Assessing USA Compression Partners (USAC) Valuation After Recent Pullback and Strong One-Year Total Return

USA Compression Partners (USAC) has quietly outperformed many income names over the past year, with units up about 16% while continuing to throw off a hefty cash distribution for investors.

See our latest analysis for USA Compression Partners.

The unit price has cooled a bit in recent days, with a roughly 4 percent 7 day share price pullback after a solid 3 month share price return. Yet the 1 year total shareholder return above 15 percent shows momentum is still very much intact.

If USAC’s steady income profile appeals to you, this might be a good moment to broaden your search and explore fast growing stocks with high insider ownership as potential next wave candidates.

With units still yielding robust income and trading at a modest discount to analyst targets, the key question now is whether USAC’s impressive run still leaves upside on the table or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 8.6% Undervalued

Compared to the last close of $24.21, the most popular narrative sees fair value closer to the mid 26 dollar range, implying modest upside if its assumptions hold.

Continued focus on high spec, large horsepower assets for rich shale plays together with a record backlog of RFQs and tight fleet utilization supports future price increases and resilience in both revenue and margins, even in periods of macroeconomic softness.

Curious how steady contract renewals, rising profitability and a richer earnings mix can justify a higher valuation for a midstream services name? The narrative leans on faster growing profits, expanding margins and a future earnings multiple that usually sits with market darlings, not pipeline workhorses. Want to see exactly how those moving parts combine into today’s fair value call?

Result: Fair Value of $26.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated customer exposure and rising capex and labor costs could quickly pressure margins and cash flows if contract pricing power weakens.

Find out about the key risks to this USA Compression Partners narrative.

Another Lens on Value

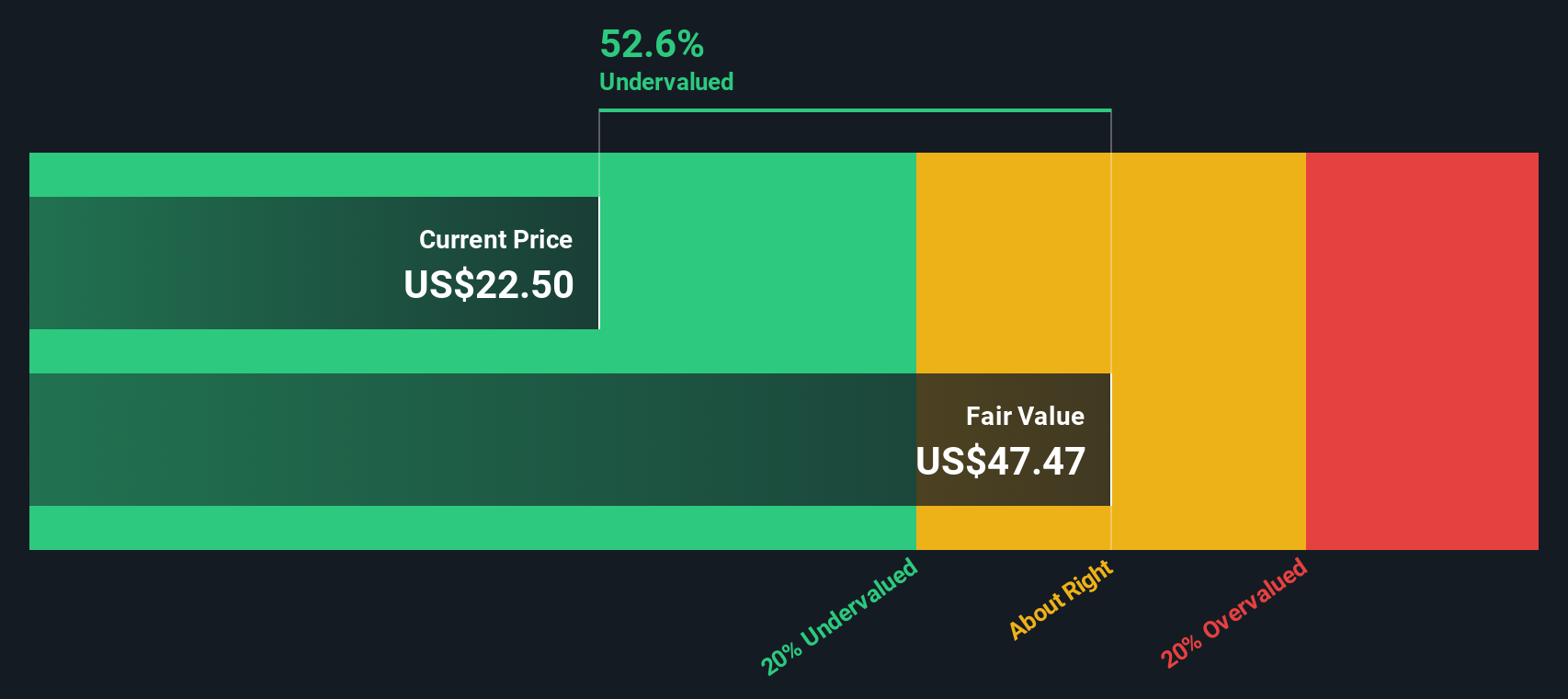

Our DCF model paints a very different picture, suggesting fair value sits closer to $11.78, which would make USAC look materially overvalued versus today's $24.21 unit price. Are analysts leaning too heavily on growth and margin optimism, or is the model overly strict?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out USA Compression Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own USA Compression Partners Narrative

If you see the story differently or prefer digging into the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your USA Compression Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work so you do not miss the next opportunity that fits your strategy.

- Capture early stage growth potential by targeting these 3595 penny stocks with strong financials that already show stronger balance sheets and improving fundamentals.

- Position your portfolio for the next productivity revolution by focusing on these 27 AI penny stocks shaping breakthroughs in automation, analytics and intelligent software.

- Lock in compelling value opportunities by zeroing in on these 909 undervalued stocks based on cash flows where prices still trail underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com