Astronics (ATRO): Reassessing Valuation After Airbus Cuts 2025 Delivery Guidance

Astronics (ATRO) slipped after Airbus trimmed its 2025 delivery plans, citing fuselage panel quality issues, and the market quickly connected that slowdown to potential demand pressure across the aerospace supply chain.

See our latest analysis for Astronics.

Even with today’s wobble on the Airbus headline, Astronics’ 1 month share price return of 12.07 percent and year to date share price return of 233.44 percent show strong momentum, supported by a 3 year total shareholder return of 435.06 percent.

If you want to see how other names in the space are positioned after this Airbus update, it is a good moment to explore aerospace and defense stocks.

With analysts still calling Astronics a buy and price targets sitting comfortably above the latest close, the question now is whether the recent surge still leaves upside or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 16.1% Undervalued

With Astronics last closing at $52.65 versus a narrative fair value of $62.75, the storyline points to meaningful upside if its assumptions land.

Strategic portfolio actions, including exiting low margin/non core product lines, rationalizing facilities, and a sharpened focus on higher margin aerospace segments, are simplifying the business, improving gross margins, and supporting a sustainable step up in net margins. Enhanced FAA certification capability (via the Envoy Aerospace acquisition) positions Astronics to better capitalize on the growing trend toward aircraft digital transformation, retrofits, and regulatory driven upgrades, attracting higher value contracts and reducing schedule risks, all with positive implications for long term earnings.

Want to see what powers that higher fair value, beyond the recent share surge? The narrative leans on rapid earnings acceleration, rising margins, and a future multiple more often reserved for sector standouts. Curious how those moving parts combine into that target price and why the discount rate still supports it? The full breakdown reveals the specific growth path behind the headline number.

Result: Fair Value of $62.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated tariff exposure and persistent execution hiccups in the Test segment could quickly dent margins and challenge the bullish growth narrative.

Find out about the key risks to this Astronics narrative.

Another View on Value

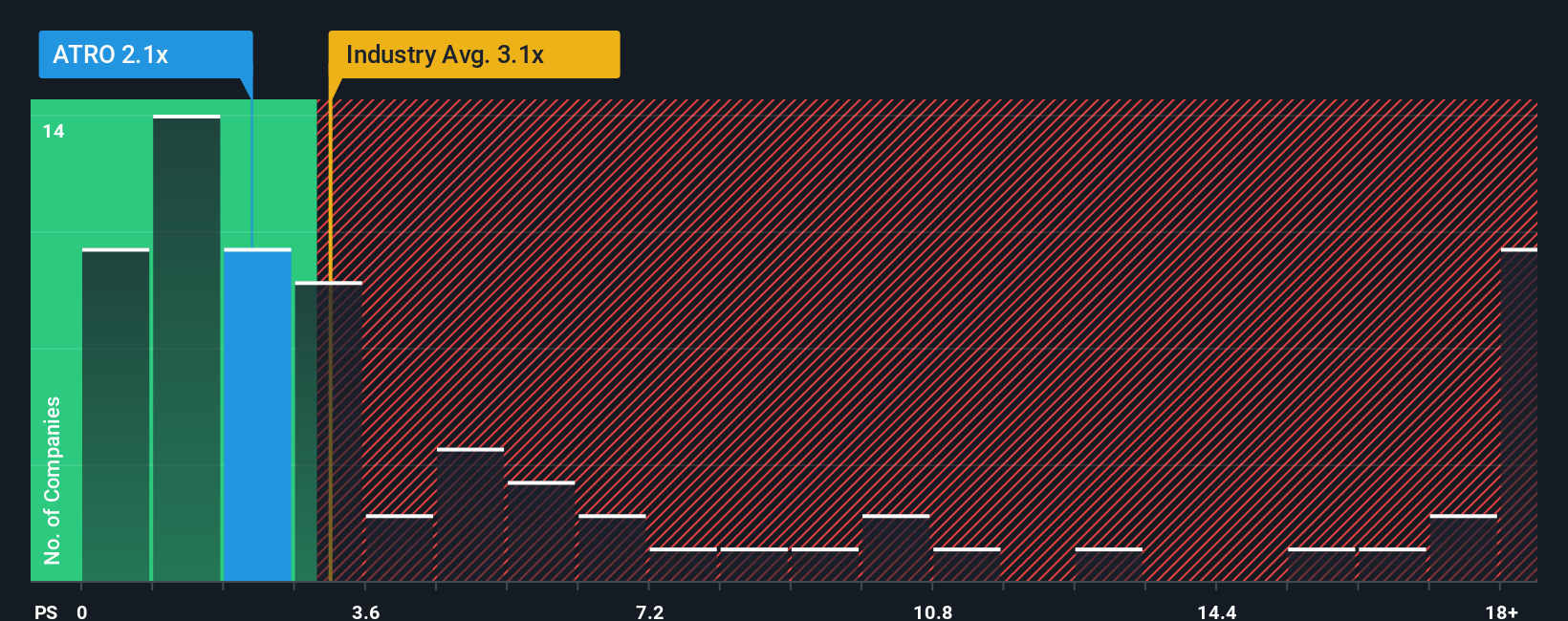

While the narrative fair value paints Astronics as 16.1 percent undervalued, our SWS fair ratio using the price-to-sales ratio tells a different story. At 2.3 times sales versus a fair ratio of 1.2 times and peers at 1.5 times, the stock screens expensive, raising the risk that expectations may already be stretched. Which lens do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astronics Narrative

If you would rather test the numbers and assumptions yourself, you can build a personalized take on Astronics in just a few minutes: Do it your way.

A great starting point for your Astronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move again, consider using targeted stock screeners that surface opportunities most investors may not notice until later.

- Explore emerging innovation by targeting early stage names using these 3588 penny stocks with strong financials that already show financial strength instead of just hype.

- Focus on the next wave of automation and intelligent software with these 27 AI penny stocks that combine growth potential with business traction.

- Seek potential bargains by reviewing these 907 undervalued stocks based on cash flows that still trade below what their cash flows suggest they may be worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com