Dai Nippon Printing (TSE:7912): Valuation Check After 10nm NIL Breakthrough Challenges Costly EUV Lithography

Dai Nippon Printing (TSE:7912) just caught semiconductor investors attention with a new nanoimprint lithography template that patterns circuits at 10 nanometers, a potential alternative to more expensive, power hungry EUV tools.

See our latest analysis for Dai Nippon Printing.

The announcement lands after a steady rerating, with a 17.5% year to date share price return and a powerful 203% five year total shareholder return suggesting momentum has been quietly building rather than fading.

If this NIL breakthrough has you thinking more broadly about semiconductor and chip supply chains, now is a smart moment to scout high growth tech and AI stocks for other potential beneficiaries.

With shares already up strongly and trading only modestly below analyst targets, does the market still underestimate DNPs earnings power from NIL, or has the stock quietly baked in years of future growth?

Price-to-Earnings of 14.2x: Is it justified?

Our DCF model estimates Dai Nippon Printing's fair value at approximately ¥3,798 per share, well above the last close of ¥2,628, implying material undervaluation.

The SWS DCF model projects the company’s future cash flows and then discounts them back to today using a required rate of return, effectively turning long term expectations into a single present value per share. By comparing this projection to the current market price, it highlights where investors may be underestimating or overestimating the cash the business can realistically generate.

For a mature, diversified group with modest forecast earnings growth of just over 2% a year and revenue growth below the broader Japanese market, a sizeable DCF gap suggests either the market doubts those cash flows will materialise, or it is applying a heavier risk penalty than the model. Yet with high quality earnings over time and a long operating history in printing, packaging and electronics related components, the DCF output points to a scenario where the share price could drift closer to intrinsic value as NIL and other electronics initiatives scale.

Look into how the SWS DCF model arrives at its fair value.

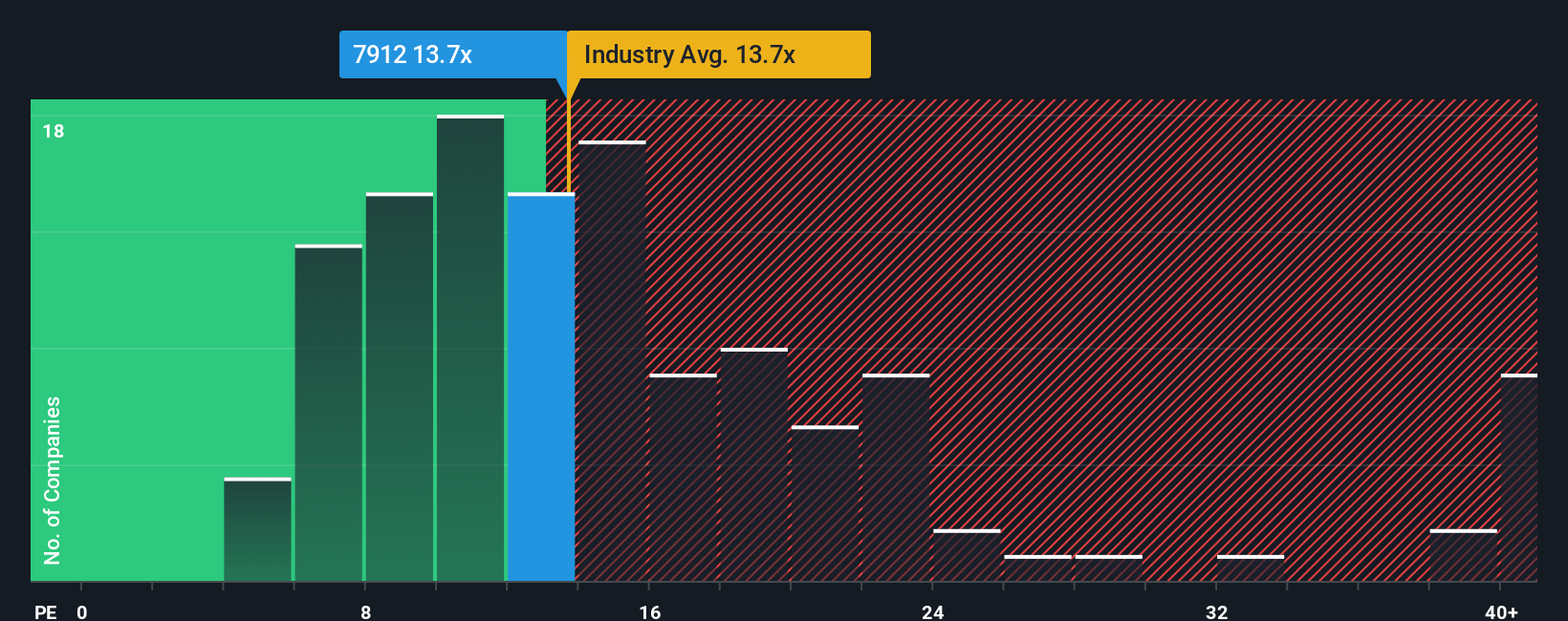

At the same time, Dai Nippon Printing trades on a price to earnings ratio of 14.2x, only slightly above the wider JP Commercial Services industry average of 14x but noticeably below a peer group average of 18.4x and an estimated fair P E ratio of 21.5x. For investors, that mix hints at a business the market still prices at a discount to what its earnings profile and fundamentals might justify.

The price to earnings multiple measures how much investors are willing to pay today for each unit of current earnings, a critical reference point for a company like Dai Nippon Printing where profitability and free cash generation underpin long term returns. In this case, the multiple sits in a middle ground, neither screamingly cheap nor obviously euphoric. This places more weight on how sustainably the company can defend and grow earnings from its core printing and materials franchises while layering in higher value electronics exposure.

Compared with the broader Commercial Services industry, trading a touch above the 14x sector average suggests the market acknowledges some premium characteristics. Yet the gap to both peers and the SWS fair ratio implies investors have not fully credited the earnings power that could emerge if margins recover from last year’s compression and NIL related demand proves durable. If the company delivers on even modest profit growth while maintaining high quality earnings, the multiple has room to migrate toward the higher fair ratio level rather than compress.

Explore the SWS fair ratio for Dai Nippon Printing

Result: Price-to-Earnings of 14.2x (UNDERVALUED)

However, slower than expected NIL adoption or renewed margin pressure in legacy printing and packaging could quickly erode the valuation upside implied by current models.

Find out about the key risks to this Dai Nippon Printing narrative.

Another View: Multiples Point to a Tighter Margin of Safety

While our DCF work hints at upside, the 14.2x earnings multiple tells a cooler story. It sits almost exactly on the 14x industry average, well below peers at 18.4x and the 21.5x fair ratio. Is this a sensible caution given DNP’s slow 2% profit growth, or a chance to buy before sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dai Nippon Printing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dai Nippon Printing Narrative

If you see the numbers differently or simply want to stress test these assumptions yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Dai Nippon Printing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next high conviction idea?

Before markets move on without you, use the Simply Wall Street Screener to uncover focused opportunities that match your style, risk appetite and return goals.

- Capture potential multi baggers early by targeting growth at the smaller end of the market through these 3593 penny stocks with strong financials with robust underlying fundamentals.

- Position your portfolio for the next wave of innovation by zeroing in on these 27 AI penny stocks where real revenue meets scalable artificial intelligence.

- Strengthen your margin of safety by pinpointing these 909 undervalued stocks based on cash flows that trade below their estimated cash flow based worth before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com