Shufersal (TASE:SAE) Valuation Check After Mixed Third-Quarter Results And Softer Recent Momentum

Shufersal (TASE:SAE) just posted mixed third quarter numbers, with sales and profit slipping versus last year’s quarter, but slightly higher net income and EPS over the first nine months despite softer revenue.

See our latest analysis for Shufersal.

The latest ILS 40.26 share price reflects that sentiment, with a modest 7 day share price return but slightly negative 3 month performance. At the same time, a 3 year total shareholder return above 100% shows the longer term trend is still strong and suggests momentum has cooled rather than reversed.

If these mixed earnings have you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential higher conviction opportunities.

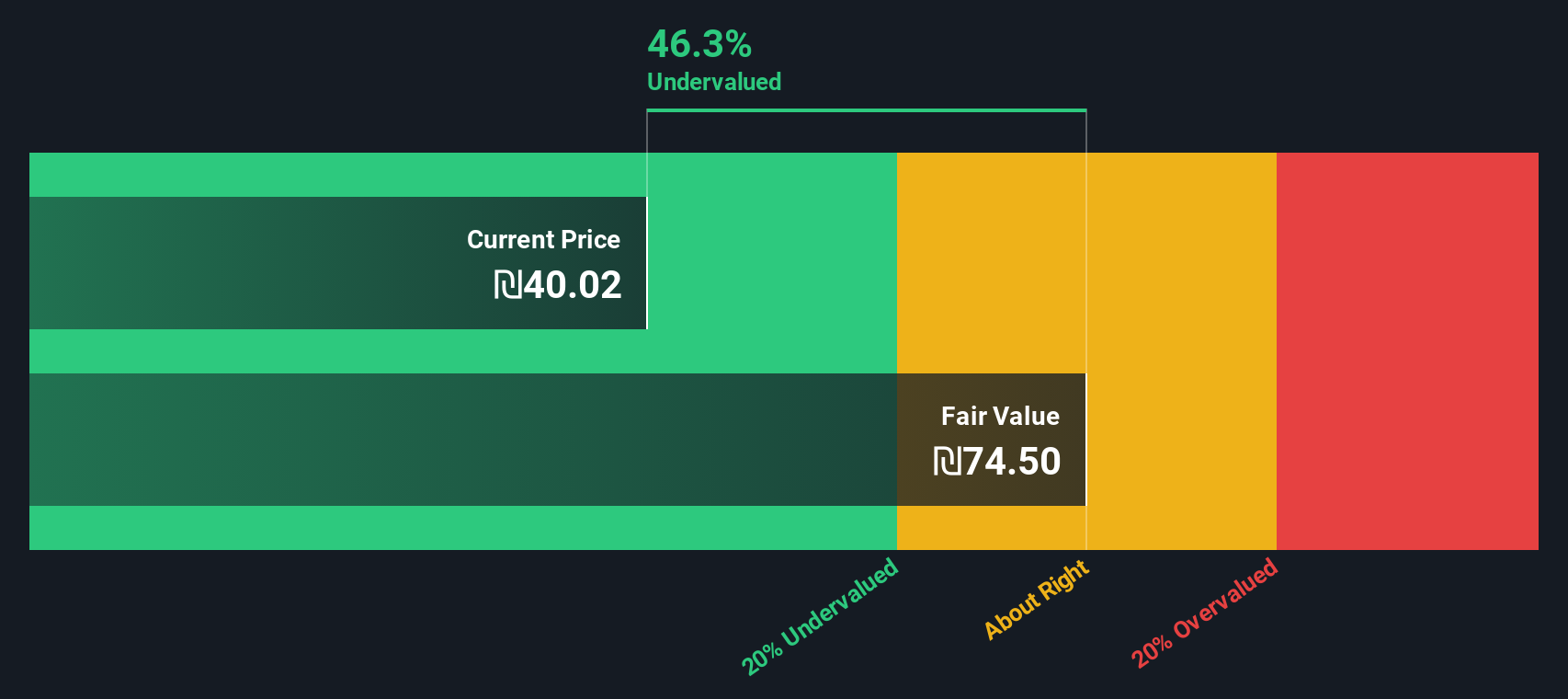

With earnings momentum softening but the share price still trading at a sizeable discount to both analyst targets and intrinsic value estimates, is Shufersal quietly undervalued today, or is the market already pricing in its future growth?

Price-to-Earnings of 16.1x: Is it justified?

On a headline basis, Shufersal’s 16.1x price to earnings multiple at the last close of ₪40.26 sits modestly below both peers and the broader regional retail group, hinting at a slight value gap.

The price to earnings ratio compares what investors are paying today for each unit of the company’s earnings. For a mature food and consumer retailer like Shufersal, which generates steady profits rather than hyper growth, this multiple is a key shorthand for how the market values its earnings resilience and cash generation.

With earnings up 7.1% over the past year and a stronger five year earnings compound rate of 16.8%, a 16.1x multiple suggests the market acknowledges Shufersal’s solid track record but is not assigning an aggressive premium for future expansion, particularly given that recent profit growth has slowed versus its own history.

Compared with the Asian consumer retailing industry average of 16.6x, Shufersal trades at a slight discount, and the gap widens further against a 21.4x peer average, which indicates that investors are paying less for each shekel of Shufersal earnings than for many comparable names despite its high quality earnings profile and net margin improvement.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.1x (UNDERVALUED)

However, softer recent earnings trends and lingering consumer spending headwinds in Israel could quickly erode that apparent valuation gap if conditions worsen.

Find out about the key risks to this Shufersal narrative.

Another View: What Does Our DCF Say?

While the earnings multiple hints at only a mild discount, our DCF model paints a far bolder picture, suggesting fair value around ₪74.53, roughly 46% above today’s ₪40.26 price. Is the market missing Shufersal’s long term cash flow potential, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shufersal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shufersal Narrative

If you see the numbers differently, or would rather work from your own assumptions and data, you can build a complete narrative in just a few minutes, starting with Do it your way.

A great starting point for your Shufersal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning a few targeted stock lists that could help you identify opportunities you may not want to miss.

- Review these 907 undervalued stocks based on cash flows to find mispriced businesses that may offer stronger upside based on their cash flow potential.

- Explore these 27 AI penny stocks to see companies involved in automation, data, and intelligent software.

- Evaluate these 15 dividend stocks with yields > 3% to identify stocks that combine dividend income with fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com