Is Now The Time To Put Électricite de Strasbourg Société Anonyme (EPA:ELEC) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Électricite de Strasbourg Société Anonyme (EPA:ELEC), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Électricite de Strasbourg Société Anonyme's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Électricite de Strasbourg Société Anonyme's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 59%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

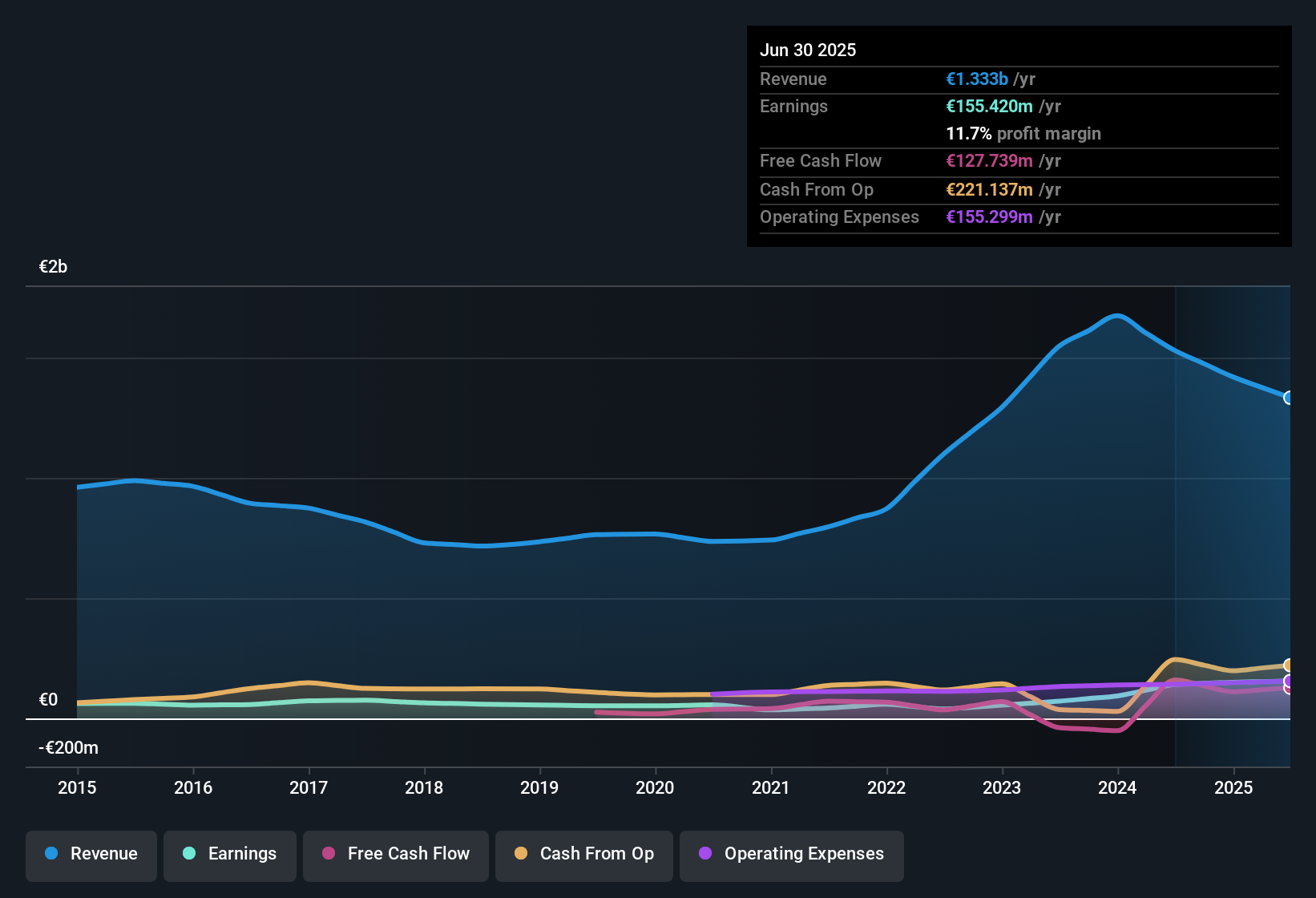

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. We note that while EBIT margins have improved from 12% to 15%, the company has actually reported a fall in revenue by 13%. That falls short of ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Check out our latest analysis for Électricite de Strasbourg Société Anonyme

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Électricite de Strasbourg Société Anonyme's balance sheet strength, before getting too excited.

Are Électricite de Strasbourg Société Anonyme Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Électricite de Strasbourg Société Anonyme, with market caps between €860m and €2.8b, is around €1.2m.

The CEO of Électricite de Strasbourg Société Anonyme only received €341k in total compensation for the year ending December 2024. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Électricite de Strasbourg Société Anonyme Deserve A Spot On Your Watchlist?

Électricite de Strasbourg Société Anonyme's earnings per share have been soaring, with growth rates sky high. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that Électricite de Strasbourg Société Anonyme has the hallmarks of a quality business; and that would make it well worth watching. What about risks? Every company has them, and we've spotted 1 warning sign for Électricite de Strasbourg Société Anonyme you should know about.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of French companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.