Middle Eastern Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

As Gulf markets ended mixed ahead of an anticipated U.S. Federal Reserve interest rate cut, the region's financial landscape is experiencing a nuanced interplay of economic indicators and market sentiment. With oil prices hovering near multi-month lows and expectations of monetary easing influencing regional economies, investors are keenly observing small-cap stocks for potential opportunities amidst these dynamic conditions. In this context, identifying promising stocks involves evaluating their resilience to external pressures and their capacity to leverage local economic strengths effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Terminal X Online | 12.94% | 13.43% | 44.27% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi (IBSE:SONME)

Simply Wall St Value Rating: ★★★★★☆

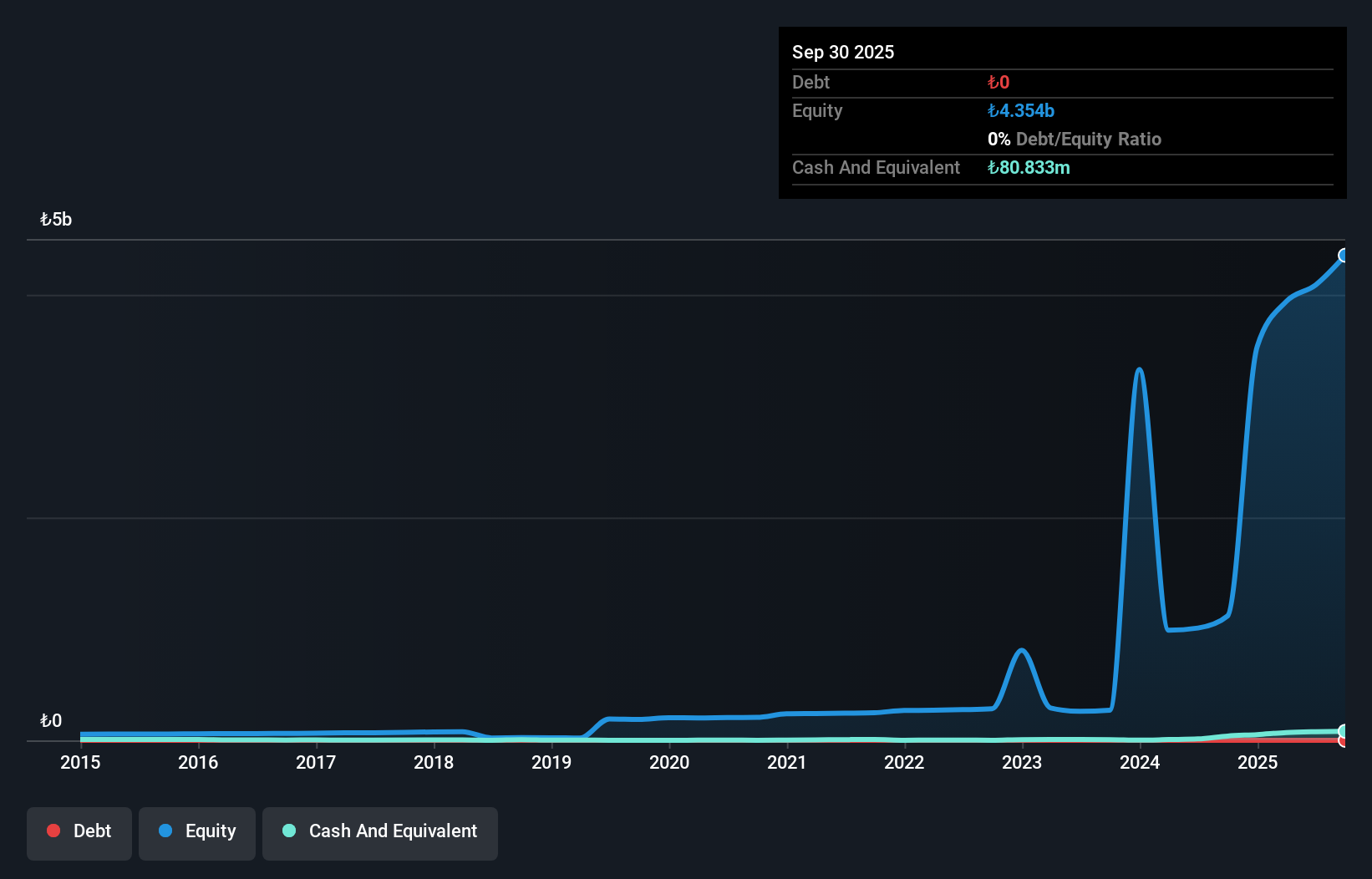

Overview: Sönmez Filament Sentetik Iplik ve Elyaf Sanayi A.S. operates in the synthetic yarn and fiber industry, with a market capitalization of TRY10.76 billion.

Operations: The company generates revenue primarily from real estate rental, totaling TRY127.31 million.

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi, a small player in the textile industry, shows a mixed financial picture. Despite being debt-free and enjoying high-quality earnings, recent performance reveals challenges. The company reported sales of TRY 12 million for Q3 2025, down from TRY 13.64 million the previous year, with net income dropping significantly to TRY 8.74 million from TRY 25.27 million. Over nine months, it faced a net loss of TRY 34.25 million compared to a prior net income of TRY 29.72 million. Negative earnings growth at -25.8% highlights difficulties against industry trends but offers potential for turnaround given its debt-free status and past quality earnings.

Edarat Communication and Information Technology (SASE:9557)

Simply Wall St Value Rating: ★★★★★☆

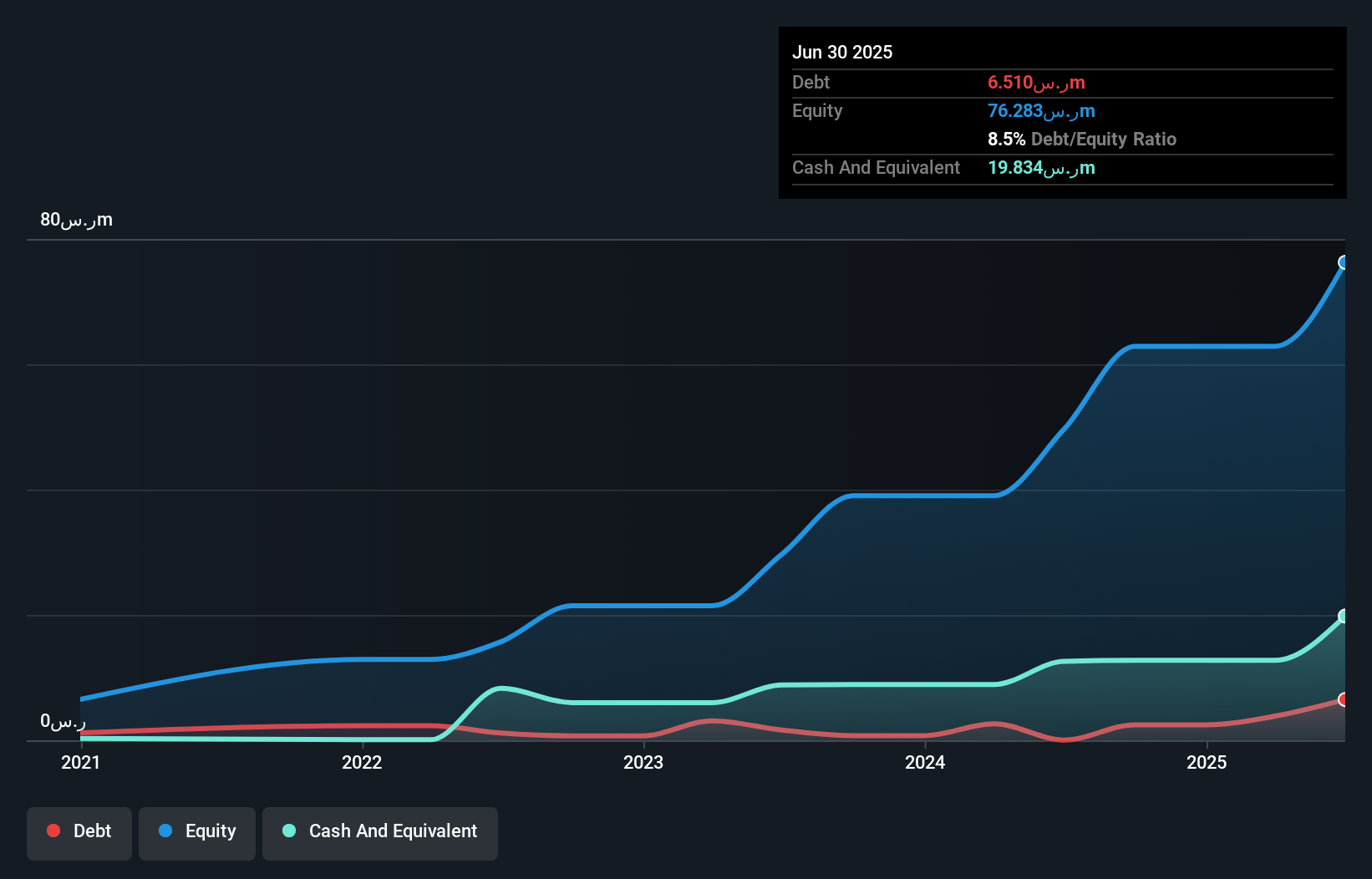

Overview: Edarat Communication and Information Technology Co. operates in the technology sector, focusing on cloud services and data center engineering, with a market cap of SAR1.13 billion.

Operations: Edarat Communication and Information Technology Co. generates revenue primarily from cloud services (SAR58.78 million) and data center engineering services (SAR75.32 million).

Edarat Communication and Information Technology, a smaller player in the IT sector, has been making waves with significant earnings growth of 36.9% over the past year, outpacing the industry's -8.3%. The company's debt is well-managed with interest payments covered 80 times by EBIT, suggesting robust financial health. Recent contracts further bolster its prospects; notably a SAR 18 million deal with Mobily for data center services and a SAR 16 million agreement with SenseTime KSA. These contracts are likely to enhance Edarat's financials starting Q4 2025 and could extend for additional years, indicating potential long-term value.

- Dive into the specifics of Edarat Communication and Information Technology here with our thorough health report.

Learn about Edarat Communication and Information Technology's historical performance.

Export Investment (TASE:EXPO)

Simply Wall St Value Rating: ★★★★☆☆

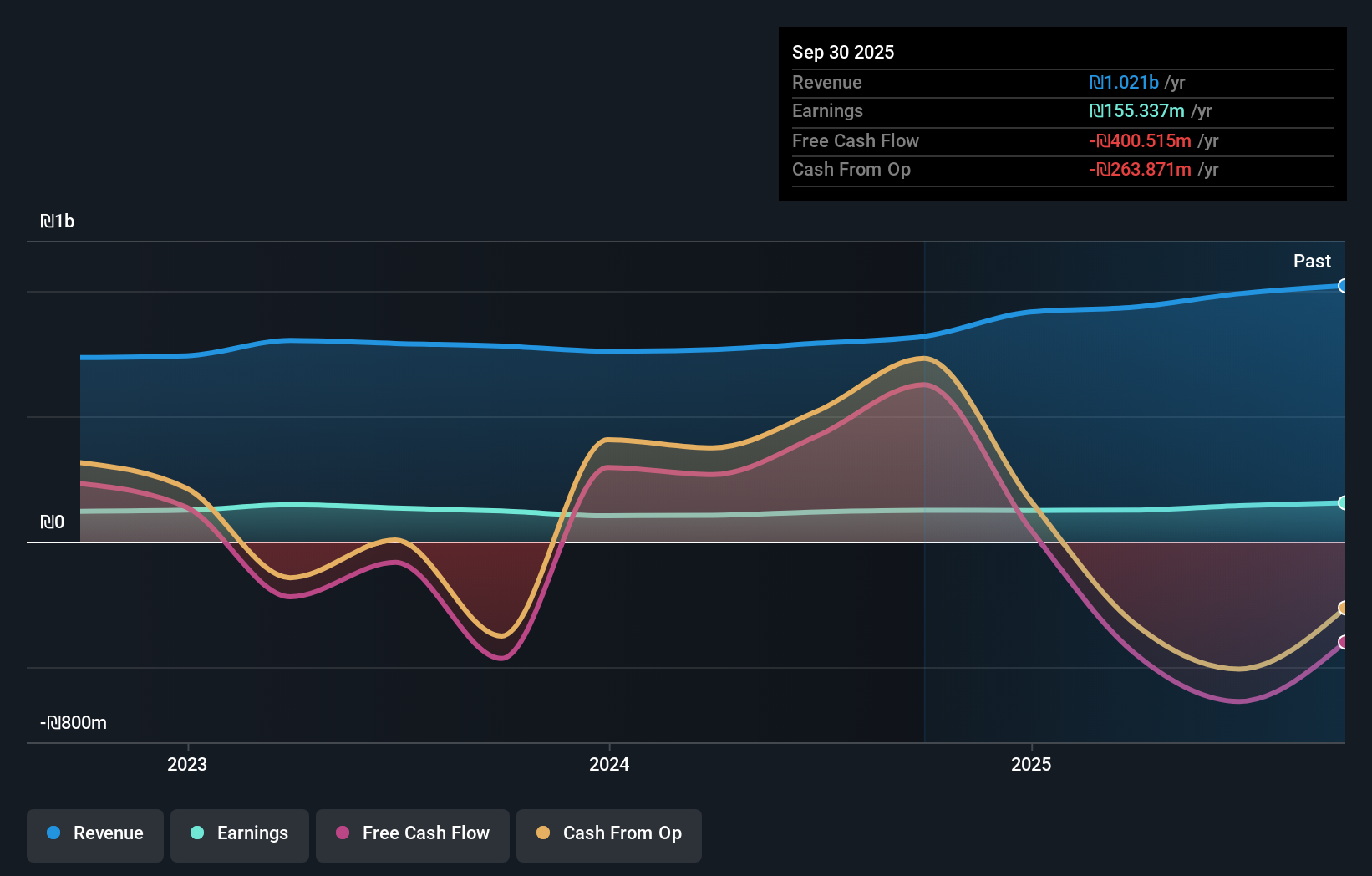

Overview: Export Investment Co. Ltd. serves as the holding company for Bank of Jerusalem, offering a range of banking products and services in Israel, with a market cap of ₪825.54 million.

Operations: Export Investment generates revenue primarily through its banking operations in Israel. Its financial performance is highlighted by a net profit margin of 15.2%, reflecting profitability from its core activities.

Export Investment, a compact player in the Middle East financial scene, showcases promising fundamentals with total assets of ₪22.4 billion and equity at ₪1.5 billion. The firm holds deposits worth ₪17.7 billion against loans totaling ₪16 billion, reflecting a robust deposit base that constitutes 85% of its liabilities, indicating lower risk funding. Earnings have surged by 24% over the past year, outpacing the broader bank industry's 10.8%, and it trades at an attractive valuation—35% below estimated fair value. Despite not being free cash flow positive recently, its high-quality earnings offer potential for discerning investors seeking value opportunities in emerging markets.

- Click here to discover the nuances of Export Investment with our detailed analytical health report.

Examine Export Investment's past performance report to understand how it has performed in the past.

Taking Advantage

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 179 more companies for you to explore.Click here to unveil our expertly curated list of 182 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com