Occidental Petroleum (OXY): Revisiting Valuation After J.P. Morgan Downgrade and Leverage Concerns

Occidental Petroleum (OXY) just saw its shares slip after J.P. Morgan cut its rating, citing stretched valuation and heavier leverage, a shift that has clearly cooled investor appetite in the near term.

See our latest analysis for Occidental Petroleum.

The downgrade comes after a tougher stretch, with Occidental Petroleum’s share price return down sharply year to date and its three year total shareholder return still negative. However, the five year total shareholder return remains robust, suggesting longer term holders are still ahead overall while near term momentum is clearly fading.

If this shift in sentiment has you rethinking your energy exposure, it could be a good moment to see what else is working in the sector through aerospace and defense stocks.

With the stock trading below consensus targets but still carrying leverage and cash flow questions, is Occidental Petroleum now a contrarian value play, or is the market already pricing in all the growth ahead?

Most Popular Narrative Narrative: 17.6% Undervalued

Occidental Petroleum's most followed narrative sees fair value meaningfully above the last close of $41.36, framing a notable gap between price and projected fundamentals.

The company's accelerated expansion and commercialization of carbon capture, including imminent operational start of the STRATOS Direct Air Capture facility and newly contracted CDR volumes through 2030, positions Occidental to monetize carbon management via government incentives (for example, 45Q credits) and growing CDR demand, supporting incremental, high margin revenue and improved net margins.

Curious how modest top line assumptions, rising margins and a richer future earnings multiple combine into that upside case? The full narrative lays out the math.

Result: Fair Value of $50.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case hinges on oil prices holding up and Occidental successfully commercializing carbon capture, both of which could disappoint if policy or demand shifts.

Find out about the key risks to this Occidental Petroleum narrative.

Another Take on Valuation

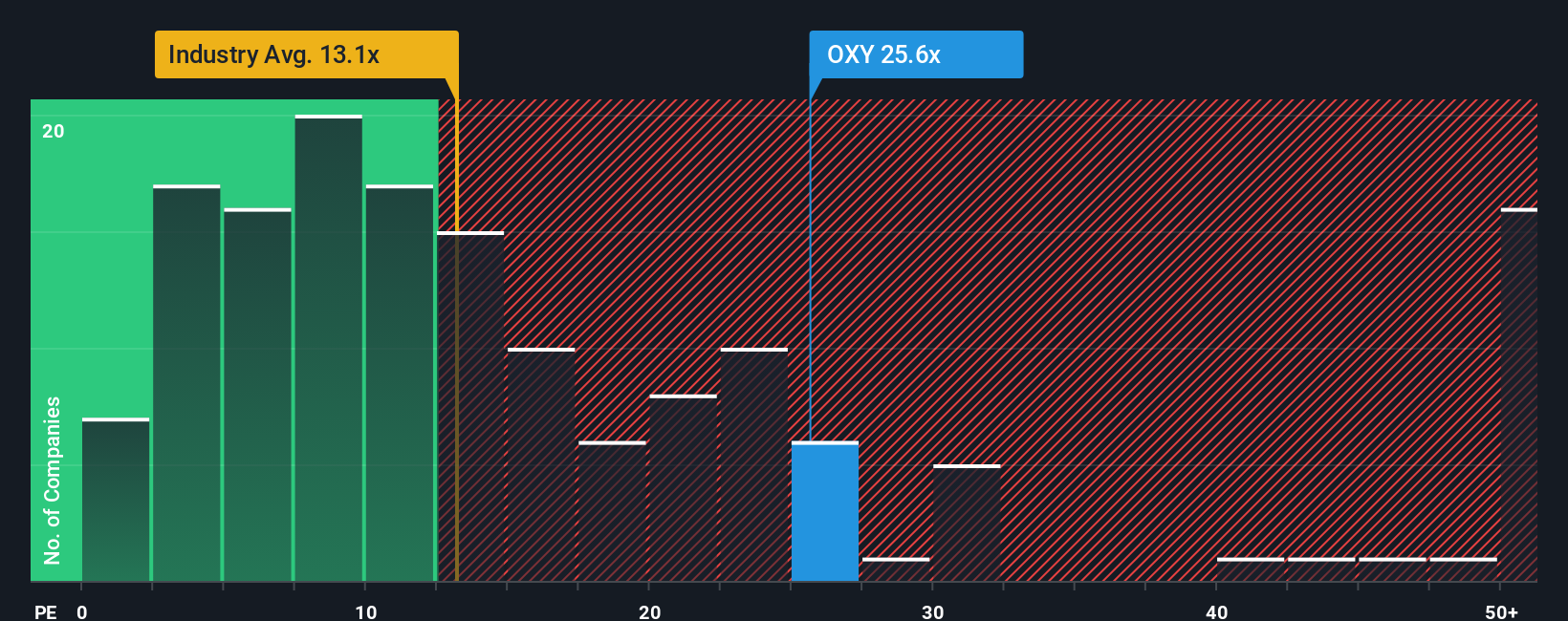

While the narrative suggests upside to around $50 per share, our valuation checks using the price to earnings ratio paint a tougher picture. OXY trades on 27.9x earnings, well above the US oil and gas industry at 13.5x and our fair ratio of 19.4x. This implies meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Occidental Petroleum Narrative

If you see the story differently, or want to test your own assumptions against the numbers, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Occidental Petroleum research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall Street Screener to identify opportunities that match your strategy so you are not leaving potential returns on the table.

- Explore these 15 dividend stocks with yields > 3% to find companies that are currently paying dividend yields above 3%, which may help you build an income-focused portfolio.

- Use these 909 undervalued stocks based on cash flows to look for potentially mispriced companies that may be trading below their estimated intrinsic value.

- Review these 27 AI penny stocks to see businesses that are using artificial intelligence in ways that could influence how entire industries operate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com