Zscaler And 2 Other Growth Stocks Insiders Are Betting On

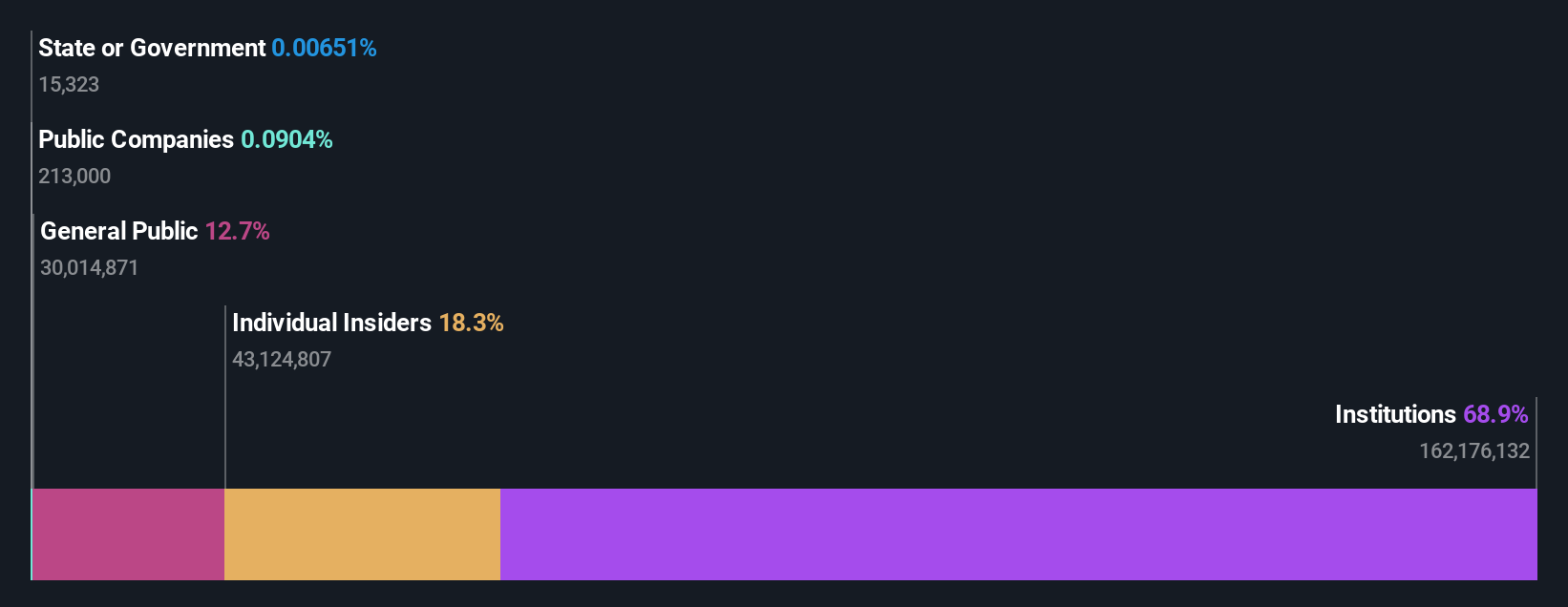

As the U.S. stock markets experience a pullback with major indices like the S&P 500 slipping after nearing record highs, investors are keenly watching the Federal Reserve's upcoming decision on interest rates. In such uncertain times, growth companies with high insider ownership can be appealing as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

We're going to check out a few of the best picks from our screener tool.

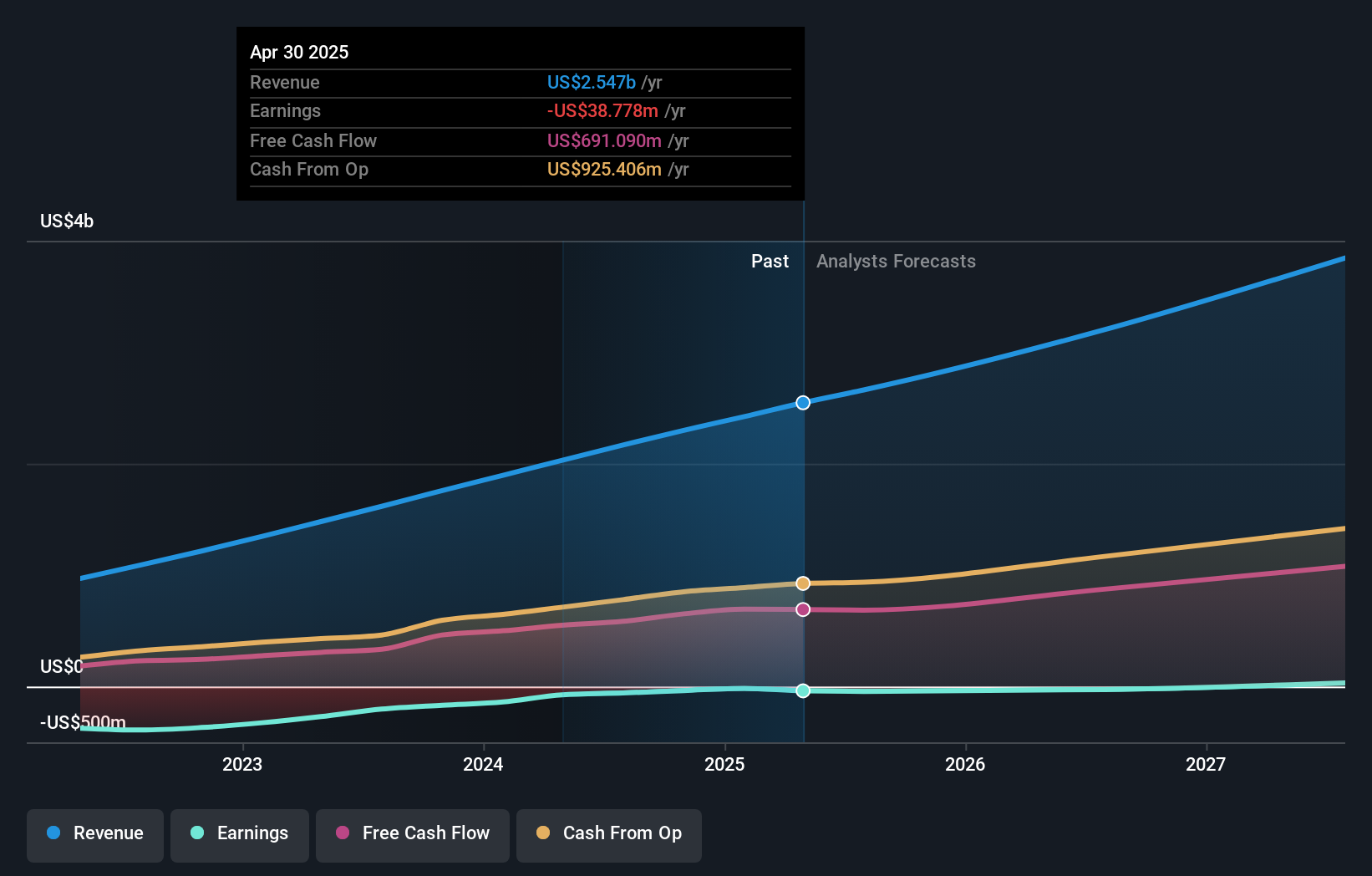

Zscaler (ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market cap of $38.70 billion.

Operations: Zscaler generates revenue primarily through the sales of subscription services to its cloud platform and related support services, amounting to $2.83 billion.

Insider Ownership: 35.4%

Revenue Growth Forecast: 15.8% p.a.

Zscaler, a leader in cloud-native cybersecurity, is experiencing substantial revenue growth, forecasted at 15.8% annually, surpassing the US market average. Despite recent insider selling and no significant insider buying in the past quarter, analysts anticipate a 34% stock price increase. Zscaler's strategic partnerships with companies like Peraton and Orca Security enhance its Zero Trust capabilities and digital transformation initiatives. The company expects to become profitable within three years while trading below estimated fair value by 15.1%.

- Take a closer look at Zscaler's potential here in our earnings growth report.

- According our valuation report, there's an indication that Zscaler's share price might be on the expensive side.

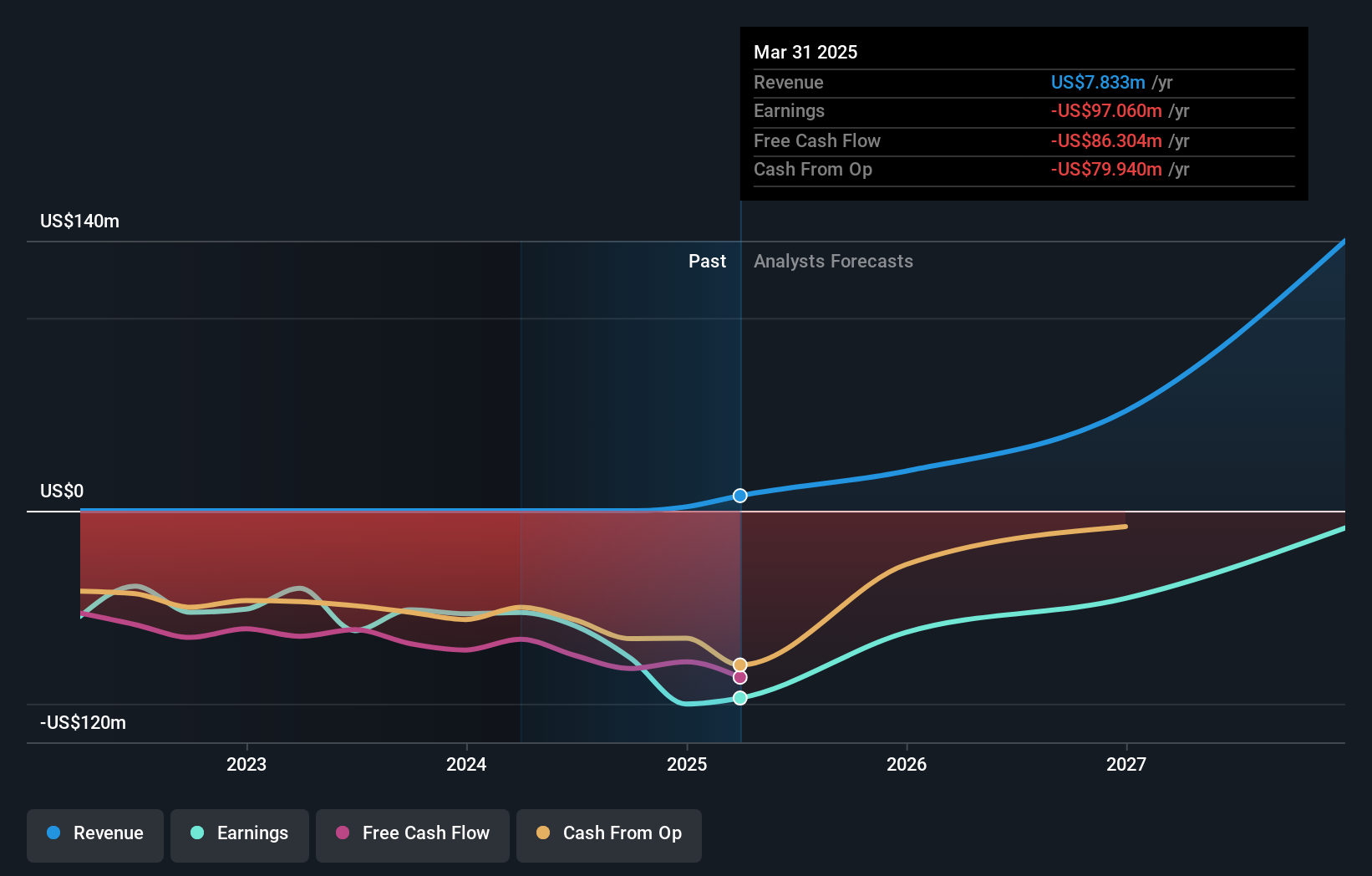

SES AI (SES)

Simply Wall St Growth Rating: ★★★★★★

Overview: SES AI Corporation develops and produces AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for various applications, including electric vehicles and drones, with a market cap of $766.65 million.

Operations: SES AI Corporation's revenue is derived from its development and production of advanced lithium metal and lithium-ion rechargeable battery technologies for applications such as electric vehicles, urban air mobility, drones, robotics, and battery energy storage systems.

Insider Ownership: 12%

Revenue Growth Forecast: 68.2% p.a.

SES AI is positioned for significant growth, with revenue expected to increase by 68.2% annually, outpacing the US market. The company aims to achieve profitability within three years, reflecting above-average market growth. Recent developments include a strategic joint venture with Hisun New Energy Materials and an expanded subscription model for its Molecular Universe platform. Despite a volatile share price and recent executive changes, SES AI's innovative approach in battery materials discovery could drive future success.

- Click here to discover the nuances of SES AI with our detailed analytical future growth report.

- The analysis detailed in our SES AI valuation report hints at an inflated share price compared to its estimated value.

Zeta Global Holdings (ZETA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $4.69 billion.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, which generated $1.22 billion.

Insider Ownership: 15.8%

Revenue Growth Forecast: 17.4% p.a.

Zeta Global Holdings is poised for growth, with revenue projected to outpace the US market at 17.4% annually. The company expects to achieve profitability within three years, and its Return on Equity is forecasted at 31%. Recent developments include increased earnings guidance and the introduction of Athena by Zeta™, an AI-driven platform enhancing marketing efficiency. Despite a recent follow-on equity offering, Zeta's strategic acquisitions and innovative product launches underscore its growth potential in a competitive landscape.

- Unlock comprehensive insights into our analysis of Zeta Global Holdings stock in this growth report.

- Our valuation report here indicates Zeta Global Holdings may be undervalued.

Make It Happen

- Discover the full array of 203 Fast Growing US Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com