Zeon (TSE:4205): Assessing Valuation After a 31% One-Year Shareholder Return

Zeon (TSE:4205) has quietly delivered a 31% return over the past year, even as earnings growth has been mixed. That combination makes the latest move in Zeon stock worth a closer look.

See our latest analysis for Zeon.

With the share price now around ¥1,757.5, Zeon has shrugged off a soft patch earlier in the year. It has posted a solid 1 month share price return and a robust 1 year total shareholder return, suggesting momentum is gradually rebuilding as investors reassess its growth and risk profile.

If Zeon has put materials stocks on your radar, it could be worth seeing what else is gaining attention among fast growing stocks with high insider ownership.

Yet with earnings under pressure and the shares trading only slightly below analyst targets despite a hefty intrinsic value estimate, the question is whether Zeon still offers mispriced upside or whether the market is already banking on a strong rebound in growth.

Price-to-Earnings of 9.4x: Is it justified?

Based on a price-to-earnings ratio of 9.4x versus a last close of ¥1,757.5, Zeon screens as clearly undervalued relative to peers and the wider chemicals space.

The price-to-earnings multiple compares what investors pay today for each unit of current earnings. This is a particularly useful lens for a mature, cash-generating materials company like Zeon. With earnings having grown 9.6% over the past year and outpacing the broader Chemicals industry, a single digit multiple suggests the market is pricing in more muted or even declining profitability ahead.

Set against the JP Chemicals industry average of 12.5x and a fair price-to-earnings ratio estimate of 12.8x, Zeon’s 9.4x looks materially compressed. This implies significant headroom if sentiment or earnings expectations improve and the market re-rates the shares toward those higher levels.

Explore the SWS fair ratio for Zeon

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, persistent net income contraction, together with Zeon trading only modestly below analyst targets, could cap upside if profitability fails to re-accelerate as hoped.

Find out about the key risks to this Zeon narrative.

Another View: SWS DCF Signals Deeper Upside

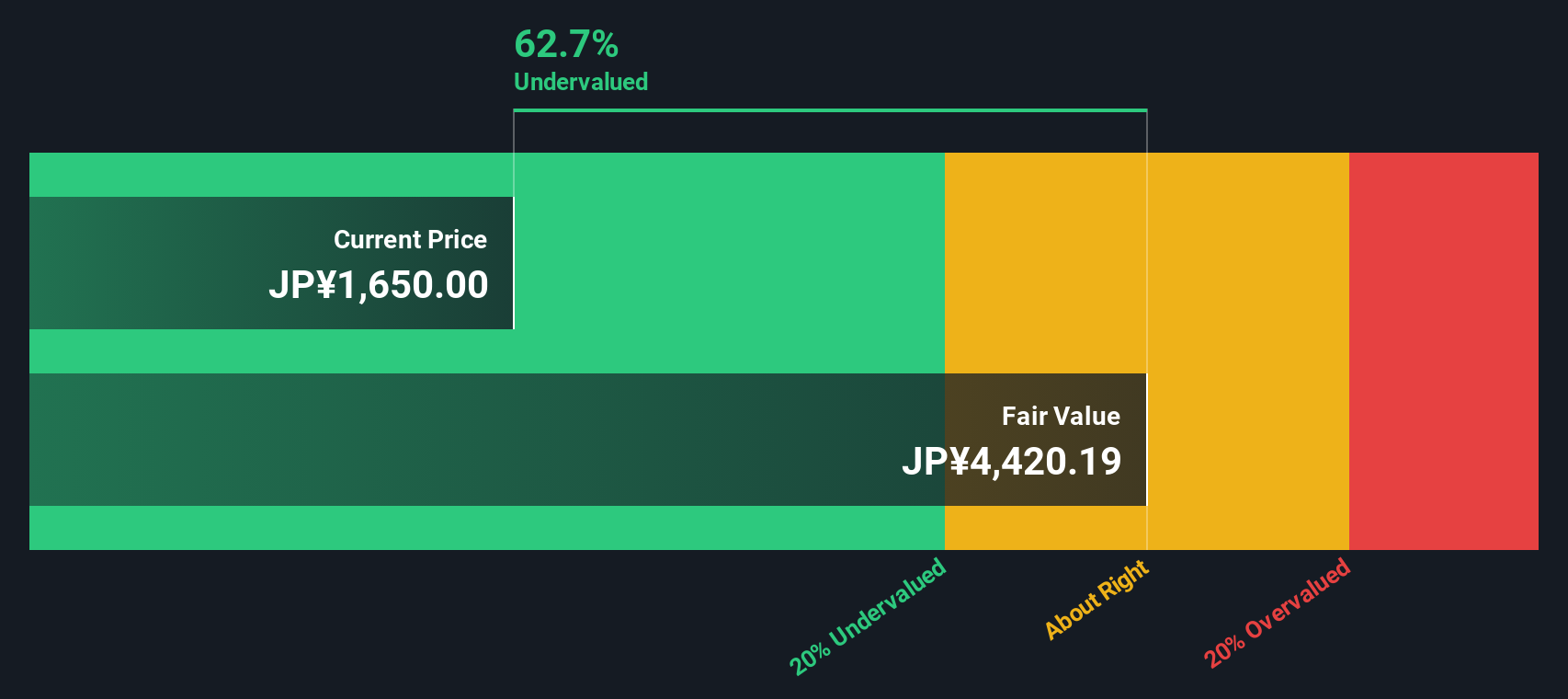

Our SWS DCF model paints an even starker picture, suggesting Zeon is trading about 64% below its fair value of roughly ¥4,907 per share. That is a much larger gap than the modest discount implied by earnings multiples, raising a simple question: is the market too cautious on Zeon’s long term cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Zeon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Zeon Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can craft a personalised view in minutes: Do it your way.

A great starting point for your Zeon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Zeon has caught your attention, do not stop here. Use the Simply Wall St Screener to uncover fresh, high conviction ideas matched to your strategy.

- Capture income opportunities by scanning these 15 dividend stocks with yields > 3% that can potentially strengthen your portfolio’s cash flow.

- Position for the next wave of innovation by targeting these 27 AI penny stocks with compelling growth stories.

- Sharpen your value edge by focusing on these 909 undervalued stocks based on cash flows where market pessimism may have gone too far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com