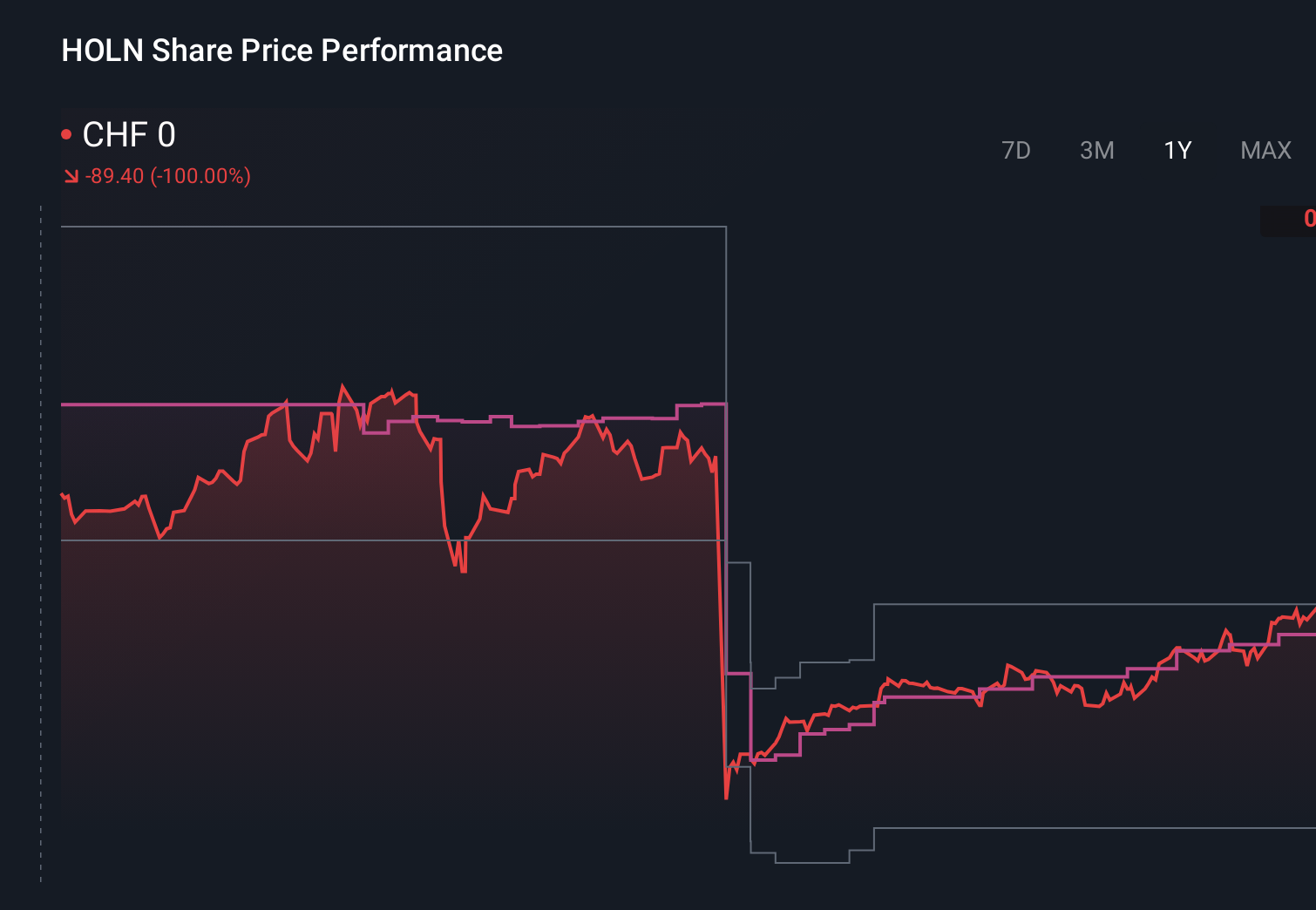

Should Holcim’s Expanded European Recycling Network Reshape Its Circular Strategy For Holcim (SWX:HOLN) Investors?

- In early December 2025, Holcim completed acquisitions of Thames Materials in West London and a majority stake in A&S Recycling in Germany, and agreed to buy a demolition materials recycler in Northwest France, adding around 1.3 million tons of annual permitted processing capacity to its European network.

- By integrating these recycling businesses into its ECOCycle® circular construction platform, Holcim is materially expanding access to low‑carbon, recycled construction solutions across Greater London, Northern Germany and Northwest France.

- We’ll now examine how this expansion of Holcim’s construction demolition recycling capacity could influence its investment narrative and future positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Holcim Investment Narrative Recap

To own Holcim, you need to believe that its push into low carbon, circular construction can support solid earnings while it manages cyclical demand and decarbonization costs. The new recycling acquisitions modestly reinforce the near term catalyst of growing ECOCycle and premium green solutions, but do not change the key risk that tighter climate regulation could still lift compliance and operating expenses.

The recent confirmation of 2025 guidance for 3% to 5% net sales growth and 6% to 10% recurring EBIT growth in local currency gives investors a reference point for judging how quickly these recycling assets might contribute. Against that backdrop, the 1.3 million tons of additional permitted processing capacity in the UK, Germany and France looks like another incremental step in Holcim’s broader circular construction plan rather than a standalone earnings driver.

But while circular construction capacity is growing, investors should also be aware that...

Read the full narrative on Holcim (it's free!)

Holcim’s narrative projects CHF17.9 billion revenue and CHF2.4 billion earnings by 2028. This implies revenue will decline by 11.9% per year and an earnings decrease of CHF0.8 billion from CHF3.2 billion today.

Uncover how Holcim's forecasts yield a CHF73.20 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Holcim’s fair value anywhere between CHF 38.97 and CHF 77.72 across 11 independent views, showing how far opinions can stretch. Against this, some investors are watching closely whether Holcim’s accelerating M&A and circular construction expansion can actually translate into the margin gains and earnings resilience that many already seem to expect.

Explore 11 other fair value estimates on Holcim - why the stock might be worth 49% less than the current price!

Build Your Own Holcim Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Holcim research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Holcim research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Holcim's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com