Antero Resources (AR): Assessing Valuation After Recent Outperformance in the Energy Sector

Antero Resources (AR) has quietly outperformed many energy peers over the past month, with the stock up around 11% and roughly 16% over the past three months, catching the attention of value-focused investors.

See our latest analysis for Antero Resources.

Zooming out, that recent strength adds to a solid run, with a roughly mid teens 3 month share price return and a near 20% one year total shareholder return indicating that momentum is still building around Antero’s growth story and risk profile.

If Antero’s move has you rethinking the energy space, this could also be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With analysts still seeing upside to the current share price and Antero posting steady top and bottom line growth, the key question now is simple: is AR still undervalued or already reflecting its next leg of growth?

Most Popular Narrative: 11.5% Undervalued

Against a last close of 37.30 dollars, the most followed narrative pegs Antero Resources fair value around 42.14 dollars, implying meaningful upside if its assumptions hold.

Low leverage, disciplined capital allocation, and a flexible return of capital approach (including share buybacks below intrinsic value) increase potential for future accretive EPS growth as the company rapidly deleverages and builds balance sheet strength.

Want to see what is driving that higher fair value, from revenue runway to margin expansion and future earnings power, and how a premium earnings multiple fits in? Dive into the full narrative to unpack the forecasts behind this 42 dollar plus valuation.

Result: Fair Value of $42.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory and ESG pressures, alongside potential pipeline constraints, could squeeze margins and cap the upside baked into today’s optimistic forecasts.

Find out about the key risks to this Antero Resources narrative.

Another Angle on Valuation

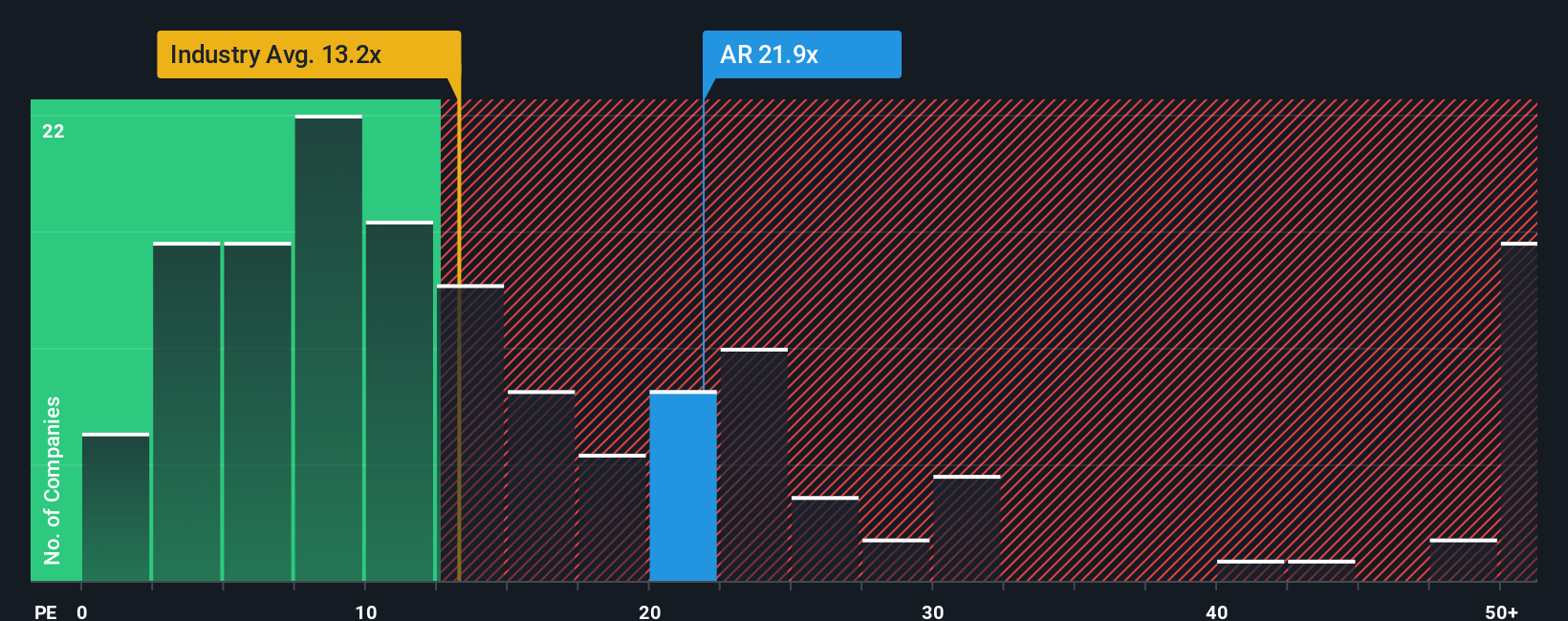

On earnings multiples, the story looks less straightforward. AR trades on about 19.5 times earnings, above the US Oil and Gas average of 13.5 times and even above its own fair ratio of 17.7 times, which hints at valuation risk if growth or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Resources Narrative

If you would rather dig into the numbers yourself and shape your own view, you can build a complete narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Antero Resources.

Looking for more investment ideas?

Round out your research by acting on fresh opportunities today, because the strongest returns often go to investors who move first on high quality ideas.

- Review these 3586 penny stocks with strong financials to explore innovative small caps with resilient balance sheets and improving fundamentals.

- Consider these 27 AI penny stocks focused on intelligent automation that is transforming areas such as cloud software and real time analytics.

- Explore these 15 dividend stocks with yields > 3% for income potential and stability from companies that combine solid cash flows with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com