Risks To Shareholder Returns Are Elevated At These Prices For Clicks Group Limited (JSE:CLS)

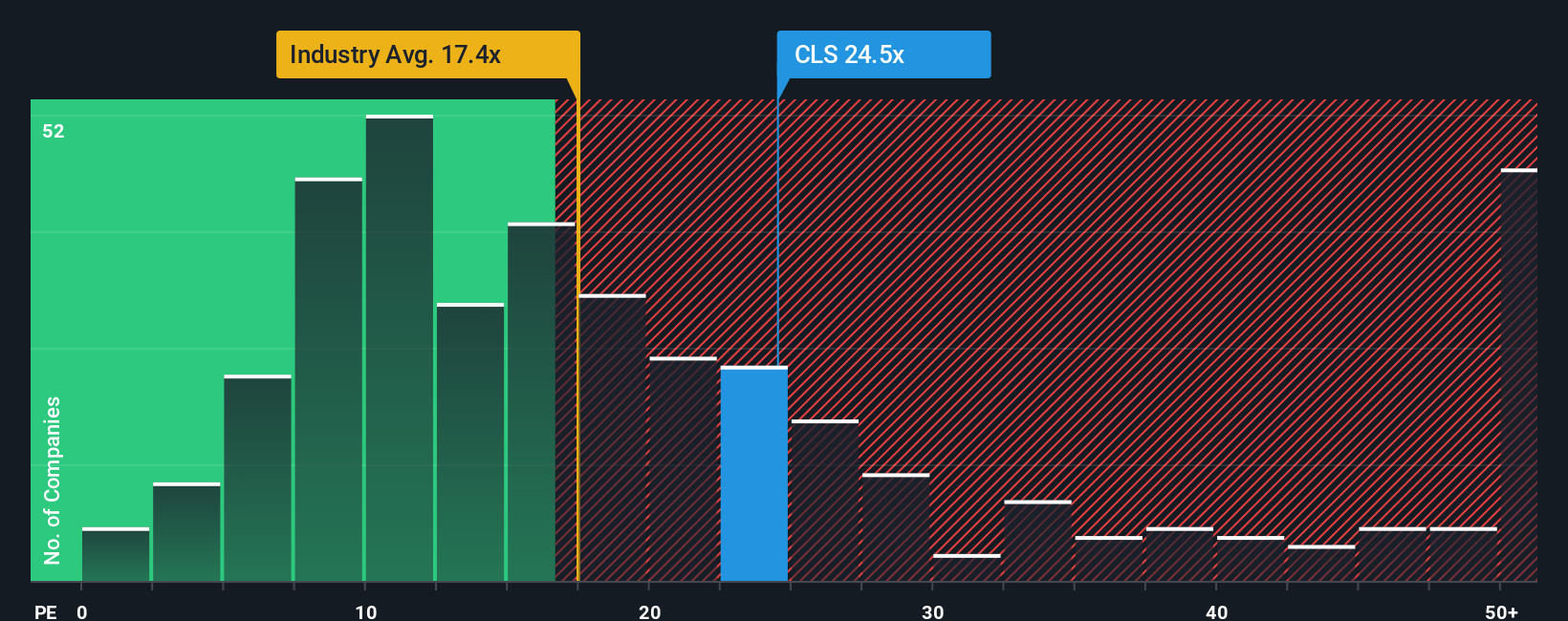

When close to half the companies in South Africa have price-to-earnings ratios (or "P/E's") below 9x, you may consider Clicks Group Limited (JSE:CLS) as a stock to avoid entirely with its 24.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

There hasn't been much to differentiate Clicks Group's and the market's earnings growth lately. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Clicks Group

How Is Clicks Group's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Clicks Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. The latest three year period has also seen a 28% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 16% per year growth forecast for the broader market.

In light of this, it's alarming that Clicks Group's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Clicks Group currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Clicks Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than Clicks Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.