Carpenter Technology (CRS): Revisiting Valuation After a Powerful Multi‑Year Share Price Run

Carpenter Technology (CRS) has quietly turned into one of those stocks investors revisit after a strong run, with shares up sharply over the past year and momentum still shaped by solid earnings growth.

See our latest analysis for Carpenter Technology.

The stock’s 75.65% year to date share price return and a 5 year total shareholder return above 1,000% suggest momentum is still firmly building, even after some recent consolidation around the 308.26 dollar level.

If Carpenter’s run has you rethinking what else might be compounding quietly in the background, now is a good moment to explore fast growing stocks with high insider ownership.

With earnings rising, a premium valuation and analysts still seeing upside to their price targets, the real puzzle now is whether Carpenter remains underappreciated value or if the market is already pricing in years of future growth.

Most Popular Narrative: 19.4% Undervalued

With the narrative fair value sitting well above the recent 308.26 dollar close, the valuation case leans on sustained growth and rising profitability.

The brownfield expansion project is set to add high purity melt capacity, allowing Carpenter to further leverage the industry supply demand imbalance over the medium to long term; this will support higher volumes and sustained pricing power, translating into increased revenue and operating income beginning FY28.

If you want to see what kind of revenue climb and margin reset this assumes, and why the future earnings multiple stretches beyond industry norms, you can dive into the full narrative.

Result: Fair Value of $382.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if aerospace demand stumbles or the $400 million brownfield expansion overruns budgets and fails to earn adequate returns.

Find out about the key risks to this Carpenter Technology narrative.

Another Way to Look at Valuation

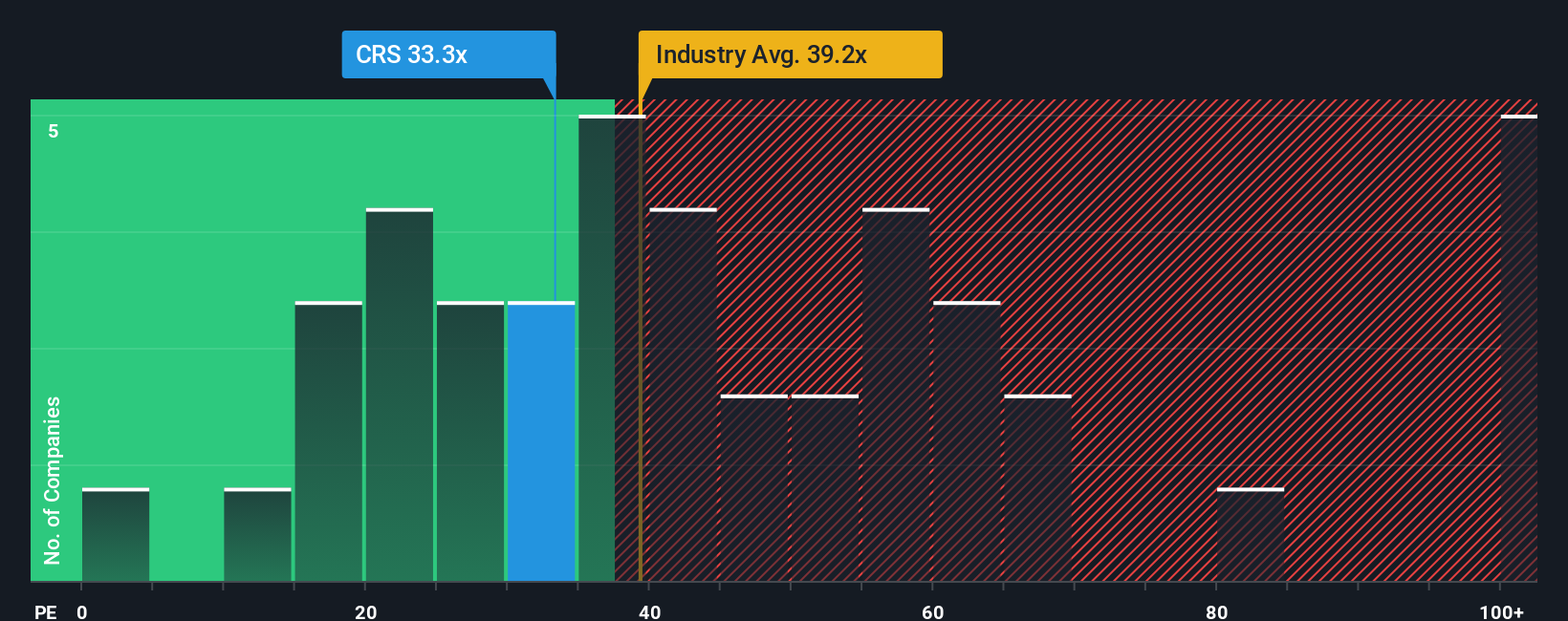

Step away from narratives and analyst targets and Carpenter looks pricey. Its 37.1x earnings multiple sits above its 32.2x fair ratio, slightly richer than both peers at 35.5x and the wider aerospace and defense group at 37x. Is the premium a cushion or a cliff edge if growth cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Carpenter Technology Narrative

If this perspective does not quite match your own, or you simply prefer digging into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your Carpenter Technology research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction opportunities?

Do not stop at Carpenter when the Simply Wall St Screener can quickly surface fresh, data backed ideas that could reshape your portfolio’s next leg of returns.

- Capitalize on mispriced quality by scanning these 909 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow fundamentals.

- Supercharge your growth exposure with these 27 AI penny stocks positioned at the heart of artificial intelligence innovation and adoption.

- Lock in reliable income potential from these 15 dividend stocks with yields > 3% offering attractive yields above 3 percent backed by solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com