Is Palantir (PLTR) Quietly Repositioning Its AI Platform From Defense Specialist To Infrastructure Backbone?

- In recent days, Northslope, Teton Ridge, and other partners have deepened their work with Palantir, while the company unveiled its Chain Reaction operating system to tackle AI’s power and compute bottlenecks across energy, grid, and data-center infrastructure, alongside expanding real-time AI collaborations with NVIDIA.

- These moves highlight how Palantir is pushing its AI platforms into both niche arenas like rodeo sports and mission-critical infrastructure, widening the range of problems its software is being used to solve.

- With these developments and Palantir’s new Chain Reaction platform in focus, we’ll explore how they reshape the company’s long-term investment narrative.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is Palantir Technologies' Investment Narrative?

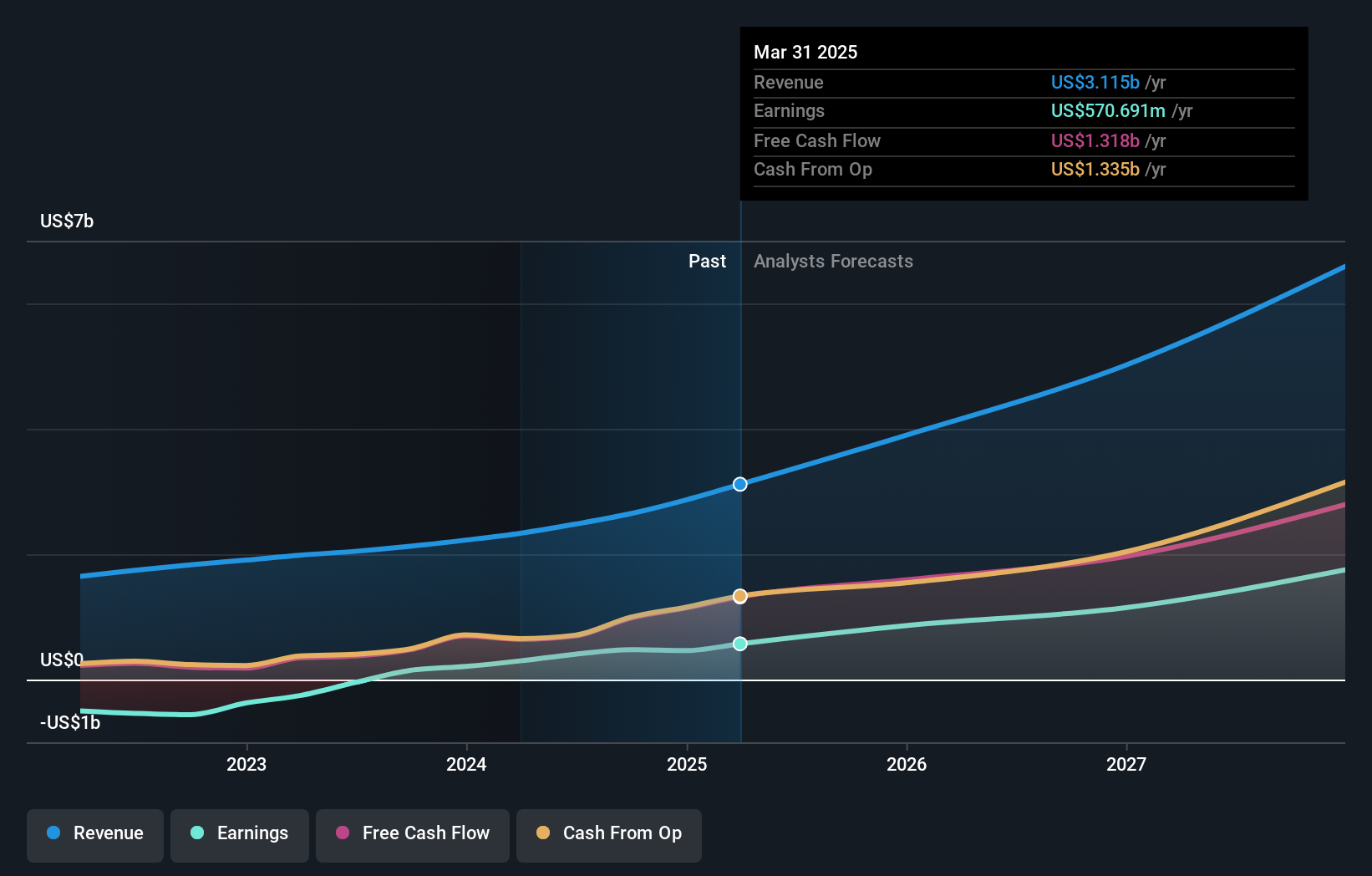

To own Palantir today, you really have to believe its AI platforms can keep scaling from high-stakes government work into broad commercial adoption without the story being derailed by valuation or execution risk. The latest Teton Ridge and Northslope announcements, together with the Chain Reaction launch, reinforce the bull case that Palantir’s software can sit at the center of both niche, high-visibility use cases and core infrastructure like power and data centers. In the short term, the key catalysts still look tied to sustaining very strong U.S. commercial growth and landing large, repeatable deployments of AIP and now Chain Reaction. These announcements support that narrative but may not be individually material given how much optimism is already in the share price, which makes any stumble on growth or margins more exposed.

However, Palantir’s rich valuation means execution risks could have an outsized impact for shareholders. Palantir Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Across 160 Simply Wall St Community fair values for Palantir, estimates span roughly US$66 to almost US$700 per share, underscoring just how far apart individual views are. When you set that against a business priced richly on traditional metrics and now leaning heavily on AI infrastructure bets like Chain Reaction, it becomes even more important to weigh several perspectives before deciding how resilient you think this story really is.

Explore 160 other fair value estimates on Palantir Technologies - why the stock might be worth less than half the current price!

Build Your Own Palantir Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palantir Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Palantir Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palantir Technologies' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com