GATX (GATX): Assessing Valuation After a Steady Share Price Climb

GATX (GATX) has quietly pushed higher this month, building on a long track record in railcar and engine leasing that tends to matter more than daily price swings for long term investors.

See our latest analysis for GATX.

With the share price now around $165.44 and a solid year to date share price return, that three and five year total shareholder return track record suggests momentum is still gently building rather than fading for patient holders.

If GATX’s steady climb has you thinking about what else might compound quietly in the background, it could be worth exploring fast growing stocks with high insider ownership as a fresh source of ideas.

With earnings still growing and the share price sitting at a modest discount to analyst targets, the question now is whether GATX remains quietly undervalued or if the market is already pricing in its future growth.

Most Popular Narrative: 12.3% Undervalued

Compared with the last close at $165.44, the most widely followed narrative points to a higher fair value, leaning on steady growth in GATX’s core leasing markets.

Ongoing shift toward rail for bulk, intermodal, and long haul transportation due to its efficiency and sustainability advantages is preserving robust leasing demand and bolstering fleet utilization, which should underpin stable or increasing lease rates and boost earnings.

Curious how this demand story turns into upside on paper? The narrative relies on rising margins, faster revenue growth, and a richer future earnings multiple. Want to see how far those assumptions stretch?

Result: Fair Value of $188.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed customer decisions in Europe and flattish North American renewal rates could easily cool that upside if macro conditions stay weak.

Find out about the key risks to this GATX narrative.

Another View: Market Ratio Signals Less Upside

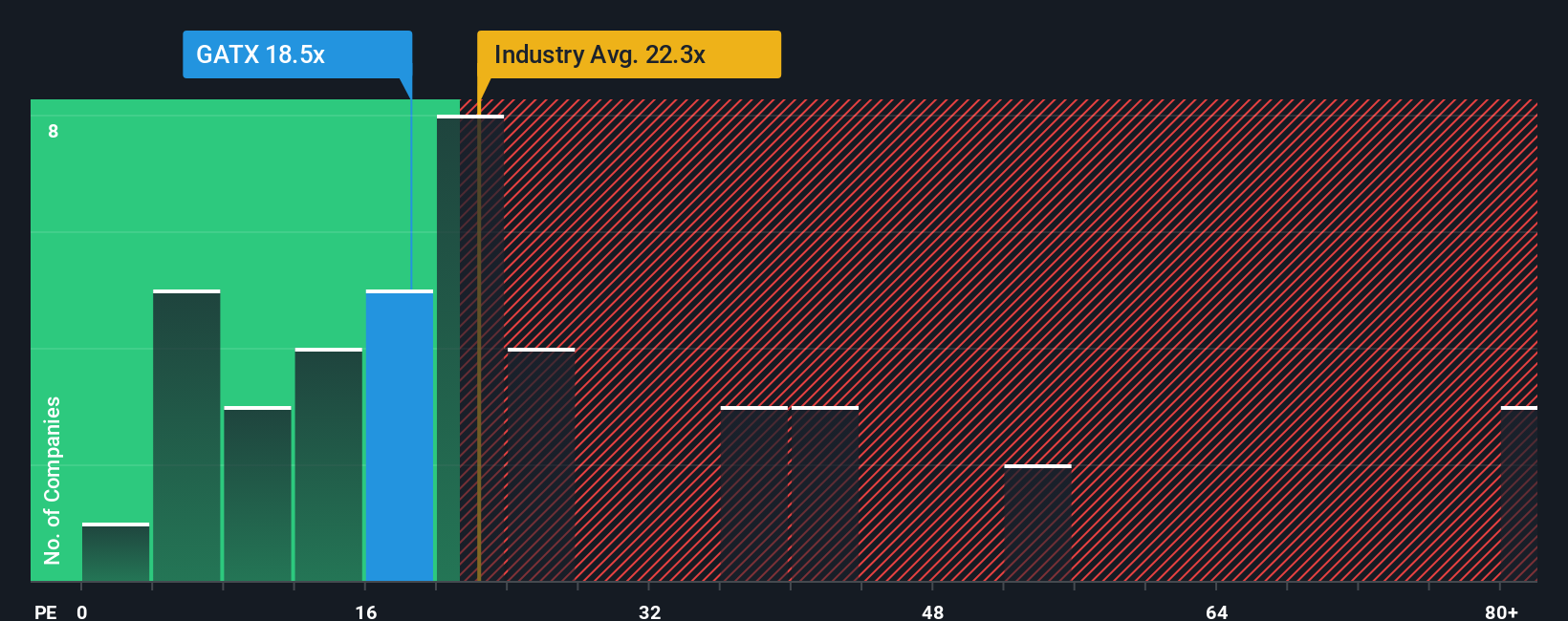

While the narrative points to roughly 12% upside, today’s valuation ratios look less generous. GATX trades on a 19.2x price to earnings, below both peers at 21.5x and its own fair ratio of 21.3x. This hints at only moderate mispricing and a tighter margin of safety.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GATX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GATX Narrative

If you see the story unfolding differently, or simply want to stress test the assumptions yourself, you can build your own view in minutes: Do it your way.

A great starting point for your GATX research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few more potential winners using the Simply Wall St Screener so new opportunities never slip past your radar again.

- Capture potential bargain opportunities by targeting companies trading below their intrinsic value through these 909 undervalued stocks based on cash flows and position yourself ahead of a re rating.

- Capitalize on innovation at the frontier of computing by using these 28 quantum computing stocks to focus on businesses shaping next generation processing power.

- Strengthen your portfolio’s income engine by screening for reliable payout candidates with these 15 dividend stocks with yields > 3% and avoid missing stocks offering healthier yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com