Yext (YEXT) Valuation After Q3 Profit Turnaround and Slower Revenue Growth

Yext (YEXT) just posted third quarter results that flipped last year’s loss into a profit, even as revenue dipped slightly, which puts the stock at an interesting crossroads for investors.

See our latest analysis for Yext.

That swing back to profitability seems to be nudging sentiment in Yext’s favor, with the share price at $8.82 and a year to date share price return of roughly 35 percent. The 1 year total shareholder return of about 25 percent shows momentum building but still recovering from a much weaker 5 year total shareholder return.

If Yext’s move back into the black has you rethinking the software space, it could be a good moment to discover high growth tech and AI stocks.

With Yext now profitable, trading near analysts’ targets, and still at a sizable intrinsic discount, the key question is whether the market is overlooking its improving fundamentals or already pricing in the next leg of growth.

Most Popular Narrative Narrative: 6.5% Undervalued

With Yext closing at $8.82 against a most popular narrative fair value near $9.44, the story leans modestly positive and hinges on future growth drivers.

Analysts expect the number of shares outstanding to decline by 4.32% per year for the next 3 years.

To value all of this in today's terms, we will use a discount rate of 8.65%, as per the Simply Wall St company report.

Curious how steady mid single digit growth, sharply rising margins, and shrinking share count can still justify a premium style earnings multiple for Yext? The narrative lays out a step by step roadmap of how those moving parts might translate into much higher profits than today, and why that projection could make today’s valuation look surprisingly reasonable.

Result: Fair Value of $9.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure from low cost rivals and uncertainty around monetizing new AI products could weaken the otherwise upbeat narrative on growth and margins.

Find out about the key risks to this Yext narrative.

Another Way to Look at Value

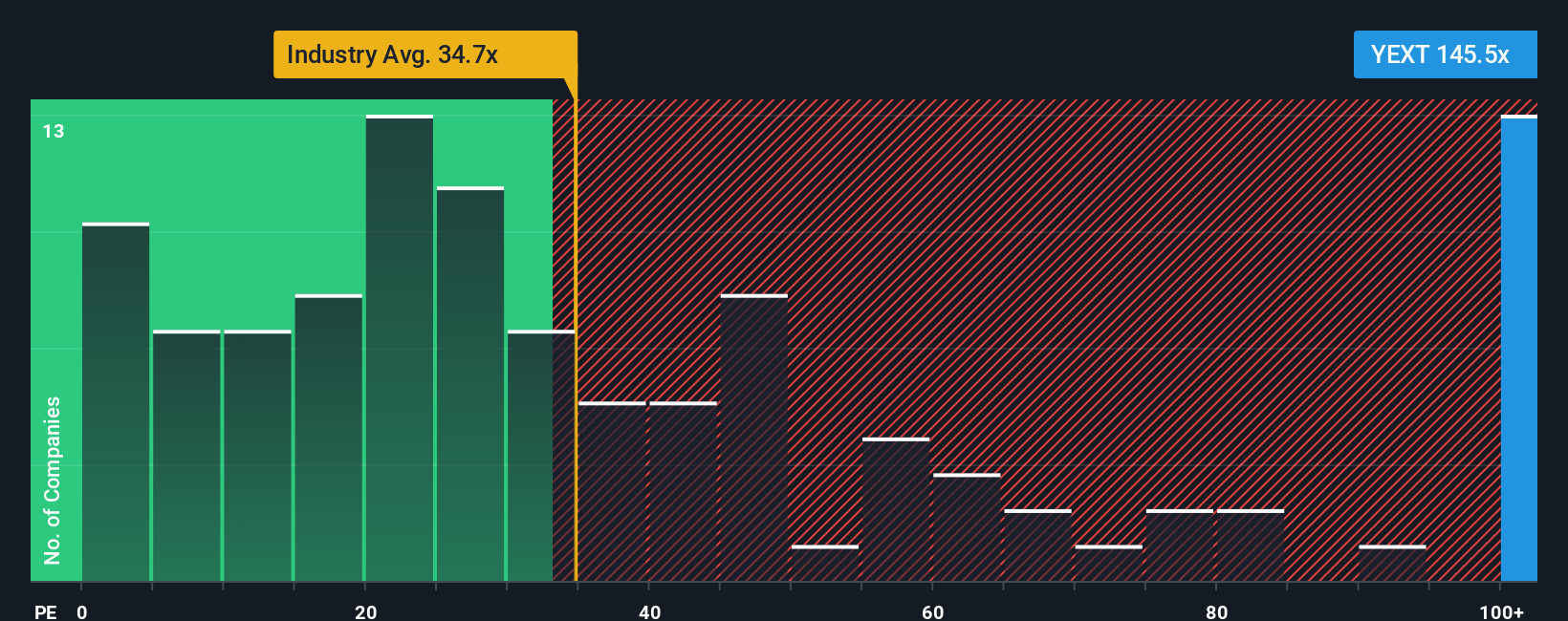

On earnings, the picture is far less forgiving. Yext trades at about 146 times earnings versus roughly 31 times for the US software industry and a fair ratio near 37 times. That gap points to real de rating risk if growth stumbles, so is the narrative premium worth paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yext Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with Yext when the market is full of opportunities your portfolio deserves. Let Simply Wall St’s powerful screener help uncover your next edge.

- Capture potential bargain opportunities early by targeting companies trading below intrinsic value using these 909 undervalued stocks based on cash flows.

- Ride the next wave of intelligent automation and data disruption by focusing on innovators featured in these 27 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers highlighted in these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com