Valuation Check on National Storage REIT (ASX:NSR) After Its Recent Strong Share Price Run

National Storage REIT (ASX:NSR) has quietly put together an impressive run, with the stock climbing about 23% over the past month and 24% over the past year, comfortably outpacing the broader market.

See our latest analysis for National Storage REIT.

That strong 30 day share price return sits on top of a solid year of compounding gains, with a 12 month total shareholder return in the mid 20s suggesting momentum is still building as investors warm to its growth and income mix around A$2.79.

If National Storage REIT has you thinking about what else is working in today’s market, it could be a good time to explore fast growing stocks with high insider ownership.

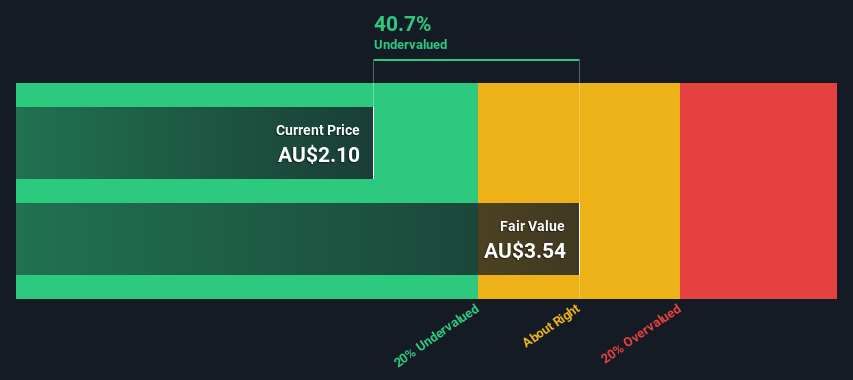

With the share price now hovering around analyst targets but still trading at a sizeable discount to some intrinsic estimates, investors face a key question: is there still a buying opportunity here, or is the market already pricing in future growth?

Price to Earnings of 142.4x: Is it justified?

On a headline basis, National Storage REIT looks richly priced, with its recent A$2.79 close equating to a 142.4x price to earnings multiple that is far above peers.

The price to earnings ratio compares what investors are paying today for each dollar of current earnings, a common yardstick for income focused, asset heavy REITs. In this case, the market is assigning a substantial premium, implying that investors expect earnings to improve meaningfully from a relatively low profit base, even though recent profit growth has been patchy and return on equity remains modest.

Stacked against its benchmarks, the contrast is stark. NSR trades at 142.4x earnings versus about 11.6x for similar Australian peers and 16.7x across the global specialised REITs space. It also sits well above an estimated fair price to earnings ratio of 20.9x, suggesting that if fundamentals do not catch up with expectations, the multiple has room to compress toward that fair level.

Explore the SWS fair ratio for National Storage REIT

Result: Price-to-earnings of 142.4x (OVERVALUED)

However, risks remain if earnings growth stalls or sector valuations cool. This could potentially trigger a pullback as the stretched multiple normalises toward fundamentals.

Find out about the key risks to this National Storage REIT narrative.

Another Look at Value: What Our DCF Says

While the current 142.4x earnings multiple suggests a high valuation, our DCF model indicates the opposite, pointing to a fair value around A$3.90, roughly 28.5% above today’s A$2.79 price. This raises the question: is the market overpaying based on earnings, or underestimating long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Storage REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Storage REIT Narrative

If you see the numbers differently or want to dive into the details yourself, you can build a personalised view in just minutes using Do it your way.

A great starting point for your National Storage REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Extend your edge by hunting for fresh opportunities on the Simply Wall St Screener, where focused shortlists can quickly surface stocks that match your strategy.

- Capture potential mispricings by scanning these 909 undervalued stocks based on cash flows that could offer meaningful upside if market sentiment shifts.

- Tap into innovation by targeting these 27 AI penny stocks riding powerful trends in automation, machine learning, and data driven disruption.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% built to support long term cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com