Evaluating Artivion (AORT) After a Strong Multi‑Year Rally: Is the Stock Still Undervalued?

Artivion (AORT) has quietly become a strong performer, with shares up sharply this year even after a recent pullback. Investors are starting to weigh whether the current price still reflects its growth trajectory.

See our latest analysis for Artivion.

The stock’s latest pullback, including a modest 1 day share price return of minus 1.17 percent to 44.07 dollars, comes after a powerful year to date share price return of 56.94 percent and a standout 3 year total shareholder return of 240.84 percent. This suggests momentum is cooling slightly, but the longer term trend still looks strong.

If Artivion’s run has you rethinking your healthcare exposure, it could be a good time to explore other specialized opportunities via healthcare stocks.

With revenues still growing at a double-digit pace, but profitability only just emerging and the stock trading below analyst targets, investors now face a key question: is Artivion still mispriced, or is the market already banking on its future growth?

Most Popular Narrative Narrative: 15% Undervalued

With Artivion’s fair value estimate sitting meaningfully above the 44.07 dollars last close, the prevailing narrative leans toward further upside potential.

Improvements in operational efficiency through leveraging existing sales infrastructure for new launches and maintaining strong pricing power, combined with significant deleveraging of the balance sheet, support expanding net margins, free cash flow, and financial flexibility for future growth investments.

Curious how steady double digit growth, rising margins, and a premium future earnings multiple all fit together? Want to see the full playbook behind that fair value?

Result: Fair Value of $51.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained upside still hinges on smooth regulatory progress and timely product adoption. Any delays or lukewarm surgeon uptake are likely to challenge today’s growth assumptions.

Find out about the key risks to this Artivion narrative.

Another Angle on Valuation

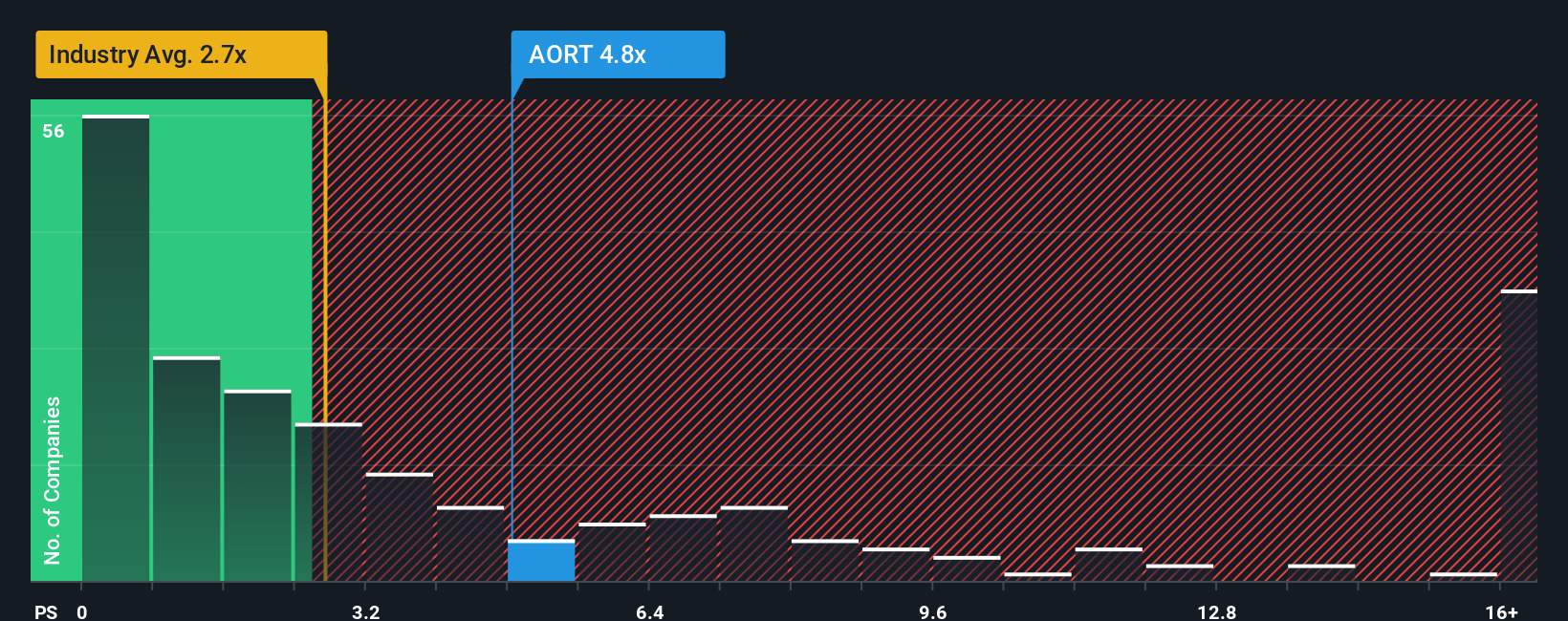

Step away from fair value models and Artivion suddenly looks pricey. Its price to sales sits at 4.9 times, well above both the industry and peer average of 3.4 times, and the 2.7 times fair ratio our work points to, raising the risk of multiple compression ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Artivion Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single healthcare name when you can use the Simply Wall St screener to spot fresh opportunities and avoid missing tomorrow’s winners.

- Capture potential bargains early by reviewing these 901 undervalued stocks based on cash flows that our models flag as priced below their estimated cash flow value.

- Position yourself for the next wave of innovation by scanning these 27 AI penny stocks tapping into real world applications of artificial intelligence.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that balance attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com