Undervalued Small Caps With Insider Buying Across Regions

As the U.S. stock market faces volatility with major indices like the S&P 500 pulling back amid anticipation of a Federal Reserve decision on interest rates, small-cap stocks are drawing attention for their potential resilience and growth opportunities. In such an environment, identifying small-cap companies that may be undervalued can offer intriguing prospects, particularly when insider buying signals confidence in the company's future performance.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Blue Bird | 12.5x | 1.1x | 46.52% | ★★★★★★ |

| Shore Bancshares | 10.4x | 2.8x | 41.00% | ★★★★★☆ |

| Wolverine World Wide | 16.4x | 0.8x | 39.71% | ★★★★★☆ |

| Peoples Bancorp | 10.5x | 1.9x | 44.24% | ★★★★★☆ |

| First United | 10.1x | 3.0x | 44.36% | ★★★★★☆ |

| Metropolitan Bank Holding | 12.6x | 3.1x | 30.59% | ★★★★☆☆ |

| Citizens & Northern | 13.5x | 3.3x | 32.03% | ★★★☆☆☆ |

| CNB Financial | 18.1x | 3.4x | 45.75% | ★★★☆☆☆ |

| Farmland Partners | 6.5x | 8.1x | -93.46% | ★★★☆☆☆ |

| Vestis | NA | 0.4x | -19.04% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

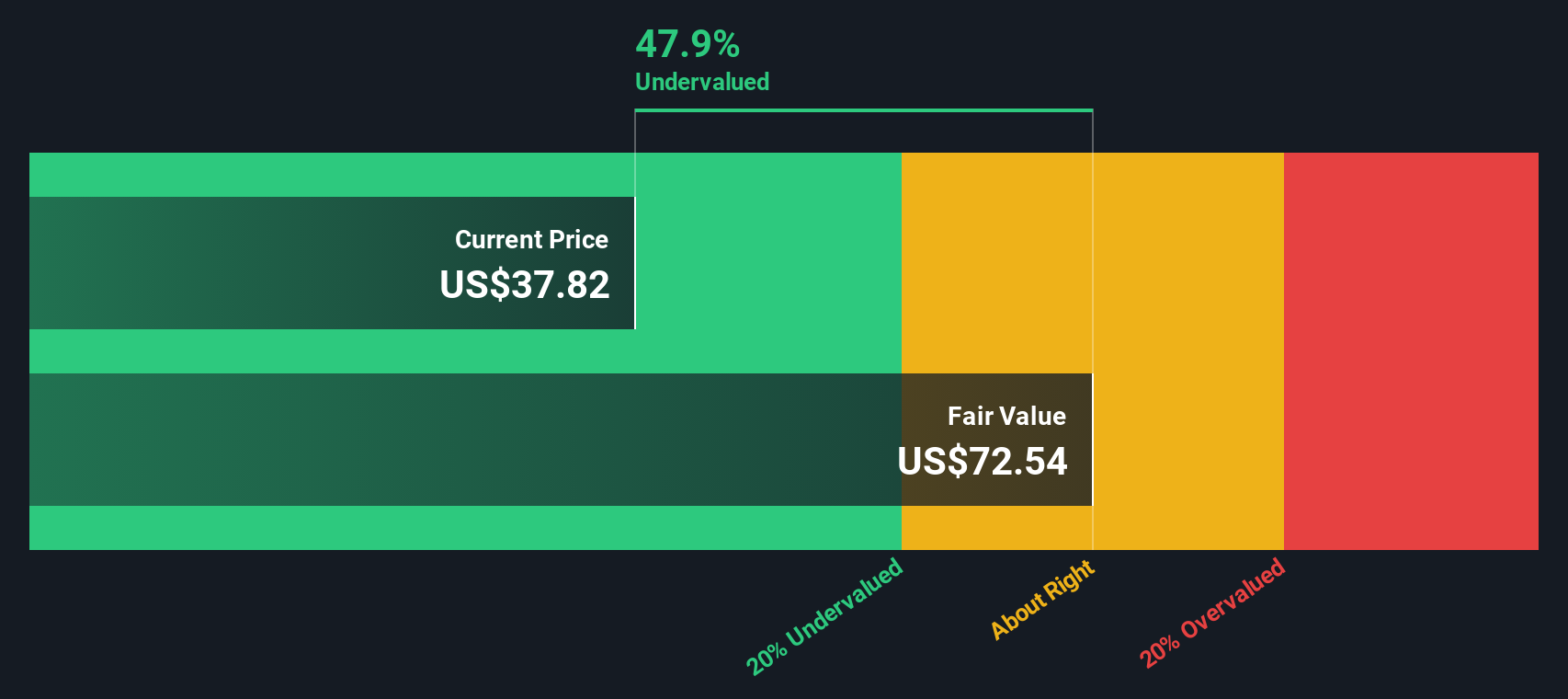

Orrstown Financial Services (ORRF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orrstown Financial Services operates as a community bank providing financial services and products, with a focus on community banking, and has a market capitalization of approximately $0.21 billion.

Operations: The company generates revenue primarily from community banking, with a recent quarterly revenue of $247.30 million. Operating expenses have shown an upward trend over time, reaching $134.55 million in the latest period, largely driven by general and administrative expenses totaling $116.16 million. The net income margin has fluctuated significantly across periods, recently recorded at 29.54%.

PE: 10.0x

Orrstown Financial Services, a smaller company in the financial sector, has shown significant improvement with a net income of US$21.87 million for Q3 2025, reversing last year's net loss. Insider confidence is evident as they purchased shares recently. The company completed its share buyback program and declared a US$0.27 dividend per share for November 2025. Despite past challenges, earnings are projected to grow annually by 6.55%, indicating potential value for investors seeking growth opportunities in this segment.

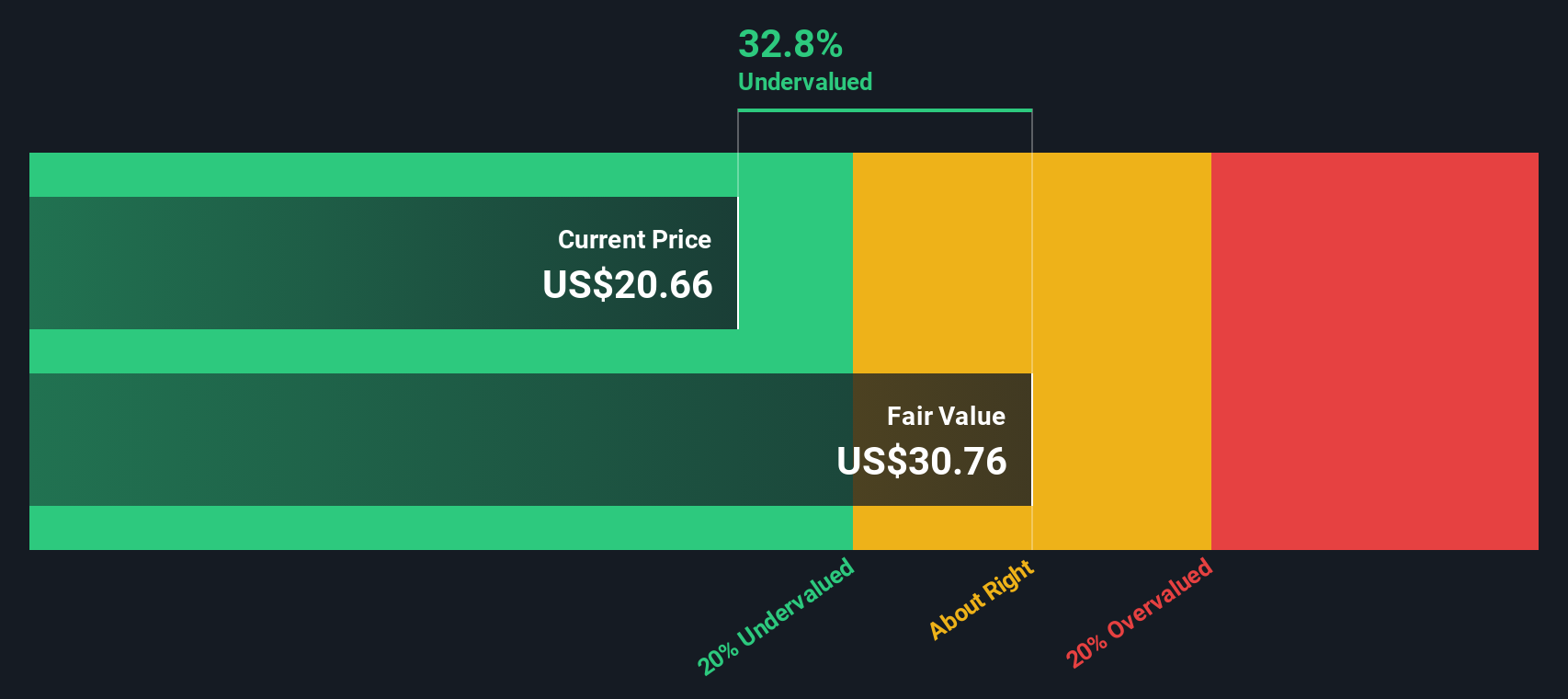

Capital Southwest (CSWC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Capital Southwest is a business development company that primarily focuses on providing financing solutions to support the growth and acquisition needs of middle-market companies, with a market capitalization of approximately $0.5 billion.

Operations: The company primarily generates revenue from its investment activities, with the most recent quarterly revenue reported at $217.27 million. Operating expenses for the same period were $30.18 million, contributing to a net income of $85.17 million and a net income margin of 39.20%. Gross profit margins consistently stood at 100% over multiple periods, indicating no direct cost of goods sold affecting its gross profit figures.

PE: 14.9x

Capital Southwest, a smaller company in the U.S. market, recently reported second-quarter revenue of US$56.95 million, up from US$48.71 million the previous year, reflecting growth potential despite challenges like shareholder dilution and reliance on external borrowing for funding. Earnings are forecasted to grow 25.9% annually, suggesting future opportunities for investors seeking undervalued stocks with growth prospects. Notably, insider confidence is evident as they continue purchasing shares, indicating belief in the company's trajectory amidst recent dividend affirmations and special dividends announced for early 2026.

- Take a closer look at Capital Southwest's potential here in our valuation report.

Assess Capital Southwest's past performance with our detailed historical performance reports.

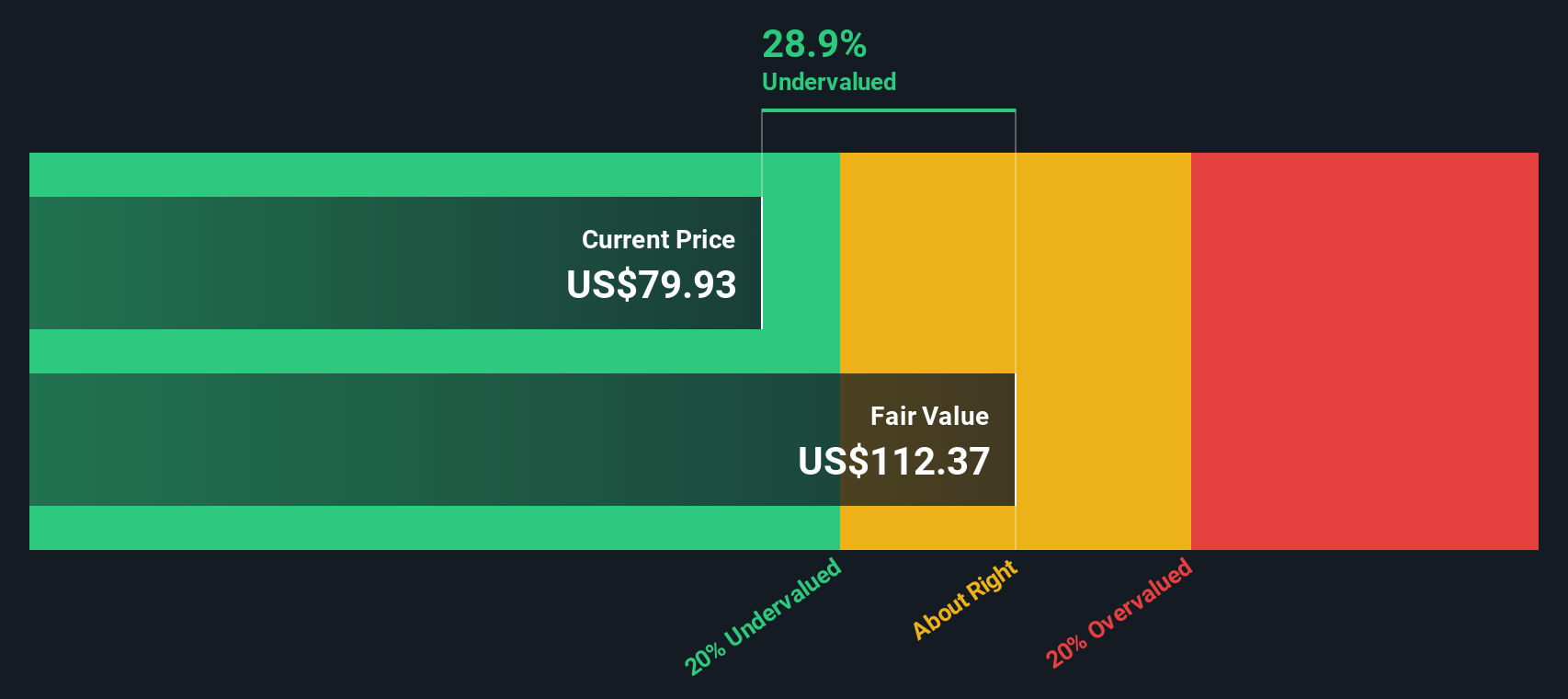

Metropolitan Bank Holding (MCB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Metropolitan Bank Holding is a financial institution primarily engaged in providing banking services, with a market capitalization of $0.34 billion.

Operations: MCB generates revenue primarily from its banking operations, with a recent quarterly figure of $261.46 million. The company's gross profit margin consistently stands at 100%, indicating no cost of goods sold is reported in financials. Operating expenses are a significant component, with general and administrative expenses reaching $135.87 million in the latest quarter, impacting net income margins which have shown variability over time, recently recorded at 24.35%.

PE: 12.6x

Metropolitan Bank Holding, a small cap in the U.S., has shown insider confidence with recent share purchases. From July to September 2025, they repurchased 39,166 shares for US$2.71 million. Despite a drop in net income to US$7.12 million in Q3 2025 from US$12.27 million the previous year, net interest income increased to US$77.31 million from US$65.23 million. With earnings projected to grow by 26% annually, this bank could present an intriguing opportunity amidst its evolving financial landscape and strategic leadership changes like Anthony J. Fabiano's appointment as Chairman of the Board.

Make It Happen

- Click through to start exploring the rest of the 71 Undervalued US Small Caps With Insider Buying now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com