Asian Penny Stocks To Watch In December 2025

As global markets react to potential interest rate changes, Asia's economic landscape is also seeing shifts, with manufacturing activity contracting and services expanding. In such a dynamic market, investors often look beyond established giants to explore opportunities in smaller or newer companies. Penny stocks, despite their somewhat outdated label, continue to attract attention for their potential value and growth prospects. By focusing on those with robust financials and clear growth trajectories, investors can find compelling opportunities that offer both stability and upside potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.72 | HK$2.22B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.02 | SGD413.39M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.92 | THB2.95B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.02 | NZ$253.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 953 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Nickel Asia (PSE:NIKL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Asia Corporation is involved in the mining and exploration of nickel saprolite, limonite ore, limestone, and quarry materials in the Philippines with a market cap of ₱51.55 billion.

Operations: The company's revenue is primarily derived from its mining operations, with significant contributions from Mining - TMC at ₱10.81 billion, Mining - RTN at ₱7.87 billion, Mining - HMC at ₱3.11 billion, and Mining - CMC at ₱3.49 billion; additional revenue comes from power generation through Power - EPI and Power - NAC totaling ₱1.24 billion, as well as services provided by RTN/TMC/CDTN amounting to ₱1.03 billion.

Market Cap: ₱51.55B

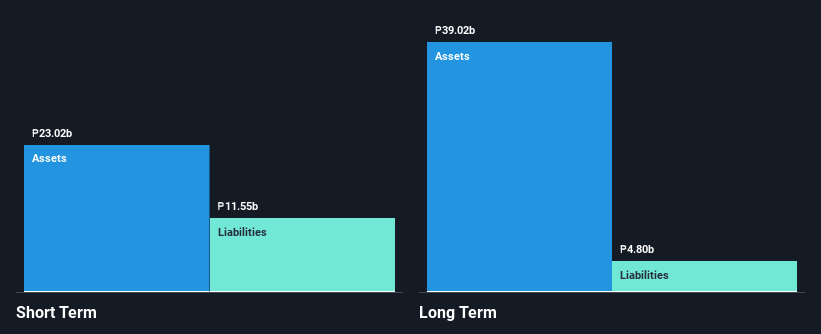

Nickel Asia Corporation has demonstrated robust financial performance with a recent surge in quarterly revenue to ₱11.05 billion, up from ₱7.69 billion the previous year, and net income rising to ₱3.09 billion from ₱1.44 billion. Despite stable weekly volatility, its earnings have declined by 16.3% annually over five years but showed a promising 56.7% growth recently, although still lagging behind industry averages. The company maintains strong liquidity with short-term assets covering both short and long-term liabilities comfortably and announced a special cash dividend of PHP 0.07 per share payable in December 2025 amidst organizational changes set for January 2026.

- Click to explore a detailed breakdown of our findings in Nickel Asia's financial health report.

- Examine Nickel Asia's earnings growth report to understand how analysts expect it to perform.

China Jicheng Holdings (SEHK:1027)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Jicheng Holdings Limited, with a market cap of HK$1.50 billion, manufactures and sells POE umbrellas, nylon umbrellas, and umbrella parts in the People’s Republic of China.

Operations: The company generates CN¥339.77 million in revenue from the sales of umbrellas and umbrella parts.

Market Cap: HK$1.5B

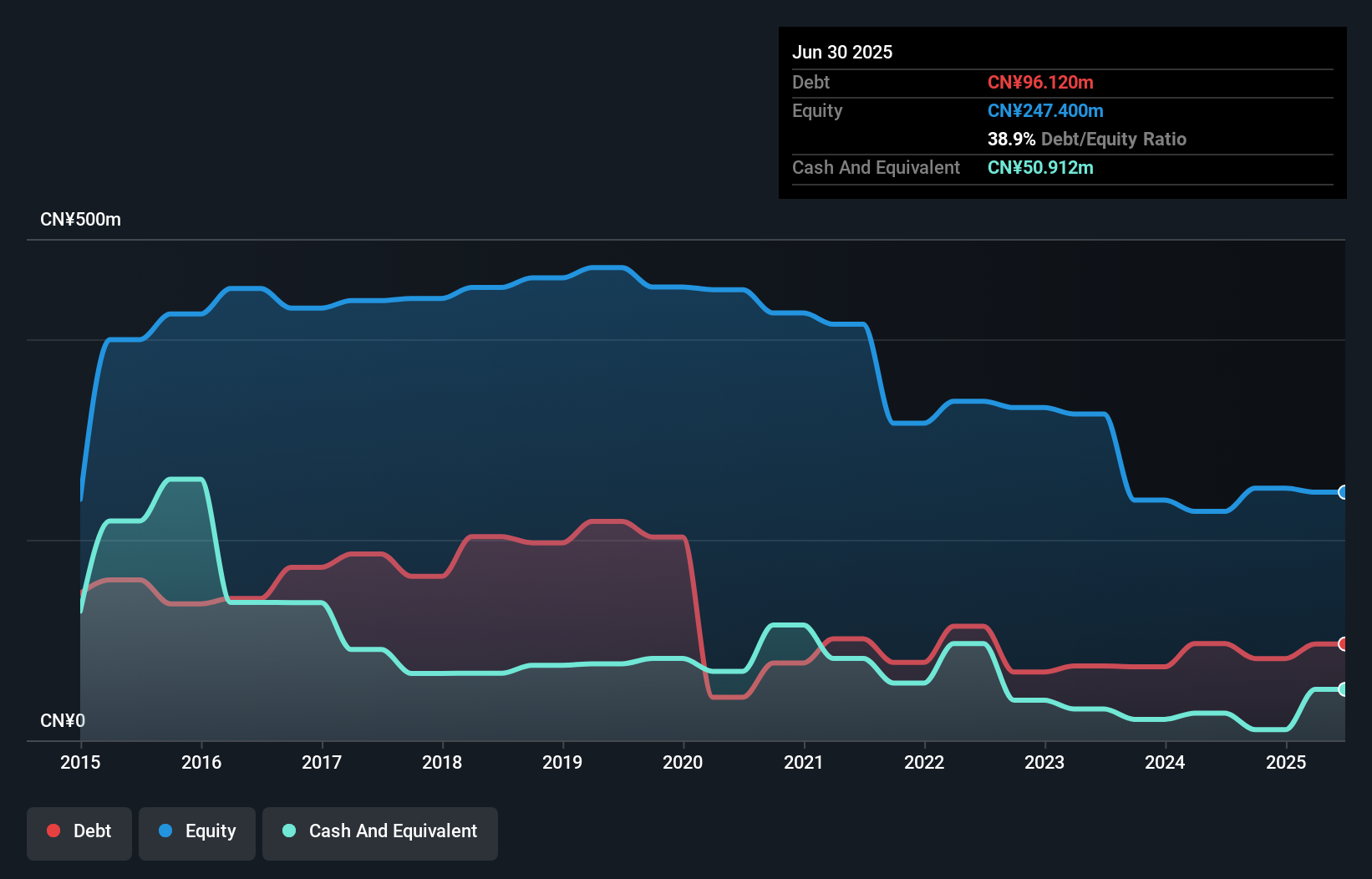

China Jicheng Holdings Limited has recently seen significant corporate developments, including the appointment of Mr. Steve Andrew Chen as Executive Director and Chairman, which may influence strategic direction given his extensive experience in education and training. The company has achieved profitability this year with high-quality earnings, although its return on equity remains low at 7.8%. Despite a highly volatile share price recently, the stock trades significantly below estimated fair value. Financially stable with satisfactory debt levels and short-term assets exceeding liabilities, China Jicheng's interest payments are well covered by EBIT at 4.3 times coverage.

- Jump into the full analysis health report here for a deeper understanding of China Jicheng Holdings.

- Assess China Jicheng Holdings' previous results with our detailed historical performance reports.

Sun.King Technology Group (SEHK:580)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for sectors such as power transmission, electrified transportation, and industrial applications in China, with a market cap of approximately HK$3.44 billion.

Operations: The company's revenue is primarily derived from the manufacturing and trading of power electronic components, amounting to CN¥1.84 billion.

Market Cap: HK$3.44B

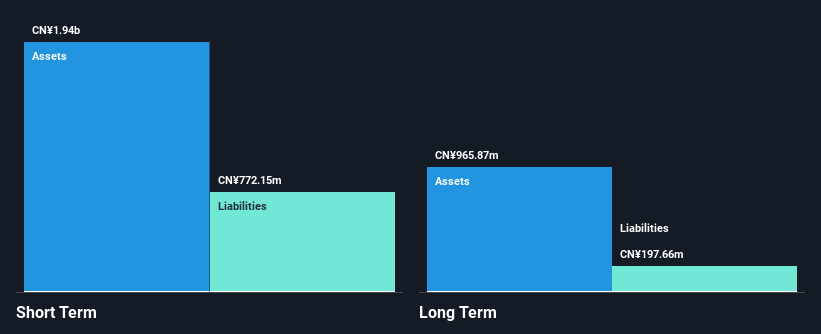

Sun.King Technology Group has demonstrated robust earnings growth, with a 127.8% increase over the past year, surpassing industry averages. Despite a low return on equity at 7.3%, the company maintains high-quality earnings and stable weekly volatility of 9%. Financially sound, Sun.King's cash exceeds total debt, with operating cash flow covering 80.8% of its debt and short-term assets (CN¥2 billion) outweighing both short- and long-term liabilities. Recent amendments to its articles of association could impact governance structures moving forward, while forecasts suggest continued profit growth at an annual rate of 23.94%.

- Get an in-depth perspective on Sun.King Technology Group's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Sun.King Technology Group's future.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 953 companies by clicking here.

- Want To Explore Some Alternatives? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com