. Despite being debt-free and having short-term assets exceeding liabilities, Yesil faces financial challenges due to less than one year of cash runway and high share price volatility over recent months. Earnings have declined by an average of 24.7% annually over the past five years, indicating ongoing financial struggles.

- Navigate through the intricacies of Yesil Yatirim Holding Anonim Sirketi with our comprehensive balance sheet health report here.

- Learn about Yesil Yatirim Holding Anonim Sirketi's historical performance here.

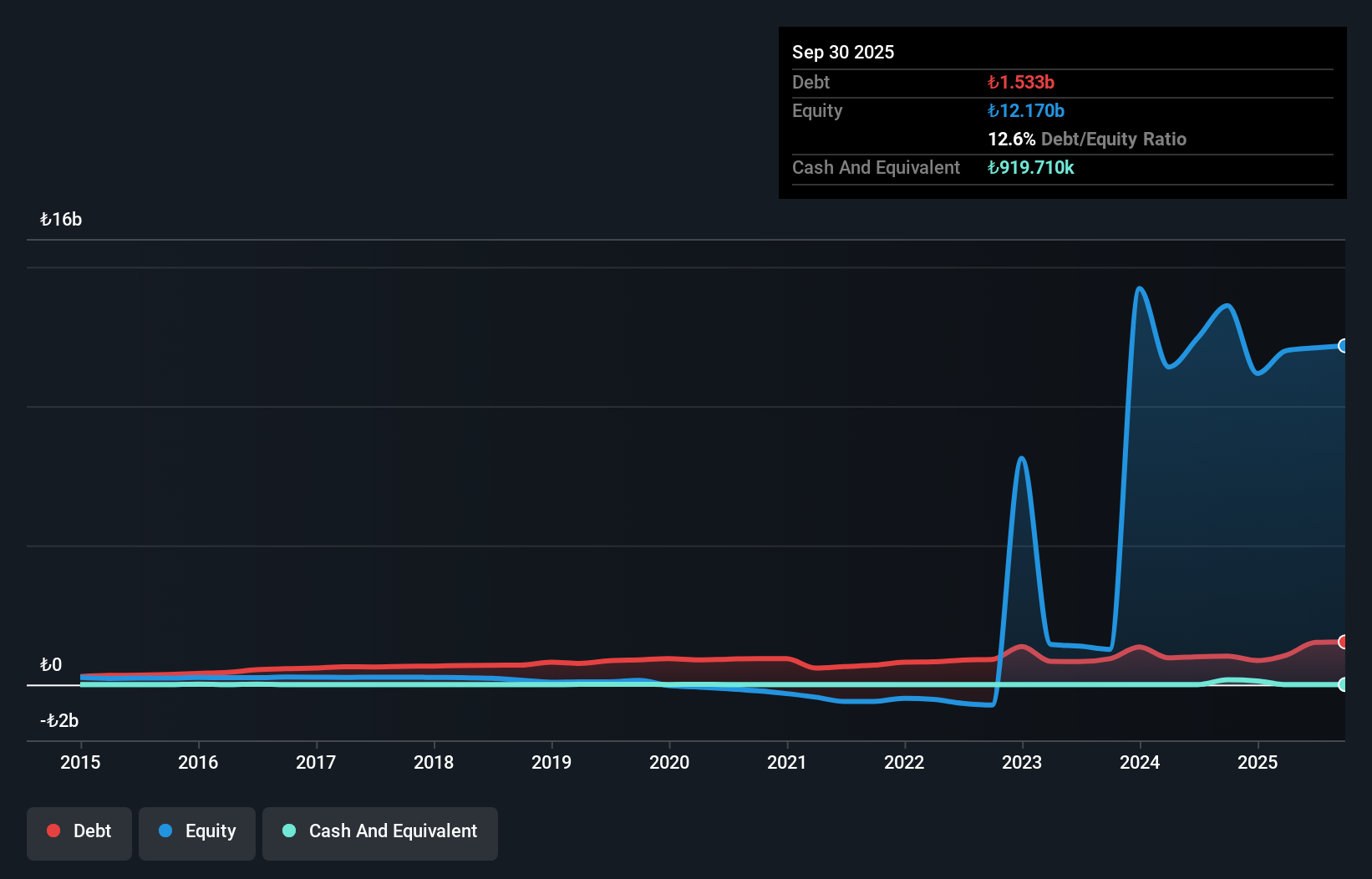

Yesil Gayrimenkul Yatirim Ortakligi (IBSE:YGYO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yesil Gayrimenkul Yatirim Ortakligi A.S. is a publicly owned real estate investment firm with a market cap of TRY1.96 billion.

Operations: The company reported revenue of -TRY3.75 billion from its operations in Turkey.

Market Cap: TRY1.96B

Yesil Gayrimenkul Yatirim Ortakligi A.S., with a market cap of TRY1.96 billion, is currently pre-revenue and reported substantial losses in Q3 2025, contrasting with positive earnings a year prior. Despite this, the company's short-term assets significantly exceed both its short- and long-term liabilities, indicating strong liquidity. Its seasoned management team has maintained stable shareholder equity without dilution over the past year. However, Yesil's high volatility and negative return on equity reflect ongoing financial instability. The firm’s debt is well-managed relative to cash flow, but profitability remains elusive as losses have grown annually by 16.3%.

- Get an in-depth perspective on Yesil Gayrimenkul Yatirim Ortakligi's performance by reading our balance sheet health report here.

- Explore historical data to track Yesil Gayrimenkul Yatirim Ortakligi's performance over time in our past results report.

Make It Happen

- Access the full spectrum of 77 Middle Eastern Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com