Huigu New Materials Venture Capital's IPO passed the listing committee meeting to focus on the field of polymer materials

The Zhitong Finance App learned that on December 9, Guangzhou Huigu New Materials Technology Co., Ltd. (abbreviation: Huigu New Materials) passed the Shenzhen Stock Exchange GEM Listing Committee meeting. The sponsor of the IPO is CITIC Securities, which plans to raise 900 million yuan.

According to the prospectus, Huigu New Materials is a platform-based functional coating material company focusing on the field of polymer materials and driven by independent research and development. The main product system covers the two major categories of functional resins and functional coating materials. The company is committed to becoming the world's leading leader in technological innovation in functional materials.

The company's main business is R&D, production and sales of functional resins and functional coating materials. Using molecular structure design as the technical origin, the company is deeply involved in key technology research and industrial application of core functional resins, and has built two major technology platforms for functional resins and functional coating materials, and built a core competitive barrier.

Functional resins are key materials for functional coating materials and determine the basic properties of functional coating materials. Their design and scale-up production have high technical and process thresholds. Functional coating materials are coated on the surface of the substrate to give the substrate specific functions and are widely used in the fields of home appliances, packaging, new energy, electronics, etc. The products sold by the company are mainly functional coating materials.

Relying on the integration and collaboration of the dual technology platforms of functional resins and coating materials, closely integrated with the development context of the national economy and the demand map of key materials, the company successfully developed a coating material system with multiple characteristics such as optical control, electrical conductivity, mechanical enhancement, anti-corrosion and weather resistance, and has formed a “1+1+N” industrial layout system for the four major downstream application scenarios of home appliances, packaging, new energy, and electronics.

The company's main products have achieved a certain market position in their respective segments and have strong competitive advantages. In the field of energy-saving coating materials for heat exchangers and coating materials for aluminum covers for metal packaging, the company's domestic market share exceeds 60% and 30%, respectively.

All of the funds raised in this offering will be used for the development of the main business. After deducting the issuance fee, the funds raised will be used for the company's main business in order of priority. The basic situation is as follows:

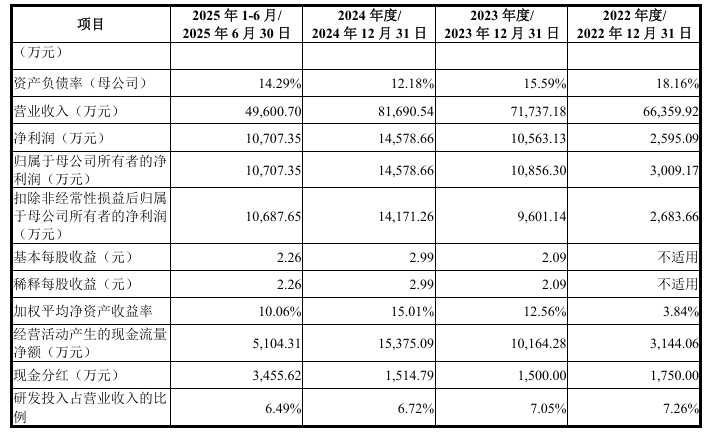

On the financial side, in 2022, 2023 and 2024, and January-June 2025, the company achieved operating revenue of approximately RMB 664 million, RMB 717 million, RMB 817 million, and RMB 496 million, respectively.

For the same period, the company's net profit was approximately RMB 259.509 million, RMB 106 million, RMB 146 million, and RMB 107 million, respectively.